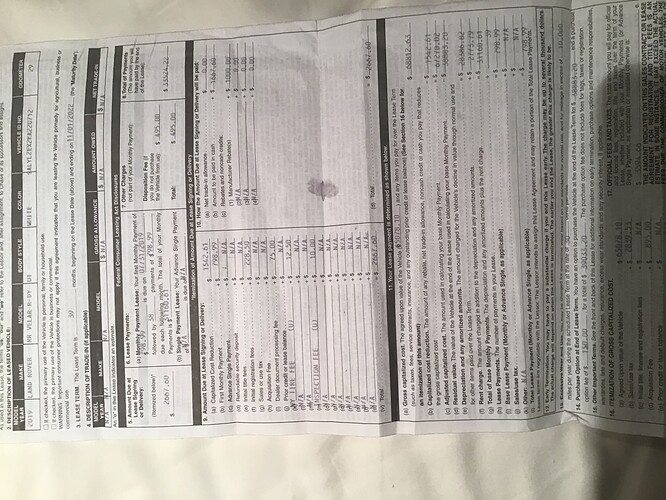

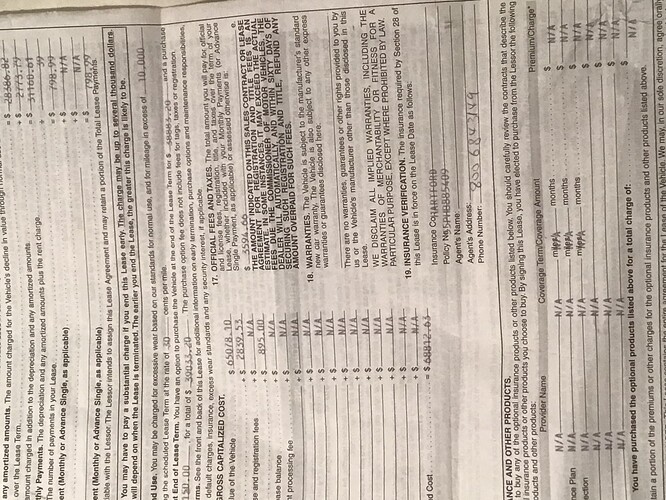

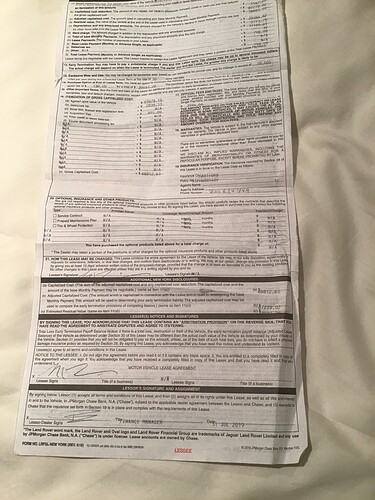

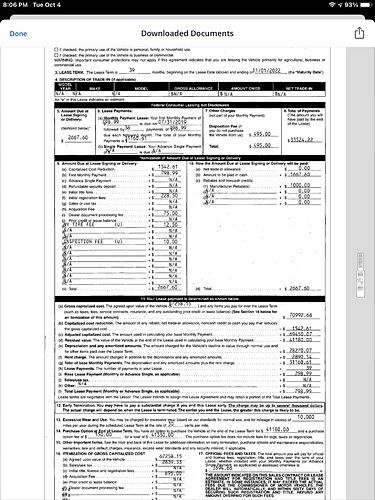

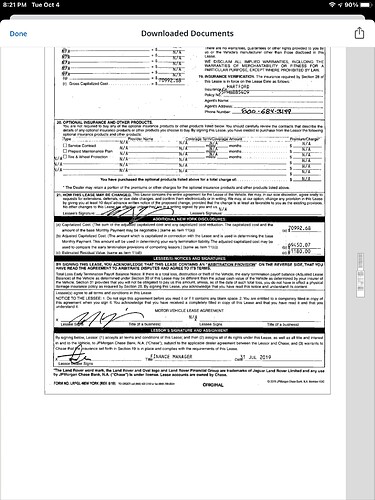

My lease with Land Rover/ chase is due up oct 31. I began my search for a new vehicle a few months ago, and when I got an offer from a BMW dealer to buy out my lease, the equity came up around $2600 short of what I figured based on their offer and my residual. It turns out that they called chase to get my residual, and it was DIFFERENT than my contracted residual buy out. I started process to figure out why with chase, as I had a bit of time before I was going to trade car in. This was the beginning of an ongoing ridiculously frustrating experience. My first inquiry was in August, which after 1 hour on the phone with folks who’s English was suspect at best, I finally was transferred to someone who told me they would start an inquiry, and I would have a decision in 5-7 business days. Fast forward to 3 weeks later, and still no answer, so I called again, and after more frustration, finally was forwarded to someone who told me that I should forward copy of my contract on Chase secure messaging center, and those messages must be answered by chase within 2 business days, which they did. Unfortunately it was more of a circular merry go round, as one message told me that they had to speak to me on phone, so I called, and was told my residual was $41,500, not the 38,883.20 that was stated on my contract. I asked if anyone looked at my contract, and was given “I don’t know, this is just the number I have on my computer.”At this point I just hung up the phone and decided to call Jamie Damon’s office. I explained the issue, whereupon they said they would have someone their team investigate, and it turns out that an Ashley at their office did call us back. Here is where I am totally confused , as I thought my case was a slam dunk. As of today, all of my payments to chase are complete, so the number I figured on as a residual is the 38883.20, plus the $150 in fees as stated in my contract. And this is what they said. The signed contract I have was not funded by chase financial, and the dealer submitted a new one that we did approve. Your monthly payment was the same, but we had to restructure the deal to get funding approved. it was done unilaterally by the dealer, so I have to speak to dealer if I want more answers. I had no knowledge of this, did not approve this or to my knowledge sign any re worked contract, and no such contract was given to me by dealer in my client package. The only contract in my package was the one I enclosed here.Of course the dealer says I have to take it up with chase financial.Mire of a merry go round…2 points, I thought residuals were set in stone( at the time it was 58%,39/10, of roughly 67,270 MSRP, so in order to get their”present residual of $41,500, the residual had to be changed significantly. 2. In my limited knowledge of contract law, I believe Any change to a binding signed contract would have to be approved and resigned by both parties, I have no idea how one party can unilaterally change a contract and expect it to be valid, and I have asked for a copy of their supposed” new contract “with my signature, but have received no answer on that request. I am enclosing a copy of my signed contract and a correspondence I received from Jamie Dimon’s office,

office. Btw, time is of the essence as the value of the Velar is dropping by the day, and the dealer who is buying it from chase has given me 2 weeks before their offer is off the table. So going the legal route may be counter productive from a timing point of view…Any input is greatly appreciated!

If your question relates to lease-end purchases with the intention to own, post under the Buy/Finance sub-category and tag “lease-end-purchase”.

Please tag if your question involves a specialized topic (e.g. tax, legal, shipping, 3rd-party-buyout, lease-transfer, etc.). You will reach experts faster that way. View all tags at Leasehackr Forum.

If you asked for a deal check, circle back after you have signed a deal – the community always loves to hear back! Submit your deal to SIGNED! (https://share.leasehackr.com).