I am trying out Rate Findr. For a 2024 F-150 Lightning in WA state it is showing a non-subvented lease option (“Ford US RCL Factors”) and a subvented lease option (“Ford US RCL Factors - 60412”. The subvented terms are substantially better, but how to know if these apply to me? In both cases the eligibly note just says “Residents residing in qualifying regions of the United States”.

I have tried searching variations of “Ford US RCL Factors - 60412” online to see if this is a known terminology and maybe I could find out more, but not getting any hits.

Thanks.

My best guess, which is a shot in the dark, is that it could apply to the area with zip code 60412- Chicago Heights, Ill.

Having a specific non-subvented lease option for a single ZIP code outside Chicago seems a bit far fetched, I think it’s more likely some kind of internal identifier.

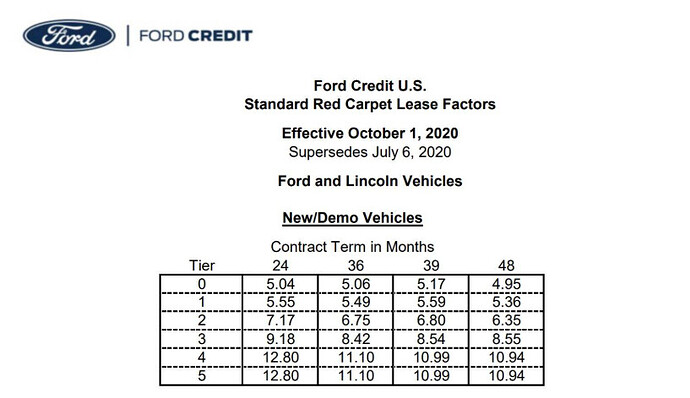

RCL is Ford’s “Red Carpet Lease” and the “60412” is just a specific program number. Call Ford Motor Credit or a dealer (GM or GSM) and ask what that program is.

RCL definitions example:

https://www.billbrownford.net/deals-specials/fords-red-carpet-lease-rcl-program/

Program # example, see Post #6:

https://www.macheforum.com/site/threads/ford-option-residuals-and-lease-terms-revealed.2045/

I agree and was thinking the same thing.

I’m aware that RCL means Red Carpet Lease. Also, what Ford describes as RCL Factors aren’t really factors. They are interest rates.

The reference to factors, I believe, began many years ago when FMC used two factors corresponding to a given interest rate and term. They called them a capitalization factor and a lease end factor. The monthly payment = cap factor x adj. cap - lease rend factor x RV. These factors may still be in use.

FMC added .001 to the cap factor to account for their industry-high acquisition fee. This equates to $1 for every $1000 of adj. capitalized cost each month. So, if the adj. cap was $30000, the monthly acq fee was simply .001 x 30000 = 30 or 1080 over a three-year lease. YIKES! They stopped doing that after a lawsuit was filed against them in the late 1990’s for non-disclosure… a violation of the consumer leasing act. Below are the details…

Mitchell v. Ford Motor Credit Co.

I complained to the dealer and to FMC about this practice in 1993, but it fell on deaf ears. Even though I knew it was an actionable claim, I chose not to pursue it as I elected not to enter into an FMC RCL agreement for that reason.

I wasn’t responding to you, but was responding to the OP.

As for the rest of what you wrote, I didn’t say anything except give OP examples of what he was asking about.

Sorry. I should have responded to OP.

This topic was automatically closed 60 days after the last reply. New replies are no longer allowed.