Did Tower require proof of income?

most CU require proof of income.

That hasn’t been my experience. I’ve used 4 different Credit unions over the years and have never needed it. Scores are 800+. Don’t mind providing it, but never required.

I’m going through this now with Tower. I identified the VIN and the dealer that is best for me, but my deal didn’t pop up in truecar. Can I still get that 0.25% off?

Is your dealer on truecar?

Something to keep in mind is how you are going to deposit funds in your new CU account if you live across the country (assuming no direct deposit) and the loan rate requires you to have an auto debit for your loan payment.

Many of the CUs will allow you to do a Mobile Deposit, but some don’t have that. If not, make sure you check the ATM network the CU uses so you can ensure you can do fee-free deposits, withdrawals, etc. wherever you live.

No, he is not. As it stands, I have been approved for 2.99% at Tower.

UPDATE: Tower said: “Unfortunately at this time, we are only able to honor the TrueCar discount if the dealership is found in the TrueCar system.”

Here’s a hot tip. Many CUs network together, so you can walk into a local CU and deposit your check just as you were at your home branch.

Here’s a locater for one of the larger ones, you can google it for the CU you use. For example, tower FCU is a member (ATM services only). But for many CUs you could walk into a shared branch, present your credentials, and use the physical teller services!

That’s good to know!

Wait, do people still walk into banks?

They did not

I wouldn’t think so. It would need to be on trucar

How does one become a member of ARMCO. I don’t belong to any of the associations they partner with. It says to call and discuss if one isnt affiliated to any of the associations. Anyone had any luck with that ?

Any recos for a Brooklyn/NYC based CU that has the kind of rates that Armco has.

![]()

![]()

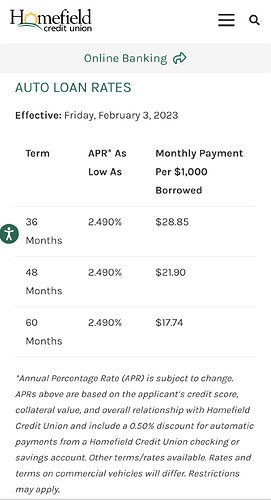

@Arzan_Sam_Wadia - here you go.

did you manage to have success with Homefield?

Not yet. I will be following up next week.

That 2.49% rate for 60 months that Homefield has may be best deal right now in the entire country.

The good news is that I do not need to finance or refinance a car at the moment. I just want to get the membership in case I need to tap them for an auto loan in a year’s time.

Wow. Thank you @Harry657ha for the info on Homefield CU I live in Middlesex county and they got right back to me after the application. 2.99 for 84 months, 2,74 with autopay. Have to send them docs but this is an incredible find. Too bad it’s so limited. They’ll finance 100% of sticker.

I ended up calling them up a few minutes ago. Initially, they could not find my application info so I had to be transferred. The next rep I spoke with was able to find my account details and apologized for the delay. He mentioned that I should be receiving a couple of forms that needed to be signed and sent back.

One question I had (I should have asked the bank) was whether the auto loan rates listed were for either new/used cars. The website is not clear on that.

Curious what the rate was for 72 months. Was this for a new car?