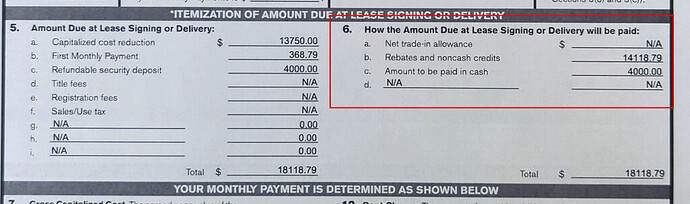

If it’s being listed in the “due at signing” rebate section, it’s considered a payment which is why it’s getting taxed. Could be itemized elsewhere and not show up there in theory.

Maybe I got lucky with my car insurance but I have Allstate, and when I got my ZDX A-spec lease a few weeks ago (traded in 2015 Acura TLX Advance with 85,000 miles), my insurance went up $25 for my 6 month coverage of both mine and my wife’s car. Maybe because I did it online and didn’t talk to an insurance agent so there was no “oh, you have an electric car now? Let me jack up your rate”

Just checked my auto insurance policy and I’m paying $353 for 6 months for my ZDX A-spec and that’s for typical $100k/$300k/$100k/$5k coverage and included full replacement cost of the car if totaled. I have $500 deductibles for collision and comprehensive rates fyi

Yes. Obviously if you’re in a state where it’s handled differently, there may be exceptions

Wonder if loaner comp from Acura changes anything here on top of a deep discount. I’m sure Acura is nowhere near Mercedes level generosity on EQS (I believe around 13.5 max loaner comp), but still, something is at play there.

Had several people ask about insurance and I’ve got a lot to share and lots of questions so I posted in Off-ramp. I’d love to get the hive wisdom on these issues.

Here is link to that post:

Insurance Practices Are Killing Me!: Need Advice on CLUE Reports, Non-Fault Claims, and Premium Hikes Hi everyone, I’m reaching out to get your advice and insights on a frustrating and costly situation we’ve been dealing with involving our auto insurance. There are several issues here that I believe highlight systemic problems in the insurance industry, and I’d appreciate any feedback or similar experiences you’ve had. Background My spouse and I (ages 42 and 47) have clean driving records wi…

The point on itemization is very interesting and not as clear as I’d thought. Many are familiar that the Volvo VCFS lease cash is treated as dealer cash and isn’t taxed, but in all XC90 deals including those I’ve worked on it’s always itemized. That’s one of the few outliers I can think of where it’s itemized as a rebate but it’s not taxed in States that tax rebates. Looking at NY tax law for leases it would seem that anything in that line item total should be taxed.

I present all offers with the assumption that dealer cash is untaxed unless it’s noted as CCR in the program. If a dealer challenged me I’d ask if they are the end recipient, as they don’t pay tax. So far all the deals I’ve done with dealer cash as untaxed have worked out when backing into the contracts. And these are all for NY folks. I have a few ZDX offers as well and not one dealer has challenged the $14,350 treated as untaxed, but I’m open to correction on any of this.

Ultimately if a dealer itemizes but collects the expected tax I don’t see an issue. A calculator deal offer that reflects all incentives as taxed is a different story. My advice would be to always build your deal assuming dealer cash isn’t taxed, and challenge (reasonably) from there.

Right. I guess that was my point. Regardless of state, it could be that:

- dealer rebates are itemized in lease contract

AND - correct taxation is applied (not taxed)

OR

- dealer rebates are itemized in lease contract

AND - incorrect taxation is applied (taxed)

I don’t think presence in itemized section HAS to mean they’re also / always taxing it.

But yes: to your point, deals being posted with calculator and having dealer cash incorrectly taxed is a diff issue.

And these are all for NY folks.

Manufacturer to consumer rebates are definitely taxable in New York, if you’ve managed to get a deal where they’re not taxed, the dealer made a mistake, down payments are taxable in New York as well, basically everything besides the plates/reg is taxable in NY.

Yes totally understood, I’m talking about manufacturer to dealer. And then whether that dealer cash gets itemized or not, or incorrectly taxed or not. In NY it should not be taxed if the dealer is end recipient.

Sorry , i did not read entire post .

Do You need to pay a sales tax from rebates in Arizona?

That’s just not happening. No dealer is putting their business on the line to pay a broker through tax fraud. The repercussions of the state finding out they weren’t paid the full tax line item the customer paid would be devastating.

Not sure if you saw all posts, but not suggesting tax fraud. Suggesting the calc inflates the payment for the deal. Contract is likely fine.

I’ve had several acura contacts state they wont lease demos and asked at the corporate level, if they’ve been certified. Not sayings its not possible but might need a non-certified car

Yes contract would have to be inflated, for indirect broker payment from dealer to broker. Instead of client to broker.

Pretty certain people would be crying in outrage here if their contract showed a lower payment than was collected by the broker or if the discount amount wasn’t as promised (the only way the dealer could overcharge the customer to pay the broker).

I just don’t see a (legal and safe) way for a broker or dealer to hide a broker fee other than in the selling price. (Or an inflated dealer doc fee, but even that is dangerous for the dealer if the buyer finds out they weren’t charged the same as someone off the street.)

Yes contract would have to be inflated, for indirect broker payment from dealer to broker. Instead of client to broker.

No, what he’s saying is that someone quotes a deal with taxed rebates when they shouldn’t be, when it reaches the dealership, they do it correctly and lower the discount, or keep discount the same and raise MF, but now there is new “profit” in the deal, as the payment matches but it takes less discount to get there.

Frankly, I highly doubt this is happening, it’s a very convoluted way of making extra money, but I am following what he is suggesting.

Unfortunately for all of us, I’ve now confirmed this is definitely what is happening. I reviewed a member’s “no fee” ZDX contract and the dealer discount was a few points off the original calc, the only itemized incentives were $11,500, and the “agreed upon value” included the full $14,350 as it should, which means it’s not taxable. Taxing it in the calc allowed a higher discount to show. Contract did not show that discount. Difference in discounts amounts to roughly $1,200.

Edit: This was for a NY buyer, and ultimately he paid the price he was quoted. This goes back to the argument we all had about the buyer that paid an extra $400 in undisclosed broker fees. I was partially on the side of the broker in that instance. I regret that position, because this is exactly the logical conclusion of not enforcing transparency.

Experienced that . ![]()

They tell you f.e. that dealer cash needs to be taxable or if there is abroker fee you need to pay by Zelle together broker fee and first monthly. LOL.

Are you being serious here or facetious? This literally and specifically has happened?