I felt this in my soul.

Remember, there is also a 30 months term possible, difference is 3% on MSRP.

OP got “the fully protected payment”

tl;dr - here is how I taunted a cobra until it bit me. Should I cancel the over priced maintenance I didn’t need?

Agree with this. sales guys can always play around with other fees, rates and confuse people when there is some DAS involved.

To me it felt more like “friendly anaconda squeezed the life out of me”.

With F&I I think it’s more hypnosis while the venom from their handshake works its magic. “Sign here. And here. And here. Thank you.”

Car Salesman on the floor are your average positional players on a baseball team.

Managers are like the starting pitchers, they are going to come in and seal the deal MOST of the time but savvy buyers will get on base.

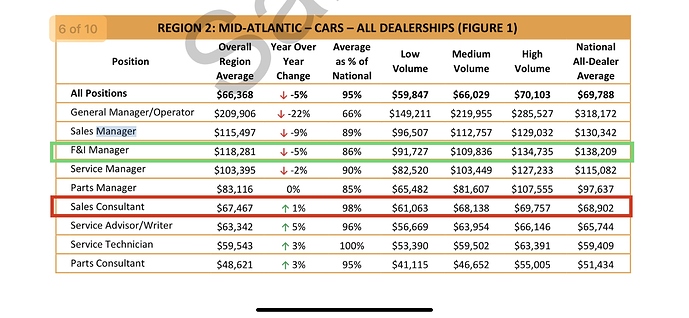

F&I managers are the relievers that you bring in when the bases are loaded in the bottom of the 9th. They are the studs in the dealership and make the dealership a MASSIVE amount of money (somewhere around 50% of dealership profit).

To show how good they are, most F&I managers are around 80% commission… So they are the second highest paid employee in the dealership on a National Average.

You are tired, want to go home in your new car, looking at your phone and thinking about plans you can now make later in the day, the ancient ass printer is screeching…

Give away the razors, to sell the blades.

Why is the F&I office so terrible? The bad forms (design, look), the 1980s printer that always prints off (wtf), all these forms and forms and forms. Is it designed to be awful? I’m a small biz owner myself and all of my company forms for customers are very well designed, clean printed, organized, yet a $100mill a year dealership looks like crap, why??

Some may complain about the length, but as someone who has a compulsion to write long stories with all the details on the internet, I am thankful that my 3% battery life lasted through my complete reading of this post. Thanks for sharing!

I especially liked this Shakespearean flourish.

Sometimes it’s the banks refusing to move into the new age. My old store went to a new set up where everything was printed on laser jet. Half the banks rejected the contracts so we went back to the old way.

The Okidata lobby alive and kicking.

Adding to that, many (most?) credit unions will sell you GAP for far less than the dealer’s list price, even if you don’t finance the car with the CU.

If you really want/need to purchase GAP, know what all of your non-dealer options are (CU, auto insurance company, etc.) before going into to sign papers.

I had something similar happen 3 years ago with my current BMW lease which is maturing in 2 months. I rejected every pitch from the the finance person but at the end, she came back and said my payment was going to be about $10 higher because of my credit. She said it wasn’t “bad”, just not “great” so the payment was going to be just a little higher. I should have rejected it but I had worked so hard to get the deal I wanted and it sounded like I had no choice anyway so I just agreed and moved on.

OP, do you think I should have rejected it? How should I handle this in 2 months when and if I’m in that office again?

$10 a month is pure last minute squeeze, since all credit issues would’ve been worked out by then. I don’t think they would want to lose the sale over $10, so you can thank them for your time and get up. I bet they will comeback saying they tried their bestest and figured out how to get the original payment.

I worked at AutoNation corporate IT for two years trying to change that. TLDR most states still require several forms to be signed with ink on paper. Therefore the F&I guys don’t bother doing anything digitally even though it’s available because they’d still have to use paper for some forms so they think it’s easier to just do paper for the whole thing.

The second reason is F&I is the profit center for the dealership and their is no tolerance for any disruption even if it’s for a positive change.

Third, they don’t want to change it. The longer they can keep you in the room the longer they can wear you down. They want it to be excruciating.

Autonation F&I only started using digital when they were mandated to by the CFO because they quantified it would save a ton of money. I know, I was on that call with all the GMs and the CFO because I helped create some of the systems.

A friend of mine that owns a car dealership told me that he “loves” the financial lady because she makes him a lot of money…

enough said

Agree, to a point… If you’re getting a great deal but MSDs aren’t optional and you’re paying some interest, doesn’t make sense to roll it in.

Lesson 1 is to understand how your lease deal structure works before engaging any dealer. My experience has been that most sales floor people don’t really understand the financial dynamics in a lease and simply go to the tower and give their manager the basic details to spit out some figures.

So I used to think the same.

But realistically, that cannot be their mindset.

If they “gave away” or didn’t try for an extra $10/month per deal, that’s a huge chunk of change at year end.

If that’s $360 per deal and they’re a high volume Toyota store writing 200 leases/month (close to $865K)

Or, if they’re a low volume RR store doing 30 new cars/month. When you have a $1500+ payment and sitting on 22 inch wheels, an extra $20-30/month for protection of those wheels is essentially meaningless.

I’m sure they will try, even if it includes lying about your sudden credit problem, but would they lose the sale over it?