There are high yield savings accounts, etc. which are currently paying 3%+. As with the longer term CD’s, I would tread carefully as we could very well see additional increases with the anticipated Fed rate hikes. I would potentially consider the 8-week, but not the 26.

Should be interesting…going to assume same as Marcus rate since Apple uses Goldman

Currently yes, they are building their own stuff to eventually replace GS entirely.

Until shown otherwise I’m going to assume that the APY will be subpar, since the rewards structure on the credit card sucks donut holes.

![]()

I have a fidelity account mainly for day trading and some long term stocks i hold.

What area are you in and what are you buying ?

I have fidelity, E*Trade, TD Ameritrade and IBKR for trading. IBKR has the lowest margin rates in case I want to go crazy. Although with the market being so unfriendly lately I’ve been sitting in cash and doing quick scalps.

I’ve been a customer for ~7 years. Now I’m just trying to use their shitty checking account to get $XX,000 over to DSD.

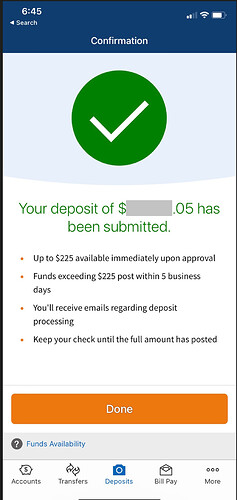

I wonder if they’ll let me access the entire $225 right away. ![]()

![]()

after i opend an account with treasurydirect, and tried to login twice it was locked. Called treasurydirect 3 hour wait. Imagine having to pull your money out.

I wouldn’t give the govt a nickel for a .3% spread over the typical banksters. I could see all types of headaches trying to withdrawal. Fidelity has been very easy to deal with on my cds

I agree with you. The only reason I tried to open it up is because they are offering 9.6% on I bonds until the end of october.

ended up moving from PenFed 1.70% to First Foundation 3.11%

they have branches in california ![]()

I find it interesting that people jump accounts for + or - half a percentage of interest.

On brokerage accounts they have similar funds with similar interest rates. But if offers instant no questions asked low interest lines of credit.

These lines if credit seem more beneficial than a few % if interest.

I have more credit than I can possibly use.

I guess I plan poorly. Sometimes I need a random wire for a larger amount that cc isn’t accepted

Rates are better than heloc and you don’t need to ask for permission or justify anything to the bank.

I guess I could always do both if it’s fun before it becomes a work type burden.

If you are in a higher state income tax state like CA you may want to look into treasuries. The current interest rate even on the shortest term t bills seems to be higher and you may save on state tax.

PM me a link

I’m not sure how that works / what that even is

This article has some good info. If you google there’s a lot of info online

We all plan differently, so I wasn’t being critical. ![]()

Shuffled some bucks around this week:

- Citi Gold accounts closed after new money bonus → back in Money Mkt

- Open order on Treasury Direct for 2yr notes in next week auction.

If you have not bought iBonds yet, do it by 10/31 before rate drops.