Theyre showing $747 in add ons

Adjusted cap cost + buyout fee + tax

Yes, but wouldn’t we take one payment off the adjusted cap cost shown on the sheet?

Yes, one base payment, before rent charge/monthly tax, so take another $760 off

Makes sense! Thanks again - this forum is awesome.

Do I need to ask the dealer of any restrictions on early lease termination / payoff? Is there any risk of this NOT working? It would be really bad to get stuck with an $1200 lease payment ![]()

I wouldn’t ask them anything because what they say is meaningless and often wrong. Read the lease agreement. They are not very long and finding the “purchase option” and/or “purchase option fee” and/or “prior to end of lease term” sections takes less than a minute. Or maybe someone here can post an example from CCAP so you get can ahead of it.

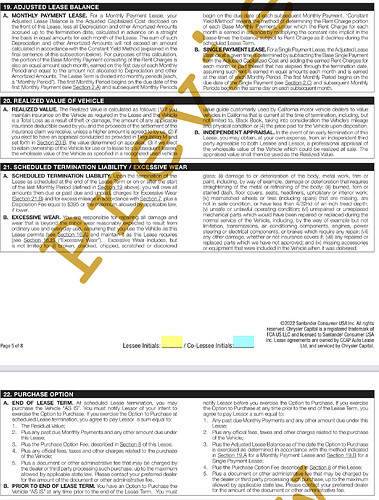

See section 22B for the early purchase terms.

It’s essentially any past due payments, the adjusted lease balance defined in Sec. 19A, plus the purchase option fee of $350.

It’s exactly how I described it in my earlier post. I would assume all CA lease contracts are the same but those are the sections to look at.

I can’t help but wonder why we don’t see this scenario more often. Is it because the lease incentives are not usually this generous? I assume the current $7500 lease incentive is really only there until they figure out the particulars for the new tax laws?

I would assume you’d have to make at least a few payments before paying it off right? As this requires the car to be registered, etc before hand? Can take up to 90 days in CA to get plates.

Roughly $53k. Would need to see the actual breakdown to be sure

Got it. I asked about the sign and drive but I don’t think they are clear on how that factors into the lease? How would this lease adjust if I wanted them to I could’ve sign and drive? I thought it was just a slight increase in MF and then the first payment as an additional rebate?

It is super simple for them to do. Ccap gives explicit step by step instructions in the ccap training portal for how to apply it.

Basically, your monthly cost would increase, but you wouldn’t pay any money out of pocket out the door and the first month’s base payment would still be subtracted from the adjusted lease balance.

Hmm the sales manager did not think it could be applied. Said he spoke to his rep…are all cars eligible? And do all dealers participate? They have a 2022 plug in hybrid at $2500 off MSRP and the rebates so I’m not sure how to convince them of the sign and drive on top based on what he is telling me?

It can, but he certainly doesn’t have an obligation to do it. Lots of dealers won’t because they just don’t want to.

Ok understood. That’s fair. It sounds like it would save a bit more money but not enough to walk away from this one. The MF is egregious but they are discounting $2250 off MSRP which I can’t find any other dealer doing.

And since the plan is to pay it off as soon as registration and plates are ready this is likely ok. What do you think?

I also wanted to ask - the plan is to throw around 10-15k at the loan once the payoff happens. Would it be better to just put that money down on the lease (I don’t usually put money down on leases), so that at least the payoff amount is the same as what we actually plan to borrow?

Putting the money down initially will save you a little bit of money in the first month’s payment from rent charge, but not a lot. You run the risk of if something happens to the vehicle between when you lease and the buyout.

It’s basically a low risk/low reward situation. Personally, I’d probably put the money towards the loan rather than the lease, but I don’t know that it matters in your situation much. There are other states where it would make a huge difference based on taxes.

Yes, not a big difference in CA. Having not done this exact situation before (I have bought out leases but not using a loan), how does it work if I want to put the 10-15k at the loan? Does it work like any other auto loan, where the lender is given the payoff and the amount I’d like to put towards the new loan as a down payment?

Probably depends on your loan provider.