Apologies is this is explained elsewhere. I searched and could not find anything to answer this specific question:

So I’m already well aware of the rule of thumb to convert MF to APR you multiply MF by 2400. However: I’m trying to “prove” this and the math isn’t working out for me and I’m not sure what I’m missing. So I figured I would pop in here and see if someone can point out where I’m going wrong.

I’m exploring the idea of leasing a Kia EV9 because the only way to access the EV tax credit with Kia right now is to do a lease. (IRS loophole allows the tax credit for leases on Kia EVs but not on purchases)

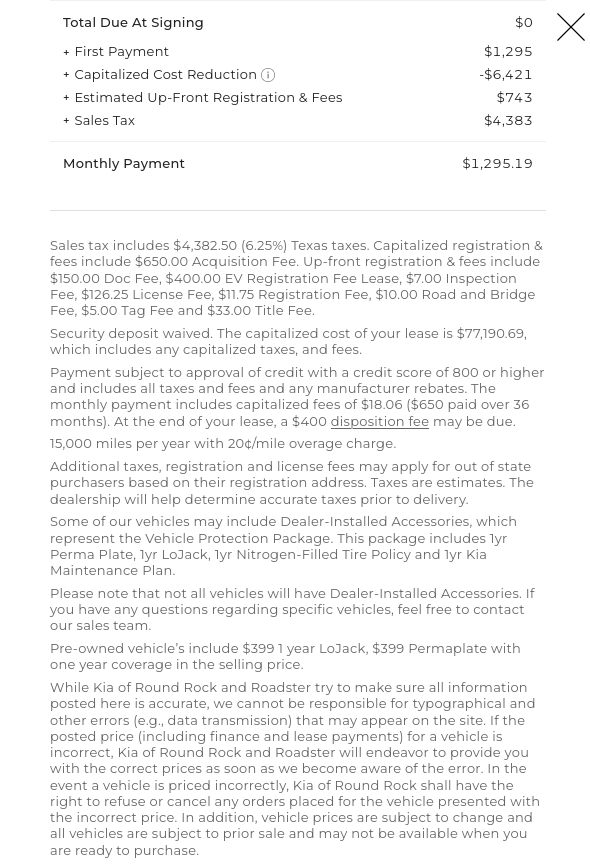

So as an easy example: Take this lease:

You can see total purchase price is $70,120 after you subtract the $7500 credit.

RV = $42,691 (55% for a 15k mile 3 year lease)

So the depreciation paid over the lease term would be $27,429. Now suppose I want a “zero down” lease where taxes and fees are financed and the total amount “financed” through the lease would be:

$27429 + $743 (fees) + $4383 (taxes)

For a total amount “financed” (If you will) of $32,555

Assumption check: I’ve always thought of leasing as though it’s just financing the first 3 years of depreciation (Rather than the full lifetime depreciation when you purchase)

So essentially if that assumption is true: With this lease I am effectively “borrowing” $32,555 - The 3 years of depreciation plus the taxes and fees. Have I missed anything on this assumption?

The lease payment quoted here is $1295.19 – No money factor is mentioned and this seems a bit high to me so I went over to the Leasehackr calculator to see if I could reverse engineer the money factor:

You can see that here: Leasehackr Calculator - Hack your next lease | Leasehackr

When I plug all the numbers into the Leasehackr calculator, I end up having to adjust the money factor to 0.00269 to end up with a payment of $1295. 0.00269 isn’t great but that works out to an APR of 6.46% which is fairly competitive with bank interest rates. (IE: If I was going to finance the vehicle, mid 6% is roughly what I would expect my interest rate to be).

However I noticed that something doesn’t add up. If we take that total amount “financed” of $32,555 (see my assumption above) and did a bog standard 3 year loan at 6.46%: The payment for a 3 year loan at 6.46% would be $997.19.

In Fact: in order to get a payment amount of $1,295 on a 3 year loan of $32,555 – I’d need to crank the interest rate up to about 25% (That’s credit card level interest)

And the numbers on the Leasehackr calculator seem to agree with me:

Notice the “Depreciation” of $33,673 (Very close to my $32,555) and the “Rent charge” of $10,988 – There’s no way a 6.46% APR can result in $11k in “interest” on a $33.5k paid over 3 years.

So can someone help me understand what I’ve missed here? I just cannot understand how a money factor of 0.00269 = 6.46% APR when it results in nearly $11k in finance charges from a $33,500 “loan” over 3 years.

Thanks!