Is there a separate buy-out/purchase clause in the agreement?

The screenshot is from VW or BMW?

I see, we will see in a couple of weeks, also the markup only changed monthly rent charge by less than 20 bucks so even I need to pay full tax for those then it only around 70 bucks, but selling price is 900 lower

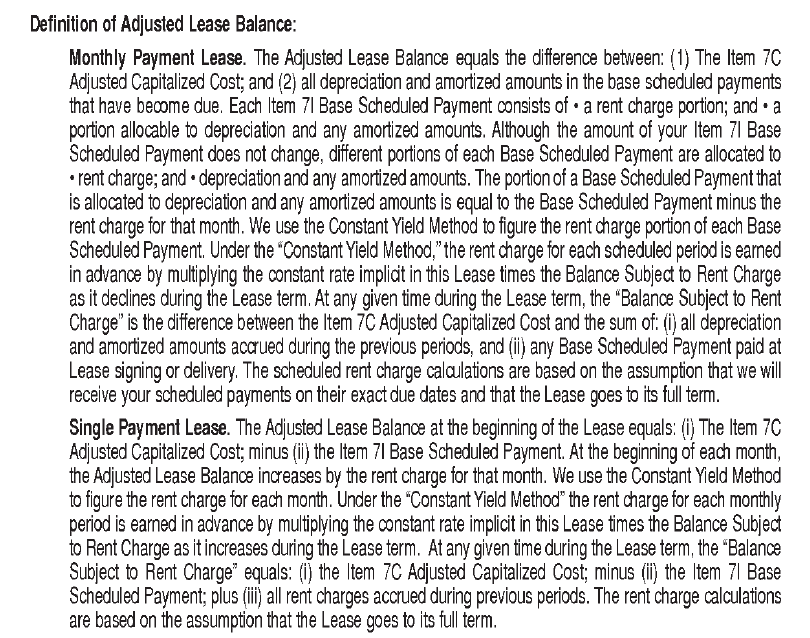

See below. Same language on paying depreciation. VW gets there by charging the full pre-tax payment and providing rebate for the unearned rent/interest. If they instead got there by charging only the agreed depreciation, early payoff customers would save hundreds of dollars of taxing.

Only the actually charged lease payments is taxable in California, which is why the rebate vs discount/adjustment matters, and why BMWFS and others handle this differently even with the ~same contract language.

I suspect it’s possible both paths are legally valid. But BMWFS (and maybe others) provides the customer favorable option whereas VW/Audi are taking the less customer favorable option.

(they take $21,432.25 * 7.75% tax = $1661 on the “Remaining Future Payments” (instead of the better option being taking $13559.57 ($21.4-$7.8) * 7.75% = $1050.

I would be raising hell if I was buying that out. Theyre clearly not following the contractual terms.

I agree. Just to confirm they actually withhold the taxes? I believe in CA you are responsible for paying them. If that’s the case wouldn’t it just be on the amount of the check you send to vw (which excludes taxes)?

Yes you’re required to send them the full amount / they withhold/remit the amount item.

Wow BMWFS approach (for leases in CA) is way more customer friendly on this dimension.

They roll everything into purchase price and you don’t pay any taxes on the unearned rent.

The contract has the same language on owing the residual plus depreciation so it’s not a contract issue. I wonder if this is borderline bad faith by VCI (they choose the worse possible way - a) they are withholding taxes even through per BMWFS they don’t need to b) they’re “rebating” the unearned instead of deducting it.

Also I wonder actually if VW’s practice to not count the remaining depreciation towards purchase price is even legit because the Bill of Sale purchase price isn’t accurate…

They appear to be overcharging taxes on the lease amount and not withholding on the rv

100% on overcharging (relative to if they didn’t ‘rebate’).

Yeah they’re not required to the RV in CA (and BMW doesn’t either)

My sister just bought out her Audi lease a few months ago and had to write the check to the dmv herself (this is California). There is also the 10 day rule in California so how would that work if you sold the car right after receiving title?

You also have to pay tax on the purchase price at the DMV (that part is normal). And you can get any taxes paid back from DMV if you sell within 10 days and file with the CDFTA for a refund.

CDFTA will not refund any amounts paid to VW/Audi (some folks tried with Hyundai/Kia, they ended up taking to small claims court to get a refund and got paid out)

Crazy but good to know. Thanks

This topic was automatically closed 60 days after the last reply. New replies are no longer allowed.