Looking for a 2024 Genesis GV60 Performance. The local dealers have 20K off a lease supported by Genesis cash. Should I expect too get a discount on sticker also. Below is the deal I have been offered for a car with a $71,525 MSRP window sticker. Is this a good deal or should I push for more. It is from my local dealer, but we bought a G70 from them and the experience was very Hyundai, so I have no loyaly and would get the car from anywhere.

Is using a broker a good idea to get the best deal? I have looked but not quite figured out how they work, do I pay them upfront of do they give me a deal they can get first and then we do the deal and I pay them.

I am open to suggestions on how to best move forward. Some background is that I was looking at a GV70 3.5 and then discovered the 20K cash back on the GV60. We usually buy cars and keep them 8+ years. I would call myself EV interested, but my wife is not sold. I am thinking by doing a subsidized lease I can try if for approx 3 years and if we do not like it just give it back. If we like it we just buy out the lease and the total cost is still cheaper than buy the car or buying a GV70 that has a very similar sticker.

FYI - In PA sales tax(6%) is just added to the mothly lease rate.

Is the deal from this dealer good?

You should expect a significant discount off MSRP in addition to the rebates. There is a reason Genesis is providing that much cash. The vehicles must not be selling well, so dealer should be willing to discount further off MSRP.

Have you checked Marketplace to see what typical discounts brokers are offering?

Edit: Ask for 8% discount off MSRP and see if they bite. Settle for 6% if you can get it. That would be a fair deal in my opinion.

Is it really (genuine question)? Most EVs have horrible residual values, but perhaps the rebates compensate.

There is one Marketplace broker in the NE who is offering GV70 Performances, but they don’t have a price or calculator link. Another broker is only offering another (less expensive) trim, but says that the programs stink this month.

Might be worth reaching out to one of them, just for comparison. Brokers can sometimes take awhile to respond, just as an FYI.

I would recommend something like an Ioniq 5 for that strategy.

Comparing a ICE GV70 to a GV60 EV, I think the GV60 is much cheaper over time due to the 20K rebate. They have about the same sticker price.

I recognize this is an apples and oranges comparison, but I am sure if I bought a GV70 ICE I will be happy with the car for many years. I am unsure on the whole EV thing and the GV60 lease end gives me an out even though I may pay a cost for that in the big picture.

I agree the EV’s seem to drop like a rock in value, so the decision in 3 years of weather to buy the car or return it is something I will face at that time.

The Ioniq 5 is not nearly as comfortable, but if it were a lot cheaper I could try it.

It’s a lot cheaper.

Effective monthly of the Ioniq 5 is like half the price, right?

I drove the Ioniq 5 and I liked the GV60 a lot more. I am willing to pay more for it. Now I just need to figure out how to get the best possible deal on the GV.

Is there an easy way to find brokers who deal with Genesis. I communicated with one but he only had one car available not in the model or color I would like.

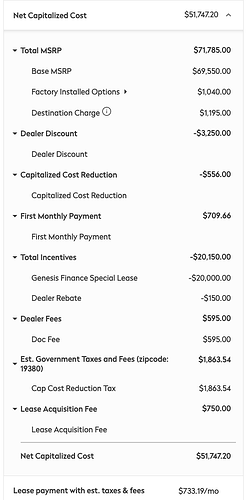

I have a possible deal for a Genesis GV60 that I am trying to match in the calculator. I told them to make the upfront payment minimal and I wanted to use calculator to tune my payment. I think this is a good deal and welcome thoughts if it can be improved.

These is a line that reads “Cap Cost Reduction Tax $1,863.54”, but I am not sure what this is. I will ask tomorrow, but not sure how to account in calculator.

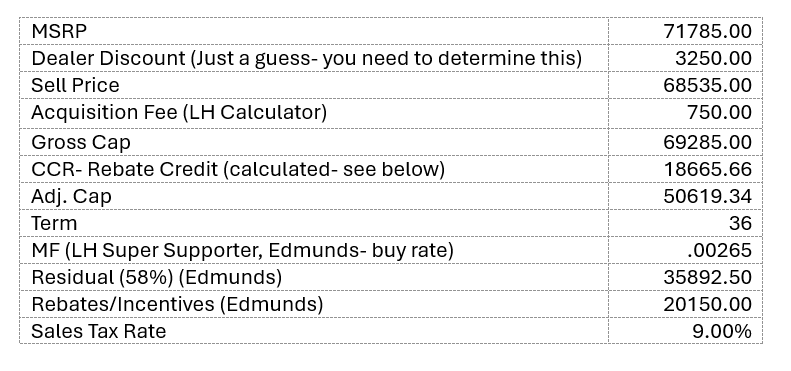

Here is my calculator:

Forget the calculator. The 1st payment is capped. Let’s do the calculations manually and learn something about leasing. Before we do, let’s discuss a few other things…

Don’t waste time trying to decipher a dealer’s worksheet or chasing after them. Otherwise, you’re allowing them to control the deal. They often omit a lot of relevant detail such as money factor, monthly base payment, monthly contractual payment, fees not itemized and even make mistakes. You need to rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.). Do your own research and establish a reasonable selling price in your market. Be sure to get a copy of the factory window sticker. Check for non-factory add-ons or dealer-installed options. And, if possible, eliminate those you don’t need or want. Get a list of all customer and dealer rebates/incentives including VIN#-specific discounts/incentives, if any. And, yes, the dealer has such a list.

The only thing useful about dealer lease worksheets is the input data (bolded below). All data should be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Check available tax credits/incentives via the fund provider who will cover taxes or, at minimum, assess a lower sales tax rate to energize sales for some models (e.g., Texas).

Organize all relevant data in tabular format like those below with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own target deal (proposal), not replicate the dealer’s deal. But we’ll replicate the dealer’s deal for now and correct a few mistakes.

Rebates are usually treated in one of two ways: (1) Compute how rebates will be allocated. Rebates are often used to cover lease inception fees with any remaining balance used as a cap reduction, and (2) Use the entire rebate as a CCR. Referencing option (1), I’ll spare you these calculations unless you would like to see how they’re done by sending me a PM.

Next, perform monthly payment calculations like those shown below.

Base Pay = .00265 x (51771.54 + 35892.50) + (51771.54 - 35892.50)/36 = 673.39

Contractual Pay = 1.09 x 673.39 = 734.00 …This does not match the dealer’s capped 709.66… They must match!

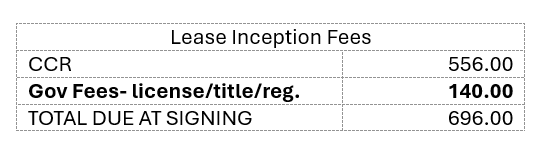

Now, table all lease inception fees and how they are to be paid. Depending upon how the CCR is calculated (there are several different formulas), will determine the amount due at delivery (signing). I always calculate the CCR so that DAS = 0 or DAS = 1st payment plus Gov. fees. As a side note, I would not capitalize non-taxable fees such as taxes and gov. fees. In those states the tax the individual payment streams, you’ll pay tax on capped non-taxable fees. As such, I would pay those at lease inception, if possible.

Bottom line: 696.00 drive-off fees followed by 35 monthly payments of 734.00 each.

Commentary

No need to pay 556.00 upfront. If used as a cap reduction, you could lose most or all of it in the event the vehicle is stolen or totaled. Remember, a car is an expense and a depreciating asset, not an investment. Suggest that you use option (1) above and allocate the 20150 rebates between a cap reduction and lease inception fees. You may need some help with this that I’ll be glad to provide.

It’s very foolish and nonproductive to waste hours sitting in a dealership negotiating. This can be a huge distraction. You need time to think things through and formulate questions within the privacy of your own home. This leads me to suggest…

Craft a lease proposal (example below) and email it to the sales manager (SM), not a floor salesperson as they’re often order takers and lack knowledge. All numbers should be accurate otherwise, you’ll lose credibility. Negotiate via phone/email. Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. Moreover, it’s helpful to know the terms and conditions of the lease contract such as early termination liability criteria and purchase option criteria as well as lease amortization methodology and excess wear/tear criteria. If all is as agreed, tell the SM that you’ll come in to sign right away. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t being transparent or is uncooperative or showing signs of incompetence, WALK AWAY AND MOVE ON!

Leasing is time-consuming a requires a good deal of study and attention to detail. If you don’t have the time to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. However, if you’re willing to commit your time and resources, always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.

The Dealer’s deal needs to be restructured.

??? Let me know.

Thank you for your help and explanation, I am struggling to understand how to calculate some of this.

Known Facts:

Genesis Fin has a 20K CCR - they seem to have added an extra 150 to make the 20150. Did you see 20,150 on Edmunds, because they said 18,500 when I asked on the msg forum.

Discount of 3250 is much better than I have found anywhere else. I will work on improving this.

The MSRP is the window sticker, nothing added on.

The standard Genesis fin Acquisition fee is $750

The sheet was a response to a Truecar inquiry, I have not been there yet. I spoke to the internet guy to tell him 12K and I told him to calculate with minimal down which is why I think he went with the $696 number.

I now want to put my deal together and then will ask for it.

Using your Calculator I tried to put it into the spreadsheet below. I have no idea how he came up with the 696 payment upfront, but I reworked it and in the calculation below it would be the 1485 fees + first month, which would be fine. I do not need to make it as low as possible it it saves me money by not capitalizing the fees.

The dealer sheet has “Cap Cost Reduction Tax $1,863.54” and I have no idea what that really is or how it is calculated. I will ask.

| Total MSRP | 71785 | |||

|---|---|---|---|---|

| Discount | 3250 | |||

| Agreed Sale Price | 68535 | |||

| CCR (must use Genesis Fin) | 20150 | |||

| Adj Cap Cost | 48385 | CC | ||

| 50% residual | 35892.5 | R | ||

| MF | 0.00265 | MF | ||

| Base Pay | 570.3492639 | MF*(CC+R)+(CC-R)/36 | ||

| Contractual Pay | 604.5702 | base Pay *1.06 | ? should this be the tax rate 6% in PA) | |

| Fees | ||||

| Aquisition Fee | 750 | |||

| Dealer Fee | 595 | |||

| Taxes & Fees | 140 | |||

| Fees to be paid | 1485 | |||

| Fist Payment | 621.6806976 | |||

| Totl Pay upfront | 2106.680698 |

I then tried to use leasehacker and match the Depreciation, rent and tax numbers but I could not match.

| Depreciation | 347.0138889 | (CC-R)/36 |

|---|---|---|

| rent | 223.335375 | (CC+R)*MF |

| Rent+ depr | 570.3492639 | |

| 6% tax | 34.22095583 | |

| Payment | 604.5702197 |

but it does not match the calculator.

Nope. I did not check Edmunds. The 150 is a dealer rebate.

It’s 556 CCR + 140 gov fees. See the dealer worksheet. The 556 is what they’re asking you to put down… to be used as a CCR. Down payment means cap reduction.

Did you look at my first table posted above? It’s the tax on the total CCR computed using a sales tax rate of 9.00%. This is the rate the dealer used. I don’t know if it’s correct or not. You’ll need to make that determination.

I think you need to look at my first table and decide which capped fees you would like to pay upfront. I would suggest CCR tax, 1st payment, and Doc fee. The CCR tax and payment will need to be re-calculated. A portion of the 20150 will be used to pay lease inception fees and the balance allocated to the CCR. The CCR calculation is quite complex. If interested, PM me.

PA tax is 9%. 6% sales tax + 3% lease tax

PA also typically does not tax incentives, so i wonder if this is an out of state dealer.

typically? Sounds iffy.

The only thing that interests me about taxes is a complex tax structure such as NY and Ill. Although important, I don’t keep up anymore with the nitty gritty of who taxes incentives and who doesn’t. I leave those details up to the OP as they have the responsibility to know. There is at least one other state that doesn’t tax incentives, and I can’t remember who they are. NJ? NC?

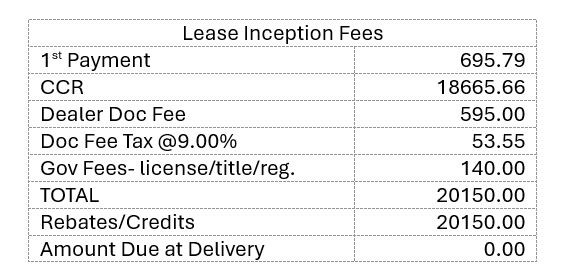

I’ve allocated the 20150.00 rebate to lease inception fees, and the balance to the 18665.66 cap reduction calculated below. And, thanks to @mllcb42, I’ve assumed that PA does not tax rebates/incentives. The revised tabulated data are as follows…

Compute the CCR:

Substituting the above assigned values into the equation, we get CCR = 18665.66. Use the CCR to compute the base payment. All lease inception fees are summarized below.

Next, perform monthly payment calculations…

Base Pay = .00265 x (50619.34 + 35892.50) + (50619.34 - 35892.50)/36 = 638.34

Contractual Pay = 1.09 x 638.34 = 695.79

Now, table all lease inception fees and how they are to be paid.

Observe that the 20150.00 rebate exactly covers the CCR as well as the remaining lease inception fees including 1st payment.

Bottom line: Zero drive-off fees followed by 35 monthly payments of 695.79 each.

I’ll leave it to you to create a lease proposal if you choose to do so.

Here is the LH Calc

Here is an LH Calc that’s a little closer to reality.

Yes it is a NJ dealer. I have also learned this is correct that PA does not tax the incentives.