I’ve negotiated many leases in Ohio for myself, family, and friends. As of January 2021, the statewide sales tax rate in Ohio is 5.750%. When coupled with local taxes, the total sales tax rate varies between 6.500% and 8.000%. So, there is a statewide sales tax component plus a local sales tax component. I reside in Lorain County where sales tax is 6.500% (5.750% + 0.750%).

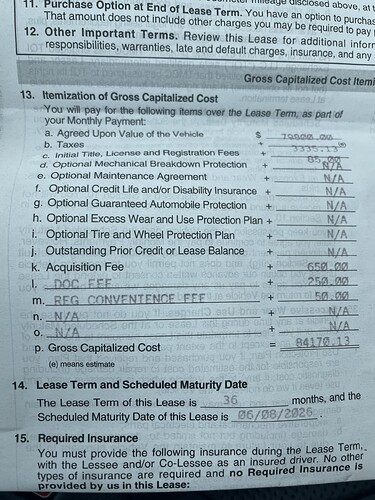

Sales tax can be paid upfront or capped in the lease. I routinely cap them in the lease where the fund provider advances the dealer a said sum, including sales tax, on my behalf. So, I’m financing the sales tax.

In consumer retail leasing, sales tax in Ohio is levied on the sum of your base payments. The base payment is computed excluding non-taxable fees to avoid tax on tax, in some instances, and is calculated as follows assuming a money factor lease and that the 1st lease payment is not capped in the lease…

B = f x (M – D - I + F - C + R) + (M – D - I + F - C – R} / N

B = base payment

f = money factor

M = MSRP

D = dealer discount

I = non-taxable incentives

F = taxable capped fees

C = capitalized cost reductions

R = residual value

N = term

T = r x (B x N + X)

T = total Ohio sales tax… this is a non-taxable to avoid tax on tax

r = sales tax rate

X = taxable cap reductions

IF I pay taxable fees upfront, I’ll pay the tax on those fees upfront as well. Your final lease payment is computed using any capped taxable and non-taxable fees.

L = f x (M – D - I + F + T + G - C + R) + (M – D - I + F + T + G - C – R} / N

L = lease payment

G = non-taxable fees other than tax (usually government / DMV fees if capped)

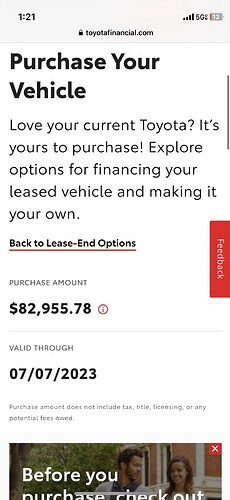

Your buyout is your amortized lease balance (equals residual value if full term) plus any purchase option fee plus any admin fees plus applicable taxes. If you buy the vehicle, you will pay taxes on the buyout price. The lease transaction and the buyout transaction are treated as two different and distinct transactions in Ohio. One has nothing to do with the other.

Hope this helps.