A best-effort to consolidate multiple wiki articles into a single table of OEMs, their captive banks, and the relevant rules that generate so many questions.

- If you find this helpful: Support Lease Hackr.

- Based on community submissions and is subject to change at any time. NOT A SUBSTITUTE FOR CONTACTING THE LENDER TO CONFIRM.

- Table scrolls left-to-right and up-down, or you may need to hit to pop-out control (diagonal arrows) in the top-right on the table when hovering over it.

| OEM | Sub-brands | Leasing Captive[1] | Captive is DBA of[2] | Acquisition Fee | Disposition Fee | Buyout Fee[3] | 1P Buyouts[4] | 3P Buyouts[5] | Reqs. Dealer Buyout[6] | Allows Transfers[7] | Multiple Security Deposits[8] | Includes Gap Ins.[9] |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Acura | N/A | Acura FS | American Honda Finance | $595 | $0 | $ | Y | N | N | N | Y | |

| Audi | N/A | Audi FS | VW Credit | $895 | $495 | $ | Y | Y* | N | Y* | Y | Y |

| BMW | N/A | BMW FS | N/A | $925 | $495 | $ | Y | N | N | Y | Y | Y |

| Ford | N/A | Ford Motor Credit | N/A | $645 | $395 | $ | Y | N | Y | Y | N | Y |

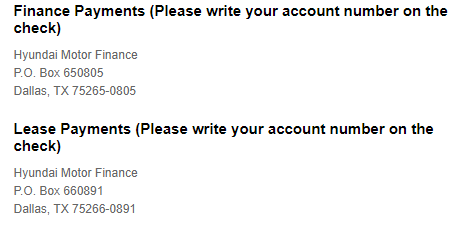

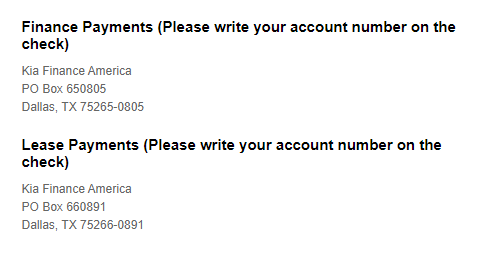

| Genesis | N/A | Genesis Finance | Hyundai Capital of America | $750 | $400 | $ | Y | N | N | N | Y | |

| GM | Cadillac | GM Financial | N/A | $695 | $595 | $ | Y | N | N | Y** | N | Y |

| GM | Chevrolet | GM Financial | N/A | $695 | $395 | $ | Y | N | N | Y** | N | Y |

| GM | Buick GMC | GM Financial | N/A | $695 | $495 | $ | Y | N | N | Y** | N | Y |

| Honda | N/A | American Honda Finance | N/A | $595 | $0 | $ | Y | N | N | N | Y | |

| Hyundai | N/A | Hyundai Motor Finance | Hyundai Capital of America | $650 | $400 | $ | Y | N | N | N | Y | |

| Infiniti | N/A | Infiniti FS | Nissan Motors Acceptance Corp | $795 | $395 | $ | Y | N | Y | Y | Y | |

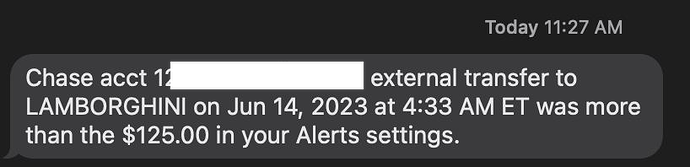

| Jaguar | N/A | Jaguar Financial Group | Chase | $895 | $300 | $ | Y | Y | N | N | N | Y |

| Kia | N/A | Kia Motor Finance | Hyundai Capital of America | $650 | $400 | $ | Y | N | N | N | Y | |

| Land Rover | Range Rover | Land Rover Financial Group | Chase | $895 | $300 | $0 | Y | Y | N | N | N | Y |

| Lexus | N/A | Lexus FS | Toyota Motor Credit | $795 | $350 | $0 | Y | Y | N | Y | Y | N |

| Lincoln | N/A | Lincoln Auto FA | Ford Motor Credit | $645 | $395 | $ | Y | N | Y | Y | N | Y |

| Mazda | N/A | Mazda Financial | Toyota Motor Credit | $650 | $350 | $0 | Y | Y | N | Y | Y | N |

| Mercedes-Benz | N/A | MB Financial Services | N/A | $795 | $595 | $ | Y | Y | N | Y | Y | Y |

| Mini | N/A | Mini FS | BMW FS | $925 | $350 | $ | Y | N | N | Y | Y | Y |

| Mitsubishi | N/A | Mitsubishi Motors FS | Santander | $695 | $0 | $ | Y | |||||

| Nissan | N/A | Nissan Motors Acceptance Corp | Nissan Motors Acceptance Corp | $695 | $695 | $ | EV:N | N | Y | Y | Y | |

| Polestar | N/A | Polestar FS | Volvo Cars FS | $995 | $450 | $0 | Y | N | ||||

| Porsche | N/A | Porsche FS | Porsche FS | $1095 | $595 | $0 | Y | Y | N | Y | N | N |

| Subaru | N/A | Subaru Motors Finance | Chase | $595 | $300 | $0 | Y | Y | N | N | N | Y |

| Stellantis | Alfa Fiat Chrysler Dodge Jeep Maserati Ram | Chrysler Capital | Santander | $595 | $395 | $0 | Y | Y | N | Y | N | Y |

| Stellantis | Alfa Fiat Chrysler Dodge Jeep Maserati Ram | Stellantis Financial | N/A | $ | $ | $ | EV:N | EV:N | N | Y | ||

| Tesla | N/A | Tesla Finance | N/A | $695 | $395 | $ | S/X:Y 3/Y:N | N | N | Y | N | ? |

| Toyota | N/A | Toyota Financial Services | Toyota Motor Credit | $650 | $350 | $ | Y | Y | N | Y | Y | N |

| Toyota | N/A | South East Toyota FS | N/A | $ | $ | $ | Y | N | ||||

| Volvo | N/A | Volvo Cars FS | Bank of America | $995 | $450 | $0 | Y | N | N | N | Y | Y |

| VW | N/A | VW FS | N/A | $699 | $395 | $ | Y | Y* | N | Y | N | Y |

Footnotes

- [1] Captive Lender’s Retail Financial Service Arm, and a link to their website

- [2] The “Captive” is often backed by a third-party bank or a parent entity. Links to NMLS showing the ownership relationship.

- [3] First-party (leasee) buyout restricted

- [4] Third-party (anyone but lessor OR leasee) buyout restricted

- [5] Some Captives that allow Third-party buyouts charge an additional fee. Those are noted in this column with Y*

- [6] Lender Restrictions on Buyout with/without Dealer. Captive restrictions aside, FL State Law requires any lease originated by a captive – that does NOT have a physical branch in the state AND a dealer’s license – to process first-party buyouts at a dealership

- [7] Captives that allow lease transfers but do not transfer the liability are indicated with Y*. Captives that only allow lease transfers within the same state are indicated with Y**. 4/15/24 update on GM lease transfers

- [8] Security Deposits reduce the Money Factor when held until disposition – how many MSDs, and by how much each MSD reduces the MF, varies by Captive. NY State Law requires that Security Deposits (MSDs) over $750 be segregated into their own interest-bearing accounts. Most Captives do not allow collection of ANY MSDs in NY, some allow MSDs up-to $750 or allow a single security deposit. Some Captives allow NY residents who originate their lease out-of-state to deposit MSDs (e.g. Volvo) and some forbid it (e.g. Infiniti).

- [9] Gap insurance pays-off the difference between what your lease is worth, and what is owed in the event of a total loss. Most leasing captives include Gap at no additional cost.

More Background about Captive Lenders

- In the US, cars are built by an Original Equipment Manufacturer (OEM) - some build a single brand of car, some conglomerates build and sell multiple brands, some have sub-brands that build and sell independently, some have a more complex web of ownership. The ownership of the OEM is outside the scope of this wiki article, but it’s important to understand that when we look at who leases or finances a vehicle in the US, we are looking at a single brand and not these ownership relationships. Every OEM selling vehicles in the US has a captive lender for financing/leasing. If they have more than one captive lender, it is because they are sunsetting their current relationship and transitioning to another. For example: Mazda Financial Services has been a DBA for Ford Motor Credit, then Chase Auto Finance, and now Toyota Motor Credit. This wiki article is only attempting to show the current relationship between an OEM and their captive lender (or incumbent and incoming captive lenders) - it’s not meant to show history. If you have an existing lease, it may not match what is in this document.

- Nearly every auto dealership in the US has a relationship with multiple banks in addition to their Captive. They may also have a relationship with local credit unions or third-party banks that also offer leases, but this is less common. The section below attempts to offer similar information about those third-party lessors.

Third Party Lessors / Not OEM-specific

| Captive Bank | Acq. Fee | Disposition Fee | Allows 3P Buyouts | Allows Transfers |

|---|---|---|---|---|

| Ally | ||||

| CULA | ||||

| US Bank |