I’m leasing a Jeep Wrangler and plan to flip in 2 months. And I’m looking at the cheapest insurance that satisfies lease requirements. Are there special insurance requirements for lease cars? I don’t see any.

Yes you must have full coverage and not Liability, each one is slightly different but a ‘full coverage’ policy will be required.

Typically 100/300/50 liability and $1000 deductibles for most leasing companies. Some will be different- Toyota for example only requires state minimum required liability limits. I have not found CCAPS actual requirement is. It should be listed on the lease agreement.

I have minimal liability, collision, and comprehensive. No “Uninsured/Underinsured Motorist Coverage”. Is it enough?

Your lease contract will specify the requirements, but minimal liability probably doesnt cut it (nor does it likely cut it in general)

No offense, but I’ve never understood why people conflate level of coverage with duration. If you’re gonna flip it in 2 months, you won’t have paid much for 2 Months of coverage anyway, plus if it’s an intended to be a Cashflow positive asset, why not ensure its adequately covered?

I found the sentence in my lease: “Liability insurance required by applicable state law, including any no-fault and uninsured motorist law”. Since CA doesn’t require Uninsured/Underinsured Motorist Coverage, I only need to have minimum liability + (collision+ comprehensive) ?

Do I need to add CCAP to my insurance policy? Or just add the Jeep as a new car?

A leased car is not owned by you so CCAP will have an addenum that they will be paid first in case of loss built into your policy.

CCAP will need to be a lienholder / loss payee in your policy.

If someone that is either uninsured or under insured hits your Jeep & causes damage you’d rather save the peanuts that the coverage cost and self insure that portion?

Is the idea to just keep your costs as low as possible while taking on greater financial risk for yourself in exchange for $100 more.

You should seriously reconsider if you think state minimums offer sufficient protection to you if you make enough money where flipping a 4xe is an option.

Maybe I don’t understand Uninsured/Underinsured Motorist Coverage that well. I thought it’s for people without collision/comprehensive? If I already have collision/comprehensive and my car was hit by uninsured persons, will my collision/comprehensive insurance pay for the repair? And I have my own medical insurance.

Sure it mostly applies to medical and some other ancillary things.

Let me ask another way since you mentioned it a few post up…when you looked at your insurance options, why do you choose to carry minimal limits?

When you look around pretty much in most states but I’d argue CA is certainly one and you see how everyone else drives, what’s the idea behind minimal limits that you carry?

I live in California (Bay Area), and while there once was a time you did not have to worry about Uninsured/Underinsured Motorist, that time has long passed. People often drive without a license, current registration, or insurance presently. I read about it in the local news daily. I imagine most vehicles on the road in the Bay do not have insurance, or it is 50/50. I have had others damage my vehicles 5-6 times over the past eight years, and only two had insurance.

That said, I keep 100/300 for Uninsured/Underinsured Motorist. Lawbreakers and opportunists are out on the road, and I do not want to come out of pocket for myself or them. You probably have more to lose than they do. Additionally, it is not that expensive; I pay $14 on my six-month policy.

Savings gone.

I’m quoting Geico and they don’t have a paid option for collision damage waiver (I don’t pay deductible if hit by the uninsured) in CA? Their website says:

If you carry collision coverage on your car, then you may be eligible for the California Deductible Waiver.

And their auto insurance example says:

This waiver is only available when you carry Collision coverage and Uninsured & Underinsured Motorist Bodily Injury coverages.

Do you think I need collision damage waiver in CA?

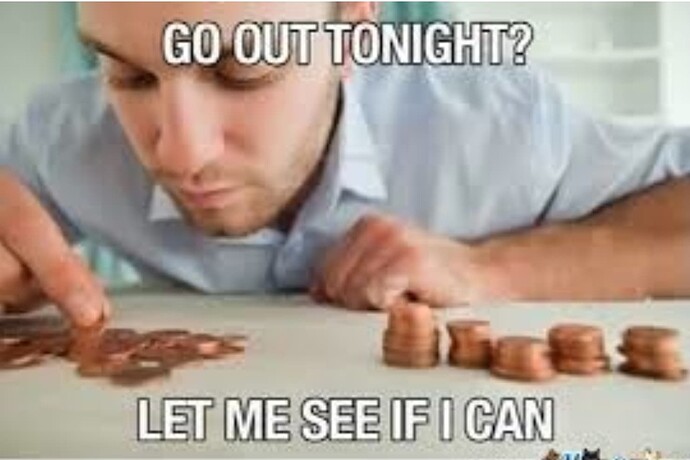

Thanks! I will change liability to 100/300/50. But I’m less sure about Uninsured/Underinsured Motorist Coverage. In the worst case, I will pay my collision deductible (1k) + medical insurance deductible (1k) if hit by Uninsure Motorist? And to cover this 2k, I need to buy Uninsured/Underinsured Motorist Coverage for $10k coverage. Worth it or not?

I want you to answer this, is the peace of mind worth the difference in insurance premium for 2 months, or are you just hypothetically pinching pennies at this point.

You’re being penny wise and dollar foolish. For 2 months, you’re talking minimal premium to increase coverages to make you safe. If you happen to hit a Ferrari, you’ll spend the rest of your life paying out of pocket if you’re just getting the minimums.

we should stop using the term full coverage

This topic was automatically closed 60 days after the last reply. New replies are no longer allowed.