For those interested, this article is available in PDF format. PM me and I’ll be happy to provide it.

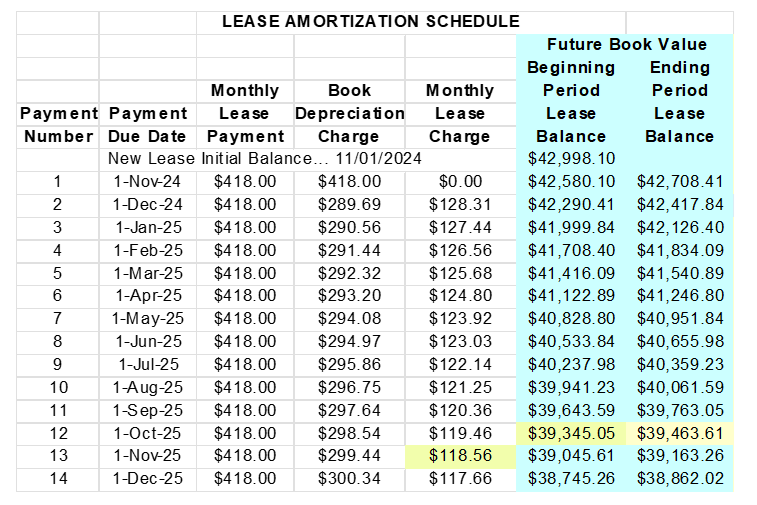

Consider the following monthly payment lease with the given lease inception and termination dates.

Term = 36

Adj. Cap Cost (ACC) = 42998.10

Initial Lease Balance = ACC – 1st Payment = 42580.10

Residual Value (RV) = 32000.00

Money Factor (MF) = .00150

CYR = 3.61601645%

RATE = CYR/12 = .00301335

Base Monthly Payment = 418.00

Lease Inception Date: 11/01/24

Lease Termination Date: 10/19/25

Elapsed Months = 12 (partial month counts as a full month)

Remaining Months = 24

The constant yield rate (actuarial rate) is the interest rate implicit in the lease and is calculated (described below) in much the same way that an APR is calculated. That rate is 3.61601645% compounded monthly and is called the Constant Yield Rate (CYR) or actuarial rate referenced in the early termination section in many lease contracts. Like the cost of money (e.g., MF), it is not disclosed in lease contracts.

CYR Calculation

Calculating the CYR using the TI-84 Calculator…

N = 36

I% = 3.61601645…

PV = -42998.10

PMT = 418.00

FV = 32000.00

P/Y = 12

C/Y = 12

PMT: BEGIN

Calculating the CYR using Excel…

Money Factor Digression

There is a difference between the CYR calculated using the TI Calc or Excel versus the often used 24 x MF to provide an estimate of the CYR ≈ 24 x .00150 = 3.60%. Note that the estimate of 3.60% slightly understates the actual CYR of 3.6160%. Regardless, this estimate still provides a very good approximation of the CYR assuming traditional leases with monthly payments provided that the calculated CYR < 12% and the lease term is less than 60 months. Otherwise, the difference grows dramatically, rendering the 24 x MF estimate useless. Because estimating the CYR using 24 x MF only applies to leases with monthly payments, its application to single payment leases does not provide a very good or useful estimate. For instance, 24 x .00150 = 3.600% differs considerably from the corresponding CYR of 4.649…% by a margin exceeding 1%. However, this should not deter one from using it just to get a rough estimate of the CYR.

Both CYR platforms modeled above use the numerical iterative algorithm known as the Newton-Raphson Method of Successive Approximations and so their CYR calculations will be nearly identical.

Next, let’s examine four methods used to compute the adjusted lease balance (ALB).

Method 1: This method is favored and commonly used by many finance captives and banks. The ALB is calculated by first subtracting the accrued depreciation through the lease termination month from the adjusted capitalized cost (ACC) and then added to the lease charge for the month following the month of termination.

Because the formula for calculating the ALB is unwieldly, I’ll Refer to the above partial lease amortization schedule. The sum of the book depreciation charges in rows 1 through 12 equals 3653.05. Subtracting 3653.05 from 42998.10 yields 39345.05 which is the beginning of October lease balance that results immediately after the October 1 payment. The lessor is entitled to collect the lease charge one month in advance of termination. Because the lease terminates in October, the lender is entitled to the November lease charge of 118.56 as lease payments are always paid one month in advance. Therefore, the end of October lease balance (ALB) is the 39345.05 beginning October balance plus the 118.56 November lease charge…

Method 2: Calculate the ALB by adding the sum of the remaining book depreciation charges to the residual value.

Referring to the above lease amortization schedule, the sum of the book depreciation charges in rows 13 through 37 is 7345.05. Adding this to the 118.56 November lease charge plus the RV of 32000 yields…

Method 3: Compute the ALB with k payments remaining by finding the present value (PV) of the remaining base payments plus the present value of the RV as follows…

As in the previous two methods, k = 24 payments remain meaning termination has occurred after 12 months have elapsed since lease inception. I’ll use the assigned values listed at the top of this thread.

ALB = PV of Remaining Base Payments + PV of the RV

Method 4: Compute the ALB after t months have elapsed since lease inception by finding the future value (FV) of the ILB after t months minus the FV of the base payments after t months. Again, I’ll substitute the assigned values.

ALB = FV of the ILB – FV of Base Payments already made.

ILB = Initial Lease Balance = Adj. Cap – 1st base payment = 42998.10 – 418.00 = 42580.10

RATE= 3.61601645%/12

P = Base Payment = 418.00

t = number of elapsed months since lease inception = 12

Or, equivalently, use the Excel FV function…

Note that all four methods result the same ALB, namely, 38463.61 as expected. I recommend choosing the method that works best for you. IMO, using amortization schedules is clumsy and awkward. My own personal favorite is…

described in Method 3. The advantage is that it is quick and easy.

Exercising the Purchase Option

You may need to add a purchase option fee, if applicable, to the ALB upon which tax may be levied. Other charges may apply as well (e.g., other taxes, admin fees, etc.). This will determine the buyout amount.