Yikes, I was just looking into a Model 3 this weekend with recent price drop and federal tax credits. Insurance premiums have been wonky lately, my 2022 Camaro LT1 manual is almost half the cost of my 2022 Civic Si, both new. Yet, the Camaro MSRP is nearly $13k more. Weird.

It’s so interesting the lt1 rates are cheap bc you’d think the exact person who on average buys an lt1 , likely a younger age guy who is looking for cheap performance rwd car, would be pretty high risk and thus crash a decent amount statistically.

This cost me $250 but I was a Tesla owner (lease owner) just for 45 minutes because I did the mistake of not checking up the insurance which for me ended up being 4x more expensive then a… Mazda CX-5 ($6k for 3years in insurance for adding Model Y on my policy).

I currently have a '21 3-Series and looking for a 2nd and I pay $2000/year for my 3-Series insurance.

Here’s how the policy would go up for adding a 2nd car (tried shopping around, no better deals):

- Tesla Model 3: policy would go up by $1500 to $3500/year

- Tesla Model Y: policy would go up by $2000 to $4000/year

- BMW X3: policy would go up by $660 to $2600/year

(bellow price is for 6 months)

Another data point regarding insurance. In Northern NJ, Allstate (which we use for home, auto and umbrella) quoted me $520/6 months for the M3 RWD we ordered. Which is just $80 more than what we are paying for a 2022 Tucson. So, not as outrageous as some were saying…

I wish! Mine went up an extra $70 a month, and that’s that I’m in the sticks of NJ, no accidents, good credit, and multiple car discount! I know someone who is squeaky clean and lives 45 miles from me near NYC and they’re paying $250 a month to insure a RWD M3. ![]()

I also would have thought this car would be relatively expensive to insure, but I have had three of them and every single time they were the least expensive car in the household to insure. I suspect the statistics in reality may not match what we think. Maybe it has mostly middle-aged men driving them who have a couple of brain cells to rub together while driving🤪

As folks have mentioned, insurance is rather wonky. Some carriers just don’t like certain cars. When we got a Tesla I switched carriers and the Tesla was the same price as the car it was replacing. One really really has to shop insurance big time or youll get stroked.

Count me jelly!

I tried to shop around but it seems that wherever I go, I get 3-4x on Tesla compared with a car like BMW X3.

Now, given that I can do free charging at work, it might even by not paying for gas but in WA, however EVs are taxed more by $250/year then gas cars so that’s that.

What I am a bit more afraid let’s say is not this initial cost for insurance but what would happen if I do end up having a claim? would I get next year’s insurance for Tesla to be $5k/year because I lost my no claims discount?

Insurance varies from individual to individal, zipcode and coverage but based on what I have now, that’s typically what I get.

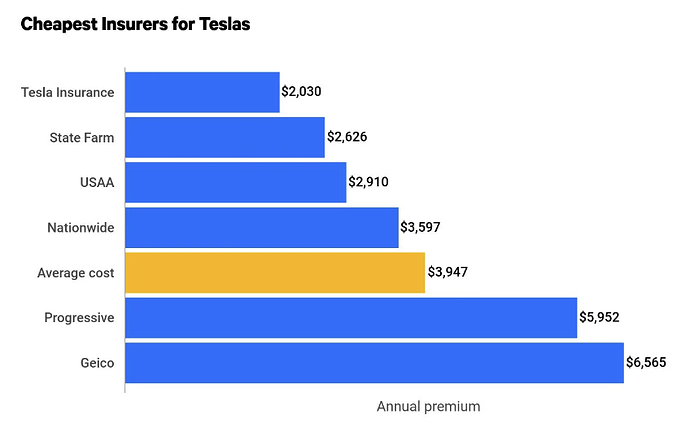

The best place to start is getjerry, because it will compare most local options for you, then you can contact the carrier directly to get a final quote. Certain carriers are known to be more Tesla friendly then others, State Farm is a good example – but this can vary wildly from region to region. I pay around $550 per 6mo.

As soon as Tesla insurance is available in Florida I will be looking into it hard-core. Since it is based on data from the car, our rates should drop big time.

We actually have progressive now and they were much much lower than others, it looks like in general they are terrible for Tesla!

Unfortunately, no matter what car you have, if you have a claim they are going to kill you on renewal.

I had a $13K claim on my 2020 Sierra Denali.

State Farm assesses a $300/mo collision surcharge, for 3 years, on 1 vehicle of my choice.

I apply the surcharge to my non-Tesla because I don’t want to complicate the TCO calculations.

Count yourself lucky! I had an $800 windshield replacement and they raised my rates $500 every 6 months ![]() Pitiful.

Pitiful.

Why did you report that to insurance?

Besides the fact that I was a moron?

I was told, clearly incorrectly, that in Florida due to the state law are requiring that windshields be replaced at no charge by insurance that they did not count against you on your records. Clearly that advice was not good ![]()

Lesson learned lol

StateFarm doesn’t offer quote for my zipcode.

Thanks for recommending GetJerry! I just used GetJerry now and seems that the best insurance that I can get for my current car is with… Progressive.

Well, I have Progressive currently and I pay more then what GetJerry has to say so I moved to final quote phase now and waiting to see if I can switch from Progressive to Progressive with a lower cost.

The best price they gave me for Tesla was with Safeco but they default it to $1k deductible and didn’t moved forward to get the quote with $500 as I’m sure it would be more.

L.E. “the carrier you chose raised the price after running reports” so there it goes, it seems that also after GetJerry I have the best insurance already.

“Did you just buy a Tesla and get quoted crazy insurance? You may be entitled to compensation.

The firm of Lease & Hackr are standing by to make sure YOU get the compensation you’re entitled to.”