I got into a 2021 Sorento Hybrid (thanks to this forum) at the beginning of 2021 and it appears that I will have a ton of positive equity as the lease comes to a conclusion a year from now in January 2024. Moving up to a PHEV presents an interesting possibility…

Has anyone actually leased any Ally financed EVs/PHEVs eligible for a tax credit? I’ve called nearly every brand dealer around me, including calling the auto dept at Ally Bank, and everyone talks to me like I’m a crazy expecting any tax credit to pass through.

If someone has actually managed to get a lease with pass through with any Ally financed brand in the San Francisco Bay Area, please let me know. Thanks.

Did you call it ‘Tax Credit’? Ask if there are any incentives for a particular brand.

Ally calls their program Capitalized Cost Reduction Allowance (CCRA). That is what you’ll want to mention to any dealer when looking to use Ally’s program. Ally releases specific bulletins for each model they have CCRA on.

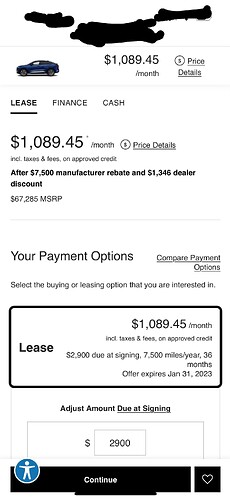

I just saw that AFS has $7500 rebates on all 2023MY E-Tron models and VW Credi has $7500 rebates on 2023MY ID.4 models.

We shall see. Do You remember what was the equity 6 months ago and recently? any difference?, any conclusion?

Would you help send a link to show the E Tron is eligible? I did some search, only saw Q5 hybrid is eligible. Thanks!

Dont confuse the section 30 purchase tax credit eligibility with the section 45 lease incentives

Got it. Thank you.

Even with the $7500-$9000 credit, lease numbers are still bad. Culprit is low RV and high MF.

That MF though … ![]()

For kicks I just looked at VWFS debt issuance — even the stuff that is SOFR + 0.95% is currently 5.25%.

Not sure if the MF changed when they added the $7500 incentive, but it would make sense that a 200 bps bump on buy rate is their insurance for fronting all $7500. Remember they have to borrow all that money 12-15 months before they’ll see it refunded. And by all the chatter here, they won’t get even 12 months of payments from lots of lessees, so they need to cover their costs.

Yep AFS and VW Credit will monitor dealer performance on their early payoffs on the EVs and if they see “excessive” payoffs they may take action against those dealers. I am not sure what that means but it was in the actual bulletin.

I am surprised any lender would give the full credit out as a cap cost reduction in the current rate environment. The interest expense on that full amount for 12-18 months really reduces the yield on these leases. Hence the worry about early term payoffs and need to bump the rate.

Bumping the RV by a % of the tax credit and reserving for the added risk is what I see as a preferable strategy to maintain profitability and have an attractive payment.

So if I leased an Audi EV, but buy it out after 30 days can they stop me not to buy before 1 yr. If yes then that has to be in the lease contract. Currently I can buy my audi lease any time I want.

It’s like a coupon bond where you get a coupon payment and misplace the bond (before they were electronic)

I’m about to close a payoff in month 2 of a Pacifica Hybrid lease with a 9.7% rate. Lenders can jack up their buy rates, but won’t that just encourage more early payoffs?

You assume you have money left, see post above yours.

Jacking up the BuyRate encourages you to look for alternative financing and costing the dealer a chargeback.

What exactly am I assuming?