Hi, I hope that someone out there can give me some advice. I’m not sure how all of this works, but I found this website and forum off of TikTok from a person who specializes in finding good deals on leases.

So here’s my situation at least a 2022 grand Wagoneer Jeep series one I still owe about 72,500 on it. It has 51,000 miles and I’ve been offered on the low and 39,000 for a trade-in on the higher end about 44,000 for a trade-in so it still leaves a lot of negative equity.

So I’m trying to find a good deal on a lease that I could roll this negative equity into the credit is good. I wanna get out of my current finance because the payment is just too high for me at this point. My income status has changed and it’s just not fitting my needs anymore.

I’m hoping that by going into lease I could be somewhere around $1200 or less hopefully.

I’m open to pretty much any car brand as long as it’s a midsize or full-size SUV I’ll even be interested in a EV. I’ve never had one before but I am open to it. Ideally, I would like to be in a 36 month or 39 month lease I don’t really wanna put any money down, but if I have to, I would if there’s anyone that could give me any advice, negotiation tactics or a way to negotiate a deal any help would be appreciated thank you.

1 Like

Rolling $30k of negative equity into a new lease is gonna be insane…

What interest rate is your wagoneer at right now?

Honestly I think the best you could probably do would be either a Wagoneer S or a Jeep GC 4xe, even then rolling that much negative equity in is insane.

Have you gotten offers from CarMax, carvana, driveway, etc? If not, do that before you do anything else.

1 Like

What’s the endgame here exactly? Is something wrong with the Wagoneer? You would have to write a pretty big check to get out of it since it would be very difficult to roll that kind of negative into anything. Did you roll negative into the Wagoneer when you got it?

That negative equity alone is going to cost you $1000/mo

1 Like

That’s tough. Do you have $ to put down?

I don’t imagine a financial institution being cool with having that much negative equity on their books knowing it’s happening. Naturally you already have that negative equity but it wasn’t already know going into the first deal.

I assume you might have to heavily consider a hornet or something really inexpensive to create the payment you are looking for.

But again who gives you that deal?

Maybe just call that Brooker and ask him / her to help.

This is what they do for a living. Maybe they have a pocket deal or 2 that generates 15+ k off MSRP, can absorb some of your negative equity and still get a bank to come in.

Someone else mentioned a wagoneer S. I bet whoever this person is knows where to find a wagoneer S or 4000 of them well below MSRP.

Good luck

LTV will be a problem with inexpensive cars, I’m afraid.

Agreed unless you have like 10-15k to put down.

If now the hornet or a 4xe is likely impossible.

But the wagoneer S could work.

Maybe even and Acura zdx

Or maybe one of those demo Volvo ex90s if the 2024 models even have lease programs anymore which I assume maybe not.

1 Like

Can we start with how come you owe $72,500 on a 22 Wagoneer?

7 Likes

I’m surprised you don’t know the answer to that question… Here, Let me tell you how it works. He borrowed x amount of dollars has paid x amount back based on X interest rate and now he’s left owing this amount at this time.

Basically every car loan works like that.

Hahaha sorry man. I couldn’t help myself.

I know Im a dick lol

i believe the poster said it was a grand wagoneer and not a regular wagoneer. wouldn’t that make it more expensive?

nonetheless…man, that sucks. 72500 owed is crazy, i’m sorry that you are in this situation. my wife and I initially liked the wagoneer but after a ton of google searches and talking to our mechanic and looking at these forums, it kinda turned us off from jeep/stellantis in general.

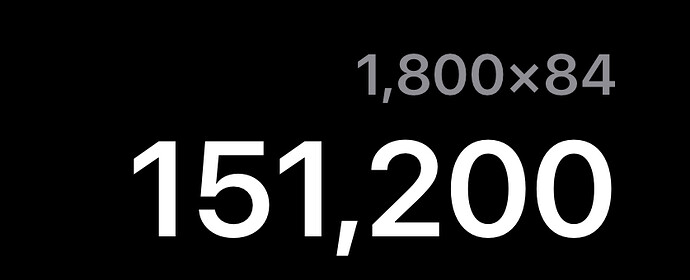

Reply to everyone yeah I know the grand Wagoneer I’m in right now is a really bad deal. I got it at a really high interest rate and I didn’t put any money down to get it. I got it I guess toward the end of Covid I did not roll any negative equity into it. My payment right now is About 1800 per month and it was on a 84 month finance term I believe so my endgame is to get into something a lot cheaper and a good lease to roll a negative equity into it and hopefully lower my payment to about 1200 and so far one of the better deals that I was looking into was the payment would be $1250 on a Kia EV midsize I don’t remember the model of it or anything and that was with $5000 down so that’s kind of what I’m looking into doing right now. I just didn’t really wanna drive a Kia but at least that was on a 36 month lease and I would be done clear out of it and have a fresh start.

Yeah it’s had a ton of electric issues and still does wish I found this forum before I bought lol

I’d start by seeing if you can refinance to a lower interest rate.

3 Likes

Speak to a lemon lawyer (it’s free), and see if you qualify for a lemon buyback. Sorry, but $1800 on 84 mths is…

2 Likes

Do you have $30k you can use to make this go away and then enough to buy a cheap used car while your finances recover?

My guess is probably not, given that OP is paying $1800/month before gas, insurance and maintenance costs.

Do you recall the purchase price? What is your auto loan interest rate? I am just trying to understand how you got yourself into this situation - I am not judging, btw.

It’s called being trolled. Even at a 90k purchase price that’s around a 15% interest rate.

1 Like