The thing about 2020 was that a lot of the younger babies like @hersheysweet weren’t old enough to understand the markets. The markets also recovered super quickly due to governmental stimulus. This time, there’s a lot more people who’ve never seen a long drawn out recession like 2008

These younger kids don’t invest though. Explaining the stock market or even 401k contribution is a foreign language to them. Now mention meme coins, Nikes or lately Pokémon cards and all of them are set for life lol.

Barrier to entry into the market for the common joe has also never been this low (compared to 10-15 years ago). Of course, with covid, everyone sitting at home and collecting stimulus checks, people naturally ‘youtubed’ and ‘googled’ and bought at some high points and now will bail or learn to weather the storm. That said: Retail investors buy stocks at largest level in 10 years, JPMorgan says | Reuters

-interestingly (in addition): $3.25 trillion wiped out from the US stock market today.

$5.4 billion was added to the crypto market.

Eh there’s tons of tiktoks doing financial advice. Not to mention robinhood gamified it.

I don’t own a tik tok

There was no Internet/retail investing in 1987 though.

Psst, forget COVID crash already??? 2022 was pretty gnarly too for tech stocks.

Down to 4 (yes, effing FOUR) per CNN. Don’t recall it that low during COVID.

These are your feeling & opinions, please only present fact and stock/tariff talks in this thread.

That was a blip and came back super fast. Any good investor knew we would all either die or stocks would come back so many deployed cash into the markets at the time and you had a bunch of people sitting home buying stocks. I posted here about oil when it was near $0. I made 600% on that trade and basically have my kids education paid for. There will be these opportunities again. I’m not a dca guy, I wait for opportunity and lump sum invest.

An actual crash takes years to reach ath again. The fed was able to paper over that also which also led to the current issues. They can’t keep doing that

1987 occurred bc the system couldn’t handle the selling. We have circuit breakers now for that. Like it or not it does allow things to settle, mainly so billionaires can exit their trades first though as it’s a rigged game. Gme and the meme craze showed us that gem.

Agree. Generational wealth is made with concentrated positions. Wealth is simply maintained with diversification. You’re not going to make generational wealth doing DCA into the SPY fund.

I would argue that DCA could lead to generational wealth by educating and guiding all family members into this process. The first million is the toughest and longest to achieve but after that the time to double and triple is expedited.

I suppose it depends on one’s definition of generational wealth, but nearly everyone that has it made it from a concentration in something, and not necessarily a stock. It could be their business or anything else.

Agreed, I think some would consider any inheritance generational. Most people won’t or don’t have the ability to drop a few 100k in a good move to create that hypothetical never work again.

I’m loading VTI as we speak (not stock advice)

Dca is fantastic for people that don’t watch the markets. Investors do and usually multiple times a day. So when you see opportunity you deploy. Dca could take years to reach parity in an actual downturn. It’s also very psychologically hard for new investors to recover from. Imagine being new and putting 20k in the market last week. It’s now 10k depending what you bought. Even if you had another 20k to invest would you?

Most people should just be in etfs and just maxing retirement accounts and not worrying about the market day to day. Retired and people near retirement shouldn’t be complaining about their 401ks either bc they should be 75%+ in bonds/treasuries/mm. As well as at the top of the biggest bull market we’ve ever seen, inflationary but it’s huge gains for people that have large retirement accounts. But many are greedy and/or dumb.

Last week was a blip when you zoom out. But it could absolutely turn into more if our “friends” don’t negotiate with us. We’ve ran up the debt, both parties are to blame, and now it’s time to pay the piper. Either through higher taxes or actual growth not inflationary policy. The fed has no ammunition. They can’t and likely won’t do anything. So we need policy change and cuts to get back on track. Do I trust the current plan, in theory yes, but I’ve been fooled before. People saying this is a way for the rich to buy back cheap, well they’re the ones that lost the most last week. Most common people didn’t sell

Hence why you should take some control over where your money is going. Volatile markets are great times for vulture advisors to move you around and eat into your retirement with repositioning fees.

I like ETF’s because I don’t have to reposition and I load it like paying a bill this is strictly 401k and Roth though.

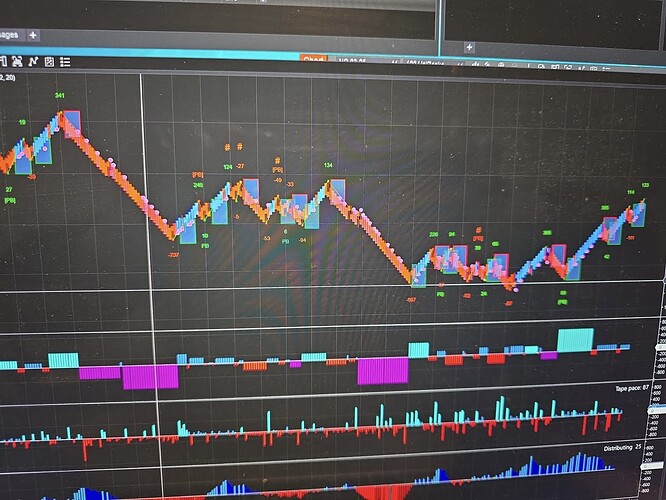

I have been working with a few people for years now on algorithmic trading and honing this current strategy we are about to deploy. This current market will really test our volatility indicators.

Who needs generational wealth? Save 20% in spy for 20-25 years and you’ll be in good shape

Oh really, the indices are down 50% since last week? This is exactly why people should not trade single stocks , which yes may be down 50% in the past week if they are some trash penny stock or whatever junk you’re referring to