First thing I did was look at the CD rates. Makes a guy think why the savings rate is astronomically high and the CD’s are at the bottom of the barrel.

My guess is that uninformed consumers (like me ![]() ) see a top-tier rate on one of their brands, so they open an account and think they’ve won The Game of Life.

) see a top-tier rate on one of their brands, so they open an account and think they’ve won The Game of Life.

And then the rate stagnates while no one notices, and then they repeat this type of offer with their other brands until the stratagem is no longer effective at bringing in new money.

(The 3.0% APY I noted in September 2022 has only inched up to 3.5% since then.)

I spoke to my “private banker” at Pnc and asked why they offer almost no interest at all in their accounts. He basically said bc they don’t need cash. Very interesting convo, I’ve never heard a bank actually say that. Reveals a lot.

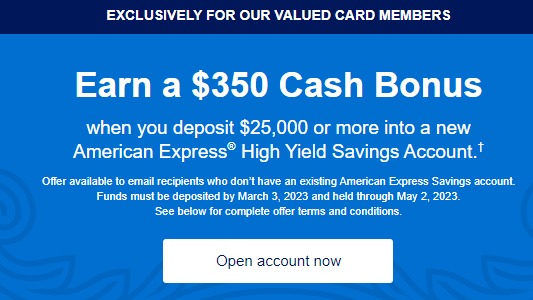

If you do the math on the difference between the interest they are going to pay you net of state tax and the 6 month T bill you are not really getting 350. One of the best deals out there IMHO is the 2k Chase private client bonus because they are not locking you into a lower interest rate savings account and you can buy T bills with the money and still get your 4.6% state tax free.

Yeah, some offers aren’t anything special once you run the numbers. Citi is one I can recall - it was awesome last year, but barely mediocre today. It has a large bonus but the money has to be locked in for too long.

I believe there is essentially no purchase limit as well, for the bills?

I did this one few months ago. Got my bonus already. Was easy money and decent APY on 25k.

what’s the difference between this and the bank CD. Any good links to read up on this?

Try taking cash out of these places, or depositing a decent amount of cash.

I did. I took a significant amount out to put into cap1. They didn’t care…

I keep just what I need to there now to keep my preferred accounts.

I am not aware of any limits. They are super liquid so most people should be able to enter and exit without a penalty and the interest basically accrues every day, so even if you have to sell before maturity you will still get some return unless there’s something really weird happening in the bond market.

This is strange. I just got my PNC relationship manager in the “choice select” program to give me 4% APY by threatening to move it into a MMF at fidelity. Took all of about a day for him to get approved by their rate pricing team.

Most CD’s you will be locked in for much more than 4 weeks to get that kind of return (over such a short span).

I’ve done it before

Some places limit you for example penfed does

They’ll make you a check for the full amount tho

No im saying actual cash, walk into your bank for fun and ask to take 40k out.

They need a week in advance for anything over 10k

Been there done that

It also helps to bank with a big bank hit up multiple locations

I once closed a Chase account in person, and after they handed me a receipt for > $20,000 they couldn’t get the check printers to work. And the account could not be re-opened.

And they claimed to not have that much cash on hand at the branch.

After refusing several times to leave and come back the following day for a check, they eventually relented and gave me cash, which I promptly drove to and deposited at Wells Fargo, where I’m certain they filed an SAR.

I moved money from CapOne to here without any issues and am earning 4.26% interest compared to 3.3% at capital one. I have not had any issues with the bank or money itself, but transfers seem to take a little longer (maybe a day or 2) than other banks, and there is no app or zelle support. Other than that no issues and earning an extra 100$ a month in interest a month is worth any negatives to me.

Had the same thing at a Capital One (after they bought out someone) back in the day except it was that no one working that day had the authority to sign a check for that amount. I was like guess the branch manager is coming in on his day off. I forget how they handled, but I definitely walked out with my check.

He told me they are doing special rates for certain regions. Maybe that’s why? I guess to get more customers in some areas. He literally told me to keep it in cap one if I’m happy with that rate. He wanted to put me in some corporate bonds etc but this is money I might need for a house eventually so just don’t want to risk losing any or tying it up.

Banks always give you issues taking out cash these days. I needed 15k for a watch purchase not long ago and they asked me 20 questions. Told me they didn’t have it on hand, after I called to make sure they would. Finally they gave it to me after I asked for a manager. I’m sure my answers to the questions being “because it’s my money” weren’t what they were looking for.