Looking to sign a one pay lease for a 2025 lexus nx450h+ soon in Ohio and do an immediate buyout to take advantage of $7500 rebate. However, when I called LFS I got conflicting answers. One rep told me rent charges for unearned months are NOT credited back on the final buyout (residual), another rep said that unearned rent charges are credited back and the residual/buyout is adjusted to reflect this. Could someone with experience with LFS chime in on which is correct?

I think it was discussed extensively here.

@GeneralKlinger did the same thing.

You need to focus on the adjusted cap cost. That’s what your buyout will be once the loan is financed with them.

You can verify this because once your online account is built, you can go on the website and check the “payoff my lease” amount, it will be a few hundred higher or lower than Cap Cost.Depending on when you check.

My costs were accurate.

Be warned though, LFS is going SLOWWWWWWW to process my payoff. I am still waiting for the title, I sent in payment almost a month ago. Ridiculous.

I thought the adjusted cap cost was going to only be the buyout in a regular lease with zero down? For a one-pay the buyout should just be the residual right?

Thanks! But this post is for a regular lease, zero down, not a one pay lease where you pay all 36 months + rent charges up front. I’m specifically wondering for a one-pay lease if I get credited back the rent charges upon an early lease buyout

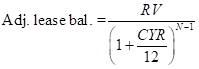

Check the lease contract. It is the final authority. I think you’ll discover that your lease buyout can be computed as follows if bought out within the first 30 days of lease inception…

Buyout = (Adj. lease bal. + PO fee) x (1 + t) + other fees and taxes… see lease agreement early termination- purchase option.

RV = Residual Value

CYR = Constant Yield Rate (or actuarial rate) referenced in your lease contract under calculation of adjusted lease balance. It can be computed using the Excel RATE function and even by using a TI-84 calculator.

N = Term

t = sales tax rate

PO = Purchase Option

Assuming LFS works like TFS, the answer seems to be that unearned rent is credited back. Not sure if @mllcb42 has experience with LFS specifically.

You will still need to know the adjusted cap cost, that will be REALLY close to what your actual payoff amount will be. Ask them to provide the Adjusted Cap Cost. ![]()

That’s not true. All you need is the RV and CYR. See my post above. However, you can use the Adj. Cap to get the Adj. lease balance as follows…

![]()

This applies as long as buyout is completed within the first 30 days of lease signing.

Thanks for your response! I will ask them for a copy of the one pay lease contract.

As an update though, I called LFS again and escalated to speak with a resolution specialist (their ‘manager’ equivalent) and she was adamant that I would NOT be credited back any unearned rent charges if I bought out a one-pay lease early. I still do not think this is correct but it worries me that LFS has such conflicting responses.

Will update again when I get an actual contract to look at

Why don’t you just do a regular lease and buyout then? Why make it more confusing with a one pay involved? You still get the $7500 rebate on a regular lease?

In Ohio I am taxed upfront on the entire lease, and then again on the buyout price (which for the regular lease is close to the adj cap cost which will be much higher for a regular lease than the one-pay where the buyoff is closer to the residual). To avoid these excess taxes on a regular lease early buyout, a one-pay makes the taxes closer to what it would be if I just bought the vehicle outright. I’m assuming you’re in a state that does not ‘double-tax’

You’re taxed on the sum of the base payments in Ohio.

That is correct.

BTW, I reside in North Ridgeville near Cleveland.

She is clueless and has no idea on how to manually calculate the lease buyout. Calculating the present value of the residual value, effectively credits unearned rent charges. See my post above.

Post it and I’ll show you exactly why this is true for LFS leases. Rest easy, partner,… you’re in good hands!

Fixed it for you

You arent credited back in the sense that they wont send you a check for it, but your buyout will have the unearned rent factored in, so the buyout would be well below your rv.

Thanks for your response! Should have a copy of a sample one-pay lease contract by tomorrow.

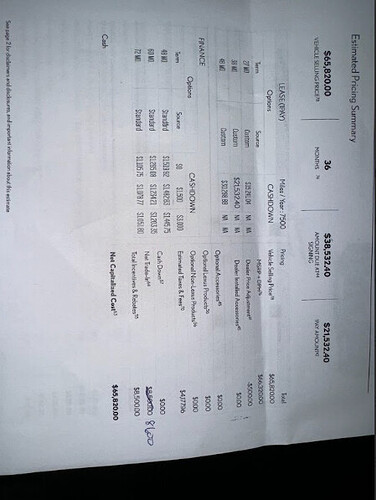

I do have some numbers for the one-pay lease though I’m not sure why the taxes and other numbers aren’t adding up for me the way they appear on the offer sheet.

These are the numbers on the offer sheet (FYI my state + county tax = 8% , likely similar to yours given you’re probably in the same county - pretty cool you live so close btw)

Non-capitalized Taxes = 2,947.66 (2118.62 State + 829.04 County)

MSRP + DPH = 66,320

Selling price = 65,820

MF = .00219

Residual = 59%

Lease incentive + adtnl rebates = 8500

Trade in = 8500

Doc Fee = 250

Registration + TitleFee = 105

Acq Fee = 795

Alternative Fuel Fee = 150

Plate Temp Tag = 20

Convenience Fee = 50

Total Fees = 1370

Total 1-Pay amount per contract = 21,532.40

My calculations:

RV = 66320 * .59 = 39128.8

Adj Cap cost = 65820 + 1370 - 8500 - 8500 = 50190

Monthly depreciation = (50190 - 39128.8) / 36 = 307.26

Rent charge = (50190 + 39128) * .00219 = 195.6

Total taxes = (36502.86 + 8500).08 = 2128.23

Total 1-pay amount = 502.86*36 + 2128.23 = 20231.19

Where am I going wrong in my calculations?

I’m in Lorain County. You’re probably in Cuyahoga. Anyway, I need to see the dealer worksheet before I proceed.

EDIT: Unless I’m missing something, their tax calculation of 2947.66 is way off based on your post. Yours is much closer but should be lower. Your 1370 capped fees include non-taxable fees like Reg. & Title, plate temp tag. I think alternative fuel fee of 150 is non-taxable. Not sure about the convenience fee (whatever the hell that is) is taxable. You need some clarity on the taxability of those fees and separate taxables from non-taxables. That’s why we calculate a base payment in Ohio. In your case, it should be lower than the 502.86. I got 494.62 because you must exclude non-taxable capped fees. If this is correct, then your total taxes would be…

8.00% x (494.62 x 36 + 8500) = 2104.51

Here is what I was provided from the dealer, I agree with you taxes seem higher than they should be.

(trade in is 8500, ignore the cross out)

Dealer taxes are way off. This is why it’s foolish to try to replicate a dealer’s worksheet. Only extract useful data (e.g., license/title fees, acq fee, doc fees, etc.) that you know are accurate. You need to research sell price for your market by checking LH marketplace, Edmunds, Truecar, etc. Vet the MF and rebates/incentives by going to Edmunds and requesting the info…

2024 Lexus NX Lease Deals and Purchase Prices — Car Forums at Edmunds.com

Next, create a target deal and construct a lease proposal…

This is only an example. Lease proposals can be structured in a variety of ways. Next, email it to the dealer and negotiate via email/phone.

Do NOT chase after a dealer. You’re allowing them to control the deal. Bad idea! Put yourself in control by doing what I’ve suggested.