It’s not impossible. Just finished mine $36,440 for an SE prime with moon roof, heated rear seats and heater steering wheel. Proof below from the TFS payoff website. I was skeptical but I can say it works.

So, here’s the situation. I found a RAV4 Prime for almost $4k under MSRP - a great deal. I thought I could stack the $6500 lease credit on top. I casually mentioned to the finance guy who was taking my lease application that I would probably just buy the car out if I really liked it after a few months.

Then the phone rings. It’s the general manager. He tells me that I would end up paying far more if I did this because I’d be paying all of the monthly payments and the residual value. He ran the numbers, we added them up, and sure enough, I’d be paying a lot more. Huh. He told me that these Reddit threads were confusing people. I pointed him to several threads and a YouTube video of a guy who did a 50+ minute review of his new Rav4 Prime - and explained exactly how he realized the $6500 savings (it came to $5800 for him after everything). He said the guy was probably wrong, it was a different trim, etc etc. He told me another customer had driven up from another state to do the same thing. When he informed her it couldn’t be done - taking the credit and buying out immediately - she cursed him, called him a crook and scammer, and then took her business elsewhere. She then came back and apologized because he turned out to be right. He then sent me a sample lease that told me I would be paying the total cost of the lease no matter what.

The funny thing is that this dealership is also listing their Rav4 Prime’s by $3-4k below MSRP. That’s almost unheard of. It kind of makes me wonder if they’ve somehow found a way to snag that credit for themselves. I’m not sure how they’d do that though.

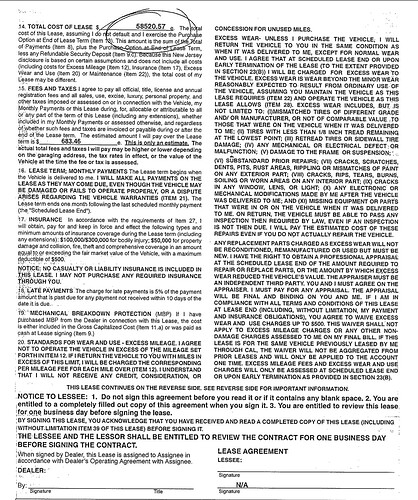

Attached is the lease agreement he sent me. I’m new to leases, so I’m not sure

My gut tells me this guy is BSing me - that he doesn’t want me to do an immediate buyout.

Have him send the entire lease so that we can highlight the actual contract language that explains that you can buy it out and it isn’t the sum of the lease payments. Then ask him why he’s quoting you a buyout price that doesn’t match the contractual terms.

Don’t tell them you are buying it out its not in their their best interest

Your adjusted Cap cost is 31,000. That is your buyout cost a week after you sign the lease. Sign this lease call toyota financial services two days later have them email you the purchase agreement which will be for $31,000 and know you just got an amazing deal. Never talk to the dealer again.

You do pay the residual and you do pay the lease payments you just don’t pay the rent. It’s clearly spelled out in the lease contract I. I believe section 29. 31,000 is what your lease plus residual will calculate to.

Congratulations you got an amazing deal!!!

Also just noticed you are putting 15,000 cash down. Forget that. If you are buying it out go zero down and pay TFS directly. If you are going to buy out a week or so after the lease no reason to get two cashiers checks.

Why would you seek advice from someone who has a 180-degree opposite financial interest from yours?

Every loan or lease involves a bank and it involves a commission from a bank … that comes with strings attached such as minimum holding period such as 4 or 6 months.

Don’t expect a GM to be looking out for you… not when commission checks for you and N other people leasing-2-buy are on the line.

I really wasn’t seeking his advice - and I am highly skeptical of his argument. He’s friendly and I’d still like to get the car there. I have had other dealers (Mazda, Kia, and one Toyota dealership) tell me to do the immediate buyout over paying cash. This particular dealer seemed to have an issue with it - hence the call of concern from the general manager, who wanted to protect me. Trust me, I was skeptical from the moment he called up, but have been playing nice.

He circled this part.

As I said, I’m really new to leases. This would be my first, and only to take advantage of this cash back.

Here’s the second page.

That was my big mistake - I just thought dealers knew people were doing this left and right. Several other dealers told me to do this - they didn’t care.

Can you send the page that talks to early lease termination. This page is not the full story as it is talking to a 36 month lease and buyout that would include rent charges which should be avoided. Still think you have no reason to pay the 15000 down. That only serves to lessen your monthly payment but if you are buying out it is irrelevant. If you are paying 15000 down your buyout will actually be closer to 46,000 if you didn’t put that down.

per the circled part, that’s the total cost of the lease should you carry the lease to term and the exercise the purchase option at END of lease term. You’re not talking about doing that here.

MSRP: $49274.00

Line 11 a : The agreed upon value of the vehicle $49843.00

Where is your dealer discount of almost $4k ??

What is the MSRP, and why are you putting $15K down on the lease? Just don’t do it. Put down as little as possible. $0 is good, but they will probably ask for at least the first month payment unless you do a true $0 DAS deal. You are paying more down than the lease will cost you over 3 years as evidenced by the negative depreciation. This is essentially a 1-pay lease with that much down.

Also be advised you will need to pay the full NC sales tax when you do the buyout, plus any fees to reregister it in your name.

Actual MSRP/window is $52,888. This price is $48,375 + 899 doc (I think).

Guys, as I said, I’m totally new to leases - so yeah, if $15k is too much to put down, I won’t. I’m being educated - and appreciate it ![]()

Noted on the downpayment - I had no idea. I thought that would reduce monthly payment because I had to pay 23 monthly payments + residual.

NC tax is 3%, so $1500 - still worth it.

Thank you everyone for the help on this. I really don’t want to be blindsided since I’d be flying to pick up the vehicle.

That’s right. In #13 it states I have the right to purchase at end of the deal, but not anything about earlier.

I also noticed that the Assignee is not Toyota Finance, but “Certified Automotive Lease Corp” at 4556 South Broad Street, Yardville, NJ. Is that right? Maybe that’s the issue, this dealership uses a different leasing company? Is this even a Toyota Lease Agreement? Do they have to lease through Toyota, or can they run their own leasing company or use a local one that gets the same tax credit as Toyota America, which it kicks back to the dealer - and thus lets them offer the car $3-4k below MSRP?

One thing you need to make sure as everyone seems to be assuming: most are probably talking about a lease with Toyota Financial Services (TFS) directly. If they are listing another bank, the terms of buyout will differ!

Yes, that seems to be the issue here. It’s not Toyota. I only just caught this - I’m a total noob when it comes to leases. But yeah, this does not seem to be a Toyota Finance Corp lease.