Haha. Exactly. They know they’ll get the money one way or the other. So why give up the car?

It’s about independence for them, more than anything. And feeling grown ups.

A kid in high school on a school bus or taking an Uber everywhere for four years?

Now LHer has truly seen it all.

Rate of teens getting there license is way down. By the time @Lvs23 kids are grown they might care less than you would imagine.

They don’t need their license in cities, but they do in suburbs. And not just to drive to school, but anywhere else. Even in DMV (maybe excluding DC, Arlington or Bethesda) ![]()

“Of those we surveyed, anxiety or fear of driving was the most common reason given (40%) for delayed licensing. Among male respondents, the rate was even higher (47%). In contrast, only 15% of unlicensed respondents reported fear of driving as the reason they chose not to get their license.”

That 47% is going to work for the other 53%.

53 > 47. Good help is hard to find!

I hear Sandy Munro of Lean Designs scream loudly from the Aptera Factory floor, that Gen Z and beyond dont want to drive normal cars. Instead they want something cheap nimble, tech laden like this. Maybe the 47% will flock to these instead.

We’ve had AMICA for decades now. In the beginning, we’d get annual rebates in addition to great service and low rates. They used to write policies on referrals from current members back then, we got in by a referral.

Later they nixed the rebates but that was after 7 years with them. Stayed loyal and insured the house and got personal liability for complete one-stop insurance with multi policy discounts.

I have been afraid to leave them because they’ve been so good to us. Even with several at-fault claims over the years, including home claims that they handled swimmingly well, rates had been very competitive.

Alas, the past 4 years have not been so good to us. We used to pay $2500 annually for 4 cars, we’re up to $9000 for 3 cars now. Almost triple in 4 years. Despite being older and having the kids no longer teens and out of college. We’re now just like the everyone else, it seems.

I truly believe AMICA were the chosen ones, and offered exceptional advantages at some point in the past. Have I been drinking the Cool Aid? Should I actually jump ship to another carrier and risk losing my (imaginary) “status” w them? Or maybe they still are something special and they are “worth it”?

It’s rare that anyone posts about this company so I’m just not sure this is a special case or just a matter of shopping better companies like so many here have said repeatedly and adamantly to do. Anyone with specific knowledge about this company, ideally internally (worked for them or wrote policies w them, or knows someone like this), would be appreciated. More than just an opinion on how to be a good consumer.

I’ve heard very good things about Amica, but it was maybe 6-8 years ago. Tried to switch twice (last time was last year), but they were more expensive.

My parents have had Amica for decades and swear by them. The company definitely isn’t exclusive anymore, ie: referrals. I stuck with them for the first few years out of college but then started switching every year or so based on who is competitive. There are other good companies out there - I’m currently with Cincinnati for the last two years, and my broker says they are quite good with claims. I would definitely shop around - loyalty isn’t worth $9k a year for a policy…at least to me.

I’ve recently heard a bunch of commercials from Amica. Their thing now is “we care”. It’s all about empathy. Vibes man, lots and lots of vibes man.

GenZ probably gulps that shit by the gallon. Meanwhile the premiums is 18% higher than StateFarm. ![]()

Amica is/was known for their service and being a notch above the mainstream insurers like State Farm but below the high end insurers like Chubb. I wouldn’t expect them to be cheaper and that’s been my experience.

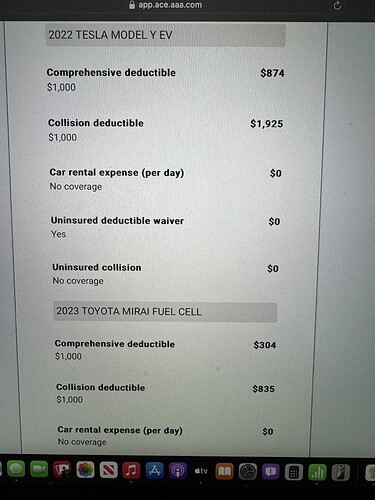

Just got a AAA quote-to see the price difference from what I’m paying with Connect (Costco).

I adjusted to the same deductibles etc. Connect is $1448/6mo and AAA is DOUBLE+ ![]()

Not sure how or why, but my geico premium just went down for the next 6 month billing cycle (not by much, about $12 per month). Pretty surprising considering how literally everything is on the rise

Did a claim or ticket come off, ie it’s past 3 years (or whatever the time period used to factor rates).

Yesterday I switched out my 2021 Jetta for a 2024 ZDX.

Amazingly my Geico auto policy only went up $100 bucks per year . When I quoted out insurance for the car before leasing I didn’t believe it and called GEICO to confirm.

Although rates will probably go up at renewal as demographic of ZDX drivers change from middle aged suburban woman to mostly lease hackers who were drawn to the deal.

SF in CA asks for 22% on an “emergency” hike for homeowners while a 30% rate increase ask is still pending.

My homeowner’s insurance in SoCal was pretty low before, it jumped 33% this month. Still a very reasonable amount. I am no where close to a fire hazard area and have no danger of fire.

Not that Im aware of. 2 claims in the last 3 years, 1 glass and 1 no fault (was rear ended). I can still see them when I look at my claims list. Is 3 years the typical for claims falling off, if at all?