Zero drive off scenario given that payment streams are taxed.

In this scenario, we capitalize all fees including both taxable and non-taxable fees. In other words, the goal is zero drive off fees given that each payment is taxed. Arizona, California, and Florida are just a few of the states that compute sales tax on the payment streams. When all fees are capitalized, including the first monthly contractual payment, the calculation of the contractual payment is a bit more complicated if payment streams are taxed as opposed to tax levied on the selling price or tax levied on the total payments as is done in New York and Ohio. We’ll consider the OP’s consumer retail lease transaction originating in California. See California pub 34 below regarding treatment of sales tax in retail leasing.

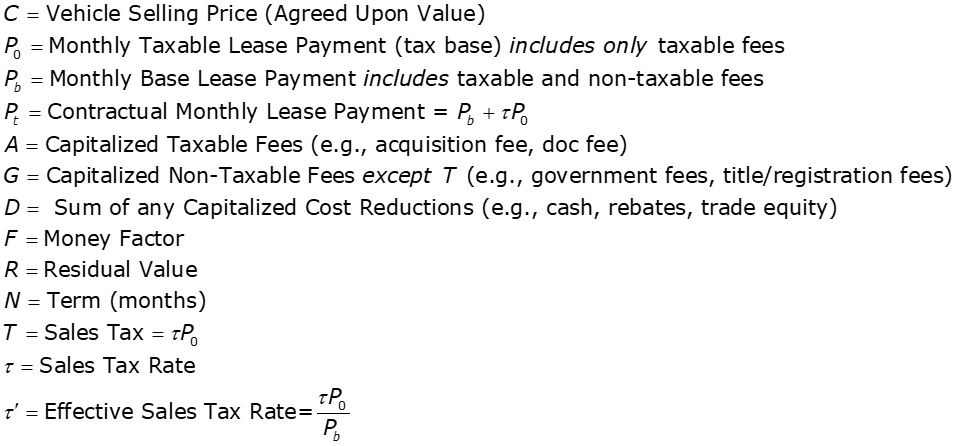

Let

Below are the relevant formulas…

Po is an intermediate calculation whose only purpose is to determine payment sales tax.

Using the OP’s Data, find the required contractual monthly lease payment, sales tax, as well as the monthly taxable payment and monthly base payment given the following OP data.

C = 27,125; F = 0.00001; R = 16,353.30; N = 36; A = 1,000.75; G = 26.10, = 7.25%

D = 360; N = 36

NOTE: I erroneously and deliberately included the 288 title/registration fee in the variable A because that is what occurred in the OP’s “Lease Alternatives.” Title registration fees are NOT taxable according to California’s pub 24 and should NOT be included in A. I assume the title/registration fees charged are not excessive.

Plugging the above values into the first equation and evaluating, we arrive at Po = 326.53. The second Equation gives T = 23.67 and third Equation yields Pb = 327.95. Sales tax levied on the taxable payment (326.53) gives a contractual payment of 327.95 + 23.67 = 351.62. These results are summarized below.

Agreed Upon Value (Selling Price)………………… 27,125.00

Amounts Financed (Capitalized)

Doc Fee……………………………………………………………… 80.00

License/Title Fee………………………………………………. 288.00

Tire/Battery Fee………………………………………………. 8.75

Other Fee………………………………………………………… 29.00

Cap Reduction Tax…………………………………………. 26.10

1st Month’s Payment…………………….…………………… 351.62

Acquisition Fee………………………………….……………… 595.00

Total Capitalized Amount………………………………… 1,378.47

Capitalized Costs

*Gross Capitalized Cost…………………………………… 28,503.47

Capitalized Cost Reduction……….…….…………………. 360.00

Adjusted Capitalized Cost………………….……………… 28,143.47

Residual Value…………………………………………………… 16,353.30

Money Factor……………………………….…………………… 0.00001

Term (months)………………….…………….…………….…… 36

Monthly Base Payment excluding Sales Tax…… 327.95

Sales Tax………………………………….………… 23.67

Monthly Lease Payment including Sales Tax…… 351.62

DAS…………………………………………………… 0.00

Observe that the above procedure avoids computing tax on tax and emphasizes the need to separate taxable items from non-taxable items.

California Sales Tax - Pub 34.pdf (1.7 MB)

![]()