You posted yesterday under a different handle

That was a buddy of mine helping me out. I was not part of leasehackr so he jumped in. I figured I would take the conversation back so I could stop bothering him. This forum is a huge help

And it is. But finding hacks like that is the point of this site.

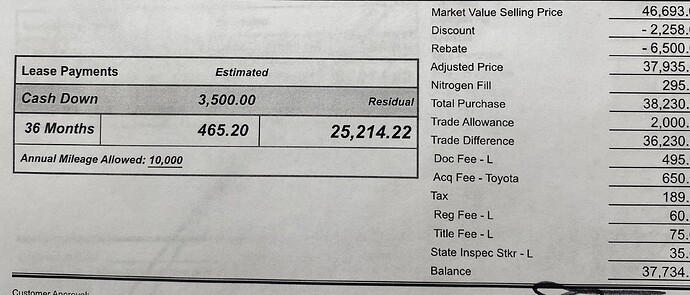

Just got this lease offer for a 2023 rav4prime. Seems like there is little difference between a 2023 and 2024. The 2023 has 29 miles vs 2024 has 5 miles both are brand new. I can get zero down on the lease it’s just not noted here. If i were to put 3500 down is a portion of that treated as “rental” or “interest”? Since I’ll be buying out in a couple weeks I don’t really care about the cash but if I will not realize 100% of that down payment against buyout cost I will choose zero down.

Have them get rid of the nitrogen fill to start.

Probs better to do zero down. Pay close attention to adjusted cap cost on the lease contract you sign as that is the number that matters

Check if your car is worth more than $3k.

Some will go to depreciation, some will go to the tax man. None of the upfront will go to rent charge.

I’ll go zero down. Carvana says 3500 and car gurus says 2400. I have one dealer at 3500 and one at 2000. I’ll probably just go trade in to lessen the hassle and keep it single source.

This has all been very helpful. Hoping to finalize things by Tuesday. I’ll post final details to help people in my situation.

If the discount is the same, the 2024 is probably better for resale in a few years.

Are these from different dealers? There is no difference between the 2023 and 2024 Rav 4 Prime vehicles. The 2024 had 3500 trade credit versus only 2000 for the 2023. See if you can get the 2024 dealer to provide a discount beyond the rebate. If not, see if the 2023 dealer will increase the trade credit to match the 2024 dealer. In other words, play them against each other to see where you get the lowest total cost.

Honestly for a total difference of only $400, I would go with the 2024 all else the same. Does one have different features from the other?

Also note that putting $3500 down on the 2024 results in a lower payment than the 2023, but that does not matter if you are buying it out immediately. You may not want to put anything down. You will also be on the hook for 6.25% sales tax when you do the buyout so save the money for the taxes.

How long does it take from when you sign the lease to when you can access your TFS online account? Does the lease paper work take a couple weeks to get mailed out?

Just signed and want to get my buy out done asap.

Just keep trying every day to register for an online TFS account. You don’t need any paperwork to register, just the VIN and your SSN.

The account was not up yet yesterday. Hopefully today. I feel like Marty McFly in BTTF waiting for this.

I’ve also read through the forums, read various accounts of people who have successfully completed the buyout and achieved $5500-6500 in savings.

Why is the dealership I wanted to lease/buy from telling me it’s impossible?

Most dealerships are clueless on lease buyouts.

It’s not impossible. Just finished mine $36,440 for an SE prime with moon roof, heated rear seats and heater steering wheel. Proof below from the TFS payoff website. I was skeptical but I can say it works.

So, here’s the situation. I found a RAV4 Prime for almost $4k under MSRP - a great deal. I thought I could stack the $6500 lease credit on top. I casually mentioned to the finance guy who was taking my lease application that I would probably just buy the car out if I really liked it after a few months.

Then the phone rings. It’s the general manager. He tells me that I would end up paying far more if I did this because I’d be paying all of the monthly payments and the residual value. He ran the numbers, we added them up, and sure enough, I’d be paying a lot more. Huh. He told me that these Reddit threads were confusing people. I pointed him to several threads and a YouTube video of a guy who did a 50+ minute review of his new Rav4 Prime - and explained exactly how he realized the $6500 savings (it came to $5800 for him after everything). He said the guy was probably wrong, it was a different trim, etc etc. He told me another customer had driven up from another state to do the same thing. When he informed her it couldn’t be done - taking the credit and buying out immediately - she cursed him, called him a crook and scammer, and then took her business elsewhere. She then came back and apologized because he turned out to be right. He then sent me a sample lease that told me I would be paying the total cost of the lease no matter what.

The funny thing is that this dealership is also listing their Rav4 Prime’s by $3-4k below MSRP. That’s almost unheard of. It kind of makes me wonder if they’ve somehow found a way to snag that credit for themselves. I’m not sure how they’d do that though.

Attached is the lease agreement he sent me. I’m new to leases, so I’m not sure

My gut tells me this guy is BSing me - that he doesn’t want me to do an immediate buyout.

Have him send the entire lease so that we can highlight the actual contract language that explains that you can buy it out and it isn’t the sum of the lease payments. Then ask him why he’s quoting you a buyout price that doesn’t match the contractual terms.

Don’t tell them you are buying it out its not in their their best interest