No and no.

Don’t waste time trying to decipher a dealer’s worksheet or chasing after them. Otherwise, you’re allowing them to control the deal. They often omit a lot of relevant detail such as money factor, monthly base payment, monthly contractual payment, fees not itemized and even make mistakes. You need to rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.). Do your own research and establish a reasonable selling price in your market. Be sure to get a copy of the factory window sticker. Check for non-factory add-ons or dealer-installed options. And, if possible, eliminate those you don’t need or want. Get a list of all customer and dealer rebates/incentives including VIN#-specific discounts/incentives, if any. And, yes, the dealer has such a list.

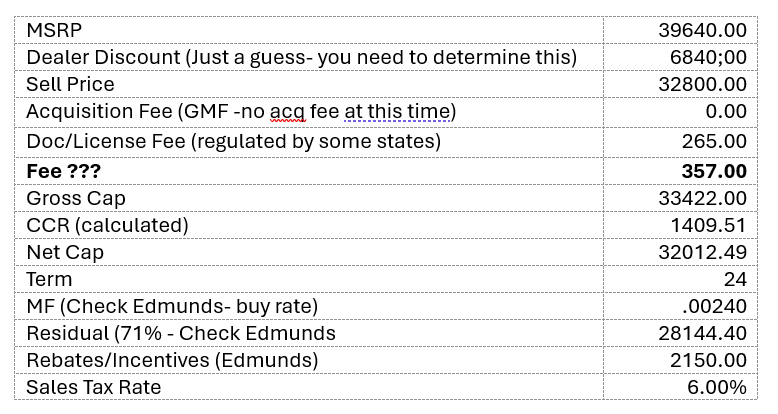

The only thing useful about dealer lease worksheets is the input data (bolded below). All data should be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Check available tax credits/incentives via the fund provider who may cover taxes or, at minimum, may assess a lower sales tax rate to energize sales for some models.

Organize all relevant data in tabular format like those below with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own target deal (proposal), not replicate the dealer’s deal.

The non-disclosed 357 fee makes no sense. Rebates are usually treated in one of two ways: (1) Compute how rebates will be allocated. Rebates are often used to cover lease inception fees with any remaining balance used as a CCR, or (2) Use the entire rebate as a CCR. Referencing option (1), I’ll spare you these calculations unless you would like to see how they’re done by sending me a PM.

Next, perform monthly payment calculations like those shown below.

Base Pay = .00240 x (32012.49 + 28144.40) + (32012.49 - 28144.40)/24 = 305.55

Contractual Pay = 1.06 x 305.55 = 323.88

Now, table all lease inception fees and how they are to be paid. Depending upon how the CCR is calculated (there are several different formulas), will determine the amount due at delivery (signing).

The CCR be calculated so that DAS = 0. As a side note, I would not capitalize non-taxable fees such as taxes and gov. fees. In those states the tax the individual payment streams, you’ll pay tax on capped non-taxable fees. As such, I would pay those at lease inception.

Observe that the 2150 rebate exactly covers the CCR as well as the lease inception fees including 1st payment. So, the 2150 rebate is comprised of two components: (1) the 1409.51 CCR and the 740.49 used to pay all lease inception fees. I have no idea what the 416.61 covers. I’m betting it likely includes a DMV fee and tax (84.57) on the CCR.

Bottom line: Zero drive-off fees followed by 23 monthly payments of 323.88 each.

Commentary

I don’t believe there is any need to pay 900 upfront.

It’s very foolish and nonproductive to waste hours sitting in a dealership negotiating. This can be a huge distraction. You need time to think things through and formulate questions within the privacy of your own home. This leads me to suggest…

Craft a lease proposal (example below) and email it to the sales manager (SM), not a floor salesperson as they’re often order takers and lack knowledge. All numbers should be accurate otherwise, you’ll lose credibility. Negotiate via phone/email. Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. Moreover, it’s helpful to know the terms and conditions of the lease contract such as early termination liability criteria and purchase option criteria as well as lease amortization methodology and excess wear/tear criteria. If all is as agreed, tell the SM that you’ll come in to sign right away. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t transparent or is uncooperative or showing signs of incompetence, WALK AWAY AND MOVE ON!

Leasing is time-consuming and requires a good deal of study and attention to detail. If you don’t have the time to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. However, if you’re willing to commit your time and resources, always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.

??? Let me know.