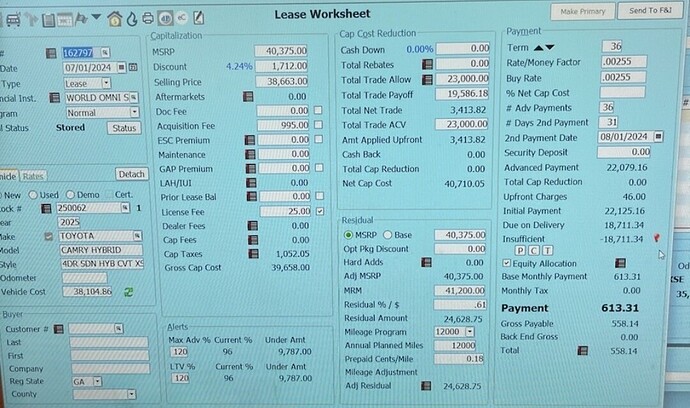

Can someone review this lease deal and let me know if there is any funny business? It doesnt seem to make sense to me. I calculate that 8k or so is going out the window to charges on this one pay upfront lease. Its georgia.

Seems a bad deal

101010char

I told you before that Toyota hybrids dont lease well…

Toyota’s a famous for being reliable.

This specific model flirts with 50mpg.

The longer you possess the vehicle the more those 2 factors matter.

That coupled with the lease program being awful make this an awesome car to puchase over lease!

Ive loved my toyota leases this far as i usually walk away with equity each time, and the cost of ownership rolling 3 year leases is palatable for me. But on this deal im specifically trying to figure out the breakdown of the roughly 8k outside the depreciation payment. Im prepaying the lease up front, there is a grand or so in tax, there is 25 license fee, there is 995 acquisition fee. Where is the other 6k going? Towards what?

The money factor that is over 200?

Not to mention this deal has quite a bit of meat on the bone. Selling price should be BELOW Vehicle cost not above it.

Can you post a calculator?

And are you rolling over ~$3500 in positive equity?

There’s a difference between getting equity and maximizing equity.

World Omni aka SETF? I sure hope you don’t plan to trade that car in early.

Not true. No funny business. Here’s what’s happening…

MSRP 40375.00

Sell Price 38663.00 … discount is very weak at best

Acq Fee 995.00

Gross Cap 39685.00

CCR 0.00

Capped Tax 1052.05 … (see calculation below)

Net Cap 40710.05

Res. Value 24628.75

Term 36

MF .00255 … (about 6.12%… YIKES!)

Sales Tax Rate 7.00%

Base Payment = .00255 x (38663.00+24628.75) + (38663.00 - 24628.75)/36

= 613.31

One Pay = 36 x 613.31

= 22079.16

Lease Inception Fees

One Pay 22079.16

Title/License 46.00 … non-taxable

TOTAL 22125.86

Trade Credit 3413.82 … Non-taxable

DAS 18711.34

GA TAVT (Tax) is computed as follows…

Sales Tax Rate x [(S – R) + M + X]

S = Sell Price = 38633.00

R = Residual Value = 24628.75

M = Taxable Capped Fees (amortized amounts) = 995.00

X = Taxable Lease Inception Fees = 0

TAVT = 7.00% x [(38633.00 - 24628.75) + 995.00]

= 1052.05

??? Let me know.

No reduction in MF for a one-pay lease? Who in their right mind pays 6% interest on a loan all upfront?

What is the advantage of a one-pay lease if all they are doing is multiplying the monthly payment by 36? Look at it this way, OP is paying over 50% of MSRP to drive the vehicle for 3 years but residual is 61%.

Somebody did say they don’t lease well…

Depends on how one is defining “funny business”

The math is not funny business. Balance sheets always balance, right? That doesn’t mean every stock is a good investment.

The judgment call on whether to proceed is not just a mathematical question.

That’s what I was wondering, too.

Never said or implied that it was just a mathematical question. I know better. … I don’t like the leasing terms… MF is too high for a one-pay, IMO. Also, the discount is horrible. All I did was confirm the dealer’s numbers for the OP. Don’t read too much into this.

Please don’t nitpick. I know what OP meant based on context.

I was just trying to make sense out of the numbers for the OP… whether it’s a good deal or not is not my call. It’s strictly a judgement call that only the OP can make. Just crunching the numbers… that’s what I do based on the info I’m given.

You’re preaching to the choir. It’s the OP’s call. Look at my comments in my post.

That’s how one pay leases are done. They compute the base payment using a discounted money factor and then, multiply it by the term of the lease.

Actually, OP is paying 46% of MSRP. But you’re right… it’s a bad lease on so many different levels. They just don’t lease well. Here again, that’s for the OP to decide. I just crunch numbers and insert comments when appropriate.

Thank you for all the work you do helping people on Leasehackr.

Why would they bother calculating a base payment and multiplying it by the term of the lease? Wouldn’t it be simpler to calculate the depreciation over the term and add the rent charge? Seems kind of silly to calculate a base payment and multiply by the term when the base payment is calculated by dividing the depreciation and rent charge by the term, but I may be missing something. Maybe taxes? In MD we pay taxes upfront anyway, so it really doesn’t make a differenence. WE get screwed either way…

Thank you!

This is essentially what happens. In order to compute the rent charge, you still need to know the discounted money factor, the residual and the adjusted cap. To compute depreciation, you’ll need the adj. cap, residual and term. The base payment has a depreciation component and a rent charge component.

base payment = discounted MF x (AC + RV) + (AC - RV)/N

= monthly rent charge + monthly depreciation charge

One pay = base payment x N

AC = adj cap

RV = residual value

N = term

It couldn’t be simpler.

The key ingredient is the discounted money factor which is analogous to using a discounted interest rate to compute payments and then, compute the present value of those payments. This is a much more complicated approach. And so, the easiest way to circumnavigate the complexities involved is to simply use a discounted money factor as is done above.

If anything can complicate a lease, it’s taxes. They can be a pain in the ass. Tax treatment varies by state. Can’t remember how VA and MD compute sale tax but I think it’s levied on the sell price. In PA, CA, and FL, it’s on the individual monthly base payment streams. In Ohio, it’s levied on the sum of the base payments (base pay x N). Ditto for Ill and NY but is more complex. In GA, it’s levied on the depreciation…

GA sales Tax = Tax rate x ((S - R) + M + X)

S = sell price

R = residual

M = taxable capped fees

X = taxable lease inception fees

IMO, this is the fairest way to assess tax. I wish all states would buy into this methodology.

If OP doesn’t put time in and figure out calcs by self he will just get hosed at some point when he is on his own vs the dealer. Should just find/use a decent broker.

I prefer Montana’s vehicle tax situation but hey to each his own!