What’s the best bet for finding a good broker in my local are, beyond a simple Google search? (NJ) Don’t have too many people to ask around for recommendations. Does anyone from LH have one?

Check NJM. If they do not price well for you, I’d look for a non-captive broker in your area on Google. This means they represent multiple insurance companies, and they get the best price/carrier for your unique situation.

We used this agency before Get a home, auto, life, or business insurance quote | Rate.com

If you have AAA, you can work with one of their agents to help you get the best rate. They cross shop different companies. I went with them last year. I switched from Travelers to Arbella (through AAA).

An independent agent is the way to go. Also switched to Arbella in MA and have Quincy Mutual (switched from Progressive) for commercial auto.

Both companies have asked why I switch cars so much, lol.

My Costco insurance went up 30% last month…zero changes and my cars are now both a year older.

I priced the competition, and it was no better.

Based on my experience, if you in an accident and get your rates jacked up, it has always been better to switch insurers after 3 years (or sooner…check at least annually) rather than assume your current one (and the one that paid out the claim) will lower the rates.

Just curious, but has anyone had a similar experience with State Farm when it came time for paying for repairs on a damaged car?

thank you, i’ll check that out!

I’ve just put in my details on the insurance websites for an EQS and Ariya. Feels like highway robbery. The cheapest I got was $3200 and all but that 1 were over $4k yr. With either 1000 or 2000 deductible. Driving 15k miles a year. Same coverage in an x2 is $2400. One was 552 a month…the lease on the EQS is barely that much.

They really don’t like Los Angeles drivers

AAA rated the EQB and Ariya the same, The Solterra was cheapest and the Q4 was just nasty.

What insurers won’t ding you for glass only claims? I have 3 in the last 2 years on 2 insured vehicles. Full windshield replacements due to highway driving and rocks coming from dump trucks & construction. Even have one on video, insurance didn’t care. Have Progressive and they’ve doubled my policy, nothing else, no tickets or anything.

Progressive has been jacking up premiums with zero claims.

Progressive has been known to give you 6 months teaser rate and jack you up on renewal.

Thanks, I didn’t realize they were that bad. They actually jacked it up before I made my third claim so I’ll be looking again. I tried quoting a bunch of the online carriers but the rates were all about the same, I will look into an agent in the future. This is for NJ btw.

I don’t know if already shared but my premiums have gone up quite a bit.

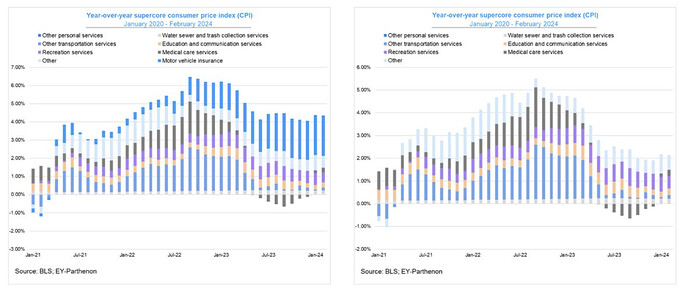

Auto insurance costs alone added 0.5% to the CPI last month.

Buy Toyota and keep it 'till the wheels fall off to save on insurance cost ![]()

Serious question: nobody wants to pay more for insurance, and I hear you that the glass broke because of something out of your control, but why would any auto insurance carrier not increase your rates on a policy that includes glass coverage, since it’s more likely they will have to pay out on a glass claim?

What does the rest of your CLUE report look like?

That sounds like no fun.

I actually had this happen to me recently. Called Geico and they said that since it’s a not at fault claim it won’t affect my rate.

My insurance actually came up now for renewal and my premium went down by around 3% (after going up 60% over the last year, lol.)

But for most people it wouldn’t be worthwhile claiming a cracked windshield anyways, since the deductible would kick in first. (Under florida law, insurance deductible for comprehensive coverage does not apply to motor vehicle glass, so I did claim it through insurance.)