I just completed a lease buyout of a 2024 RAV4 Prime XSE.

Here was the bottom line - North Carolina buyers take note:

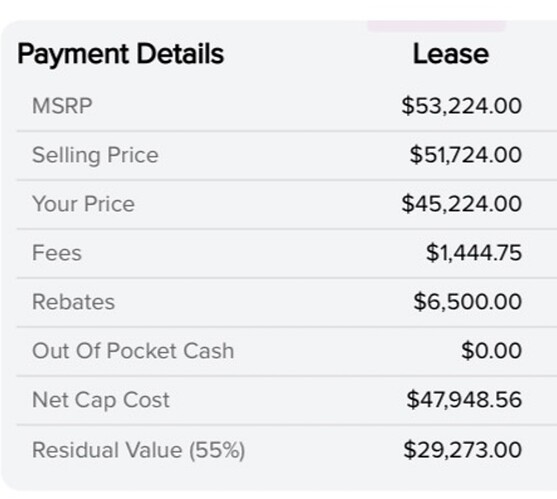

MSRP:

$52,863.00

Dealer discount (Coleman Toyota in Bethesda, Maryland)

$2405

12k/24 month lease, $0 down, first payment:

$877.00

Buyout price, including NC 3% sales tax $1405, $698 doc, $350 disposition fee, $30 inspection, $110 title/tags:

I am expecting a refund of $825.00 for a GAP policy that did not intend to buy. I flew up to Maryland to get the car, waited a while, and then was signing furiously. I wanted to get out of there and wasn’t paying attention I guess when the finance manager just slipped it in. I’m sure he mentioned it quickly but yeah, whatever. The refund application was processed the day after I signed the lease, and according to Toyota Financial would be cancelled anyway by the buyout.

Total cost, including first month payment and minus GAP refund:

$48,432.28

Maybe add $200 worth of airline miles and gas to get from North Carolina to the dealership in Maryland and back.

This should have been c.$1050 less, but because I live in North Carolina I was required by law to complete the buyout at a dealership - a law probably pushed through by the strong dealership lobby here. I therefore had to pay a $350 disposition and second doc fee of $698. This was really annoying and also cost me three more hours at a dealership - it was like buying another car. I might have been able to avoid this fee had I taken out a loan from a bank and let them complete the transaction, but that was one more hoop I didn’t want to jump through. In retrospect, given how much time I spent at the dealership, maybe I should have. But yeah, just didn’t want to deal with it, and now it’s done. Basically, I gifted an NC dealership a grand - so the law is doing what dealerships intended. But I was able to give a sale to the nice saleswoman who showed my wife a car a few weeks earlier that we didn’t buy, so there’s that I guess.

I still saved a good bit. If I hadn’t done the lease and just got the dealer discount of $2405, my OTD cost would have been c.$52,761.00, so I saved an additional $4300 or so. If I didn’t live in NC, I would have saved closer to $5400 more. So, I’m still pretty happy with the deal overall - and got a car I wanted but couldn’t find in North Carolina.

This forum helped out a lot. I appreciate everyone who contributed to this thread.