Isn’t that the conundrum everyone faces?

You’re spot on here. At least with a car you know the value of your ‘investment’ after maturity. $0.

S&P isn’t the only option. I think my point is getting lost in this quasi economics discussion.

My point is just this: I would have used the $6k differently. (full stop).

The problem is you can’t just see every $ spent as an opportunity cost.

If that’s the case you better save every penny and invest.

Would using the 6k to grow would be a better investment?

Sure, but the poster did save the 2k, so wasn’t completely a bad decision as he still would have had to pay something for the car.

If you have a different risk tolerance, that’s fine.

The point that I’m trying to make is that generally when people make claims in these discussions about how much better of investment something like the stock market is and how poor of an investment reducing rent charge is, the math rarely actually supports the point. People often remember periods of high growth and block out the other side of the coin.

Case in point being that from 2009-2020, there was 1 actual time where the S&P averaged 16% over 3 consecutive years and that 10 out of 11 times, it was a losing bet.

That plus they often forget that time of the initial entry is completely ignored & the idea that you can invest on January 2nd & cash out on December 31st just can’t happen so the real returns are just impossible to predict.

It wasn’t a bad decision at all. It was just different from what I would’ve done.

I feel like we’re all beating a dead horse here. I don’t agree with using lump sums in today money to ensure savings in future money. That’s it.

I’ve done it before many times. With my runner ($5k), my bimmer ($3k), my vw ($3k) etc and i’ve learned it does not work well for my long-term objectives. If it works for OP that’s great. If it works for you that’s great. Feel free to ignore me.

I subscribe to that theory as well but only on longer horizon debt or investment only.

In a shorter term it’s just what makes sense for your budget vs what makes you comfortable.

We all have seen people who rather have a smaller monthly payment just cuz it makes them feel comfortable vs the people who rather just care about total cost.

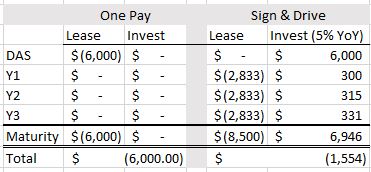

After thinking it through a bit more I think the sign & drive and one-pay leases are roughly equivalent. I come to the same conclusion as before: It depends what you’re optimizing for.

In one case (one-pay) you’re spending less in total, but not preserving your capital. In theory you’re “cash poor” though you’ve saved up-front.

- One pay you spend $6k up front

- Value at maturity is $0 (not including appreciation in this crazy market)

In the other case (sign & drive) you’re spending more in total, but preserving you capital and off-setting cost with interest which compounds over time. (though you’re accepting the risk of not having income to pay the lease, or a market downturn).

- Invest the 6k up-front

- Spend more on the lease, but you get the benefit of the interest

- At lease maturity your lease value is still $0

- Your investment value is presumably equivalent (on average; yes, i know the market swings)

- Over time your investment value continues to grow.

For my current approach I’m taking the equity out of the cars we have leased ($7.5k out of our 2018 Mazda CX-5 and $14k out of our 2020 Toyota 4 Runner). I’ll be putting that cash to work in our real estate business and getting another couple of sign & drive leases. I guess some people on here would take that cash and not have a car payment for the next decade lol. To each their own!

As a thought exercise, what would be the return if the monthly lease payment is that is no longer being made is put into an investment account, what would be the investment returns?

Let’s get back on topic. Slow mode until @nmata010 can stop beating what, by his own admission, is a dead horse.

Last swing at the dead horse…

If we assume the same cash flow (6k upfront, $2833 per year, only reversing the order of application of the funds):

Can you send spreadsheet to looneyx11@gmail.com

That’s a sharp ride!

Help me understand why this is helpful to my question, Jon.

Based on the info you gave, a minivan seems like it fits your needs the best.

Thanks for the shitty counsel, Budget sales guy. I’m not about that life unless we’re talking Previa???

I guess you didn’t get my hint. You are asking random strangers which vehicle (one being an SUV and one a sedan) we should pick for YOU when you don’t even tell us what you are looking for in a vehicle? If it doesn’t matter, just get the cheaper one.

Lighten up dude. I just want to hear from people who have actually driven/leased these cars as I’m curious about their thoughts and experiences. THAT would be much more constructive for a first-time leaser and BMW driver.

I’m not asking for you to make a life decision on my behalf, like helping me choose between a Camry and an Accord.