Hello and thanks for your great suggestions. I didn’t mean to drop out for the last couple of weeks but I helped my son move and now I find myself getting ready to move which I wasn’t expecting .

@mevora question: After reading and watching a bunch of videos regarding leasing I hear that it’s best to not put money down at signing usually because “what happens if you get totalled on the way home”.

That makes sense but I also hear that it’s a good deal to do a single payment lease. Those two seem to contradict each other, didn’t they?

I see some of the lease deals here on LH that seem great and have single pay options.

Is it better to single pay or do the traditional lease of course this assumes an already negotiated deal that your happy with.

I’m confused.

Also is there a reason I see 2023 ionic6’s with a higher price than 2024’s was there a feature change that makes the 23 more desirable?

Thanks very much for your incredible sharing of your knowledge I do appreciate it.

Jeff

If you fall under SCE most likely you fall under South Coast AQMD. The state has delegated administration of these programs to the local air quality districts.

Check here if you fall within their geographic area:

https://xappprod.aqmd.gov/RYR/Home

Hope this helps!

EDIT: Rebate amounts are increasing after July 1st, but they are also changing the rules of cars that are eligible. If you’re interested in strictly getting a battery powered EV, I’d wait until July 1st to apply.

Are you sure vehicle leases qualify for this program? It seems this program may only apply to purchasing, not leasing, a new vehicle. In that case you would need to purchase a vehicle that meets the requirements for the Federal Tax Credit.

To put it in Layman’s terms:

- One Pay leases are usually prorated and refundable, also saves you on the MF a.k.a % interest

- Downpayment is lost forever

- 2023 RV and MF may have changed for worse, and there was some features changes for 2024

Yes, purchased or leased all qualify for the programs

@plumdiggity thanks for your input. I don’t live in that programs area I’m in NorCal, and I have applied and been approved for the CCFA’s $10k grant.

The grant is also stackable with the$7500 tax incentive.

I’ve been waiting for this program to be California wide. Wasn’t that supposed to happen the beginning of this year? Why only San Diego for SoCal?

You’re not covered by any of the jurisdictions shown in my post above? Replace Your Ride is supposed to cover LA, Riverside, OC, and San Bernardino.

I’m in LA county. I guess my understanding was CC4A had a flat 10k no matter how much the trade in was, and Replace Your Ride was up to 9k (car trading in is definitely not worth 9k) which was my concern aha

I think you need to read up on Replace Your Ride. It’s not tied to the value of the vehicle being traded in (the cars they want to take off the road just have to be old and presumably worth very little).

The CC4A is a state thing that is up to the local air districts to administrate. If you’re in LA County, Replace Your Ride should be the program that you qualify for. Check your zip code.

If your income and zip code qualifies, you will get $7,500 or $9,500 to turn in any clunker (you need to be ultra-low-income to get $9,500) and then get a BEV/FCEV/PHEV. This value stacks on top of the federal $7,500 EV rebate.

Yeah I just checked and I qualify for 9500. Your explanation helped me understand it, thank you. The “up to” wording always makes me think I’m not getting all of the discounts mentioned.

Oh shit, I guess I need to fully read into it since apparently it’s participating dealerships only which is like Hyundai and carmax

There are some Toyota dealerships, and one Honda. But yeah, I see what you’re saying that it’s not 100% participation. There are no Benz, BMW, or Audi dealers… but this program isn’t meant to help low income people get into a new Benz anyway.

https://xappprod.aqmd.gov/RYR/Home/Resources

IMO CarMax isn’t too bad… the rebate could work for a slightly used PHEV and you’ll come out ok.

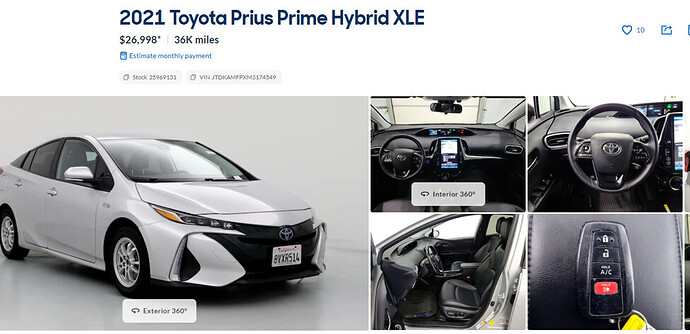

Like this one… stack on $9,500 from Replace Your Ride, $4,000k from the federal government for the used car PHEV, $4,000 from SCE on a used PHEV… you can probably find more government money someplace if you look hard enough… and your CarMax sourced Prius Prime is almost free.

What’s your opinion of buying from the Hertz sale going on presently. In my area there are a few model 3 that qualify for the 4k tax rebate. I also checked CarMax and Carvana but all the vehicles that qualify for the 4k tax rebate are being sold already. I’ll keep checking.

@mevora when you say a new car for sub 300 as offered here on the forums are you talking lease or purchase deal

If I could get a 2021 model 3 for 24k and take the 4k tax rebate at point of sale, then use my 10k grant from CCFA as well and pay cash for the balance, or finance that which should be around 10-11k then get the PGE 4k money, well that sounds like a great deal.

The things is the CCFA has a list of approved dealers that must be used and I’m not sure Hertz or CarMax are on it.

Writing this I realize that I can hopefully do this kind of a deal through one of the approved dealers. I didn’t know why I didn’t realize that. It could be that I’m trying anything I can to stay away from the dealerships

Anybody see any mistake in my plan sometime I have overlooked?

I think I would rather end up owning a useda model 3 than leasing a newer model 3 or Hyundai i5.

Thanks to all of you who have helped me get this far. I’m hoping I can pull this off with your help.

Thanks!

Sparky

every state has a list of dealers that’re approved so you’re kinda limited there.

I was saying sub $300 about lease . But you can’t go wrong with Prius tbh. Great deal if you can stack all the grants together

CarMax is on many of them… and I suspect the ones that don’t appear may just not be updated. CarMax knows their target audience and has the corporate muscle to do the filings with each air district.

Hertz on the other hand… plz no. Do not buy a used rental car from Hertz. Doesn’t matter if you get $20k of government money. No family that is already low income needs to deal with the noise of trying to repair a busted-ass BEV or PHEV that came out of the Hertz fleet.

Also @Sparky11 , don’t forget to look into the $4k of PG&E rebates for low income support on a USED EV (sorry no leases for this PG&E thing). There are also a few fragmented EV rebates across community-level and municipal-level incentives.

Getting a 36k miles used Prius Prime for $10k after rebates is like $240 a month over a 4 year credit-union loan term. That’s basically the spirit of the program. I don’t think leasing a car for $300 makes as much sense for this demographic.

Again My apologies for dropping out. I was away for about a week but yes I agree wholeheartedly that my best move and the way to make this money work hardest for me would be to use it to buy a used EV.

I was hoping to buy a used Tesla but in the fine print of the grant program I saw that you are not allowed to buy a used Tesla, only a new one. I have heard that some Model 3’s can be found at very good prices. But if I buy a new car I would not be able to take advantage of the PGE program. But I suppose that would be offset by the tax rebate of 7500 vs 3750 for a used car.

I also just read on the IRS website that you DO NOT have to have a tax situation that is large enough to use the$7.5k the rule I read said the IRS will forgive the difference.

Copy and pasted from the IRS website

“Q4: What if a buyer has insufficient tax liability to fully use a transferred credit? (added Oct. 6, 2023)

A4. The amount of the credit that the electing taxpayer elects to transfer to the eligible entity may exceed the electing taxpayer’s regular tax liability for the taxable year in which the sale occurs, and the excess, if any, is not subject to recapture from the dealer or the buyer.”

I was surprised but I guess they really want to get all the ICE cars out.

Made me wonder if they know something about just how bad our climate change problem really is?

So anyone have any recommendations about which used EV is the better one to go for. I’ve had a lot of people try and talk me away from the Hyundai ionics but I like them the most. Is there a year to avoid in either the 5 or 6?

Again I thank you for reading this if you have made it this far and especially for any advice you might offer.

Can’t wait to get this done!

Jeff/Sparky

I stand happily corrected. I just reread the fine print and it seems you can buy a used Tesla just NOT from Tesla. If one of the approved dealerships has a used Tesla the grant money can be used.

Yes!

Just wanted to let anyone who I got help from a while back know that I did end up buying a 2021 Model 3AWD Performance Tesla.

Used 10k from the CCFA Grant program along

With the PGE 4K used ev Grant stacked on top.

The car had 62k miles, one owner, a Carfax that showed it was in great shape. Dark blue. Special tires with red calipers it’s a beautiful car.

Cost was 28k

So I paid 14k for a 2021 M3 AWD Performance.

I was looking for one under 25k so I could get the 3750 tax rebate but time was running out and I love the car and feel like I got a fair deal to start with and with the grants ended up with a car I will enjoy for some time for a great price

Tesla’s warranty follows the car and the performance model gets an extra 20k miles on the warranty. Power train only of course.

Again thanks to all who offered there knowledge when I started this process.

Good luck to all

Sparky