Weird way to announce you don’t have 1MM in investible assets.

Or maybe he doesn’t have his assets with BofA?

A post was merged into an existing topic: Off-Topic Landfill 6

What does CharGPT have to do with the deal? You lost me

Did I use ChatGPT to run the deal?? Yeah- call it lazy math but I don’t really understand the reference here.

You guys keep continuing on calculating ownership losses while I’m calculating usage cost. My goal isn’t to ‘own’ a depreciating box; that doesn’t make sense unleee it’s 5 years old or older and fully depreciated. My goal is to drive new, warrantied metal every 3 years for less than it costs to finance one. MBFS inflated the residuals and baked in the $7,500 EV credit-meaning Mercedes is covering a chunk of the depreciation. You can buy assets, I’ll lease leverage.

….and I think you guys are referring to the fact I should use ChatGPT to justify the numbers but again- what’s the goal? My goals are different and people burn cash on many different ways. So again, I’m lost here

I don’t sell a program either. Lots of wild and negative assumptions going on in this thread. I love cars and tech- lease hacking is also about getting the car you want at the cheapest price. I’m not aiming to be an economist- I want the things I want at a low price. Not hard! Every car I leased had equity; at the end of this maybe not but overall I’m in the green. Not anyone else’s problem but thanks for being positive and productive guys! Bunch of productive rockstars in this community.

You can buy a car and sell it the next day if you want. I don’t really understand the framing or your sentiment that leasing is always beneficial. Logic would dictate that the captive banks are not clueless and can probably place value expectations on the cars as good or better than you can. so if leasing was a free lunch, why would the terms be as they are? It’s situational, like most other financial transactions.

you are committing to 36 months of payments with a fixed amount of assumed depreciation baked in. Feel like the situation you’re selling just doesn’t match reality and it seems like you honestly don’t really understand what is going on, which is a lot shocking given you apparently are on social media teaching other folks about this stuff

And you have failed at that goal with this deal. That is what I’m trying to relay to you. You can spend $75k on a G580 for 3 years or you can buy a redesigned G63 for MSRP and sell it for a hell of a lot more than a net 75k loss after 3 years. Not to mention Section 179 and whatever other ancillary benefits you want to throw in there.

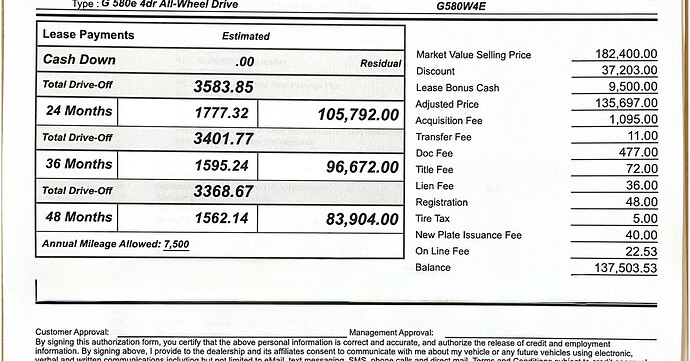

This lease makes no sense – and as stated above, makes even less sense to get without the $15k BOA incentive

Except the first urus you shared which you rolled 22000 dollars of negative equity into the second one, right?

The sales price of that one if you look was 10% off to wash that negative. Did you see that too?

Have your chat GPT talk to my chat GPT. Might be able to teach yours some things.

Yes you got a discount but that doesn’t get rid of the negative equity. Someone else could have simply bought the car at 10% off with no trade in, unless you’re claiming the deal was structured this way by design and you only got 10% off for accepting less than market value on your car on purpose

Correct! They weren’t offering anyone that discount off the street.

You’re absolutely right and I must be definitely doing something wrong. Let’s just focus on the cars though- so tell me what color is your Lambo and G-Wagon? I like sticking with white and black myself…you?

Failed?! You might be missing perspective here. I pay $2K a month with a residual at $95K to buy at the end (and we still don’t know how the depreciation will play on this- it’s an assumption); whereas a G63 will cost double every month and based off historical data I should be able to flip and regain the money I spent into it. So you’re logic is to spend the $4K/month for 3 years at $144K with JUST the highest probability I’ll recoup that money VS the $75K in 3 years and buying at at residual (assuming it meets market). You have any idea what I can do with the additional $70K in my pocket rather than gambling on the higher probability the G63 will always pay me back?! Listen there’s a reason I am in my income bracket and there’s a reason people don’t match up outside their weight class- it’s rarely fair.

Your hyper focus on ownership seems to be an ego play while my focus on more car for less payment caters to my lifestyle, immediate cash flow, and overall car goals. We are speaking different languages here but to each their own.

Mine are 2xMSRP Color, only way to go ![]()

You’re bored

Explain why that’s funny since Leasehackers deal was worse than the deal I got. Lots of opinions here but nobody likes to ride the data. SMH

Don’t think this is a good deal at all. I was given better deals in $1300 range (BOA incentive) and still passed. Car isn’t all there and which is why MB is having a tough time selling these. I personally would have just financed a G63, as many said, or even a CPO G63.

If you feel like you got a deal, then great but most of the members on here won’t see it as a flex. Here were my initial numbers without any bargaining and missing BOA diamond rebate