SWVXX is at 4.68%. $115B in assets.

Doesn’t that require like $1M minimum investment?

Yes. After I remembered that, I posted the current yield for SWVXX that doesn’t have a minimum.

two month treasuries are at 5% now.

That’s what I’m currently doing with most of my cash.

I also put a good amount into jepi. It’s up about 5% from where I bought it last month and gets a 12% annual dividend. Def a risky play but it would have to drop pretty substantially to lose money with that dividend.

I also just switched to chase/J.P. Morgan wealth management and they gave me a $3000 bonus for signing up with them

Pnc closed my checking/savings account that I’ve had with them for 20 years. They said it was bc they don’t like all my bank transfers in and out of crypto. Crazy. They did say I could keep my portfolio accounts with them tho, how nice of them. But I’ll take the $3000 from chase instead.

Did you have to roll over 2M or more? thats the offer that i am seeing or is there another way to get that bonus

It was $500k when I did it. Not sure if that changed since then. It doesn’t have to be cash either, can be retirement accounts as well

With an expense ratio of 0.35 and a 7-day yield of 4.66%, does that mean the net/actual yield is 4.31%? Is my maths mathing?

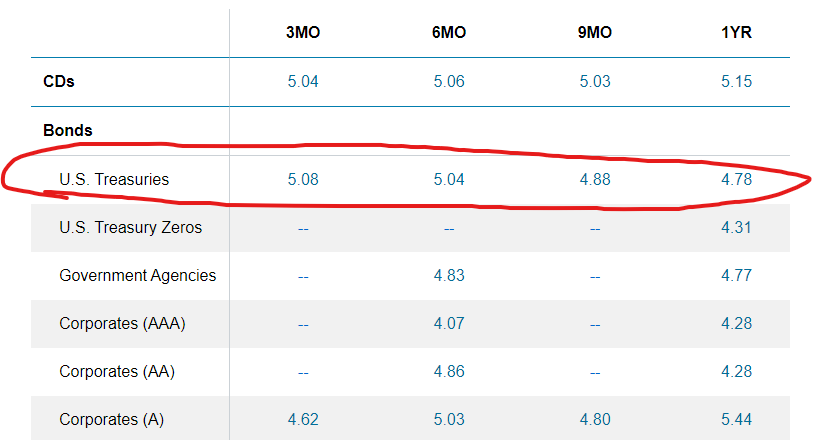

I did the same thing earlier this year but here’s something to watch out for. I moved funds from Schwab where I’m currently heavy in Treasuries, CDs, and money market. I assumed I could just buy the same products at JPM. When I checked rates, JPM had substantially lower yields than Schwab…I assumed Treasuries were the same price no matter what bank you used. The crazier thing is, at the time, Schwab had a JPM CD paying around 5% (?) and JPM had the same JPM CD at around 3.5%. When I sent the screenshot to my JPM advisor, he said he could talk to his manager and matched the rate. I had planned to close the account when that CD matures (after the bonus clawback period); however with the recent banking crisis, I will probably leave the account open but will closely scrutinize any purchases I make.

Very interesting and thanks for your insight. I have been getting the targeted advertisements for this. Currently a chase checking customer only. I have considered moving from vanguard to chase to obtain this sign up bonus to chase wealth management if I didn’t have any drawbacks to Vangauard.

I’m a wild man. I keep all my liquid funds in crypto and a couple of months of dollar bill expenses in my checking account. Whenever I need a chunk of money I just ape out and let the regret haunt me for months.

If they can’t buy at the best rates I’ll just transfer some out and keep my equities there for now. They can’t change those dividends.

Isn’t JEPI just SPY with covered calls? I was looking into it the other day and it was flat YTD vs 7% for the SPY. You can just buy the SPY and sell calls on your own and you will probably do better.

I switched to apple just for ease of use.

The ease of use is a big factor for me.

i dont understand why other accounts are different. can you explain this please?

Simplicity for me as im a heavy apple user and it’s convenient without needing another app. Less clutter now I can get rid of this Ally app lol

and you’re willing to accept a significantly lower interest rate for that convenience?

Others have to jump through hoops this is simple