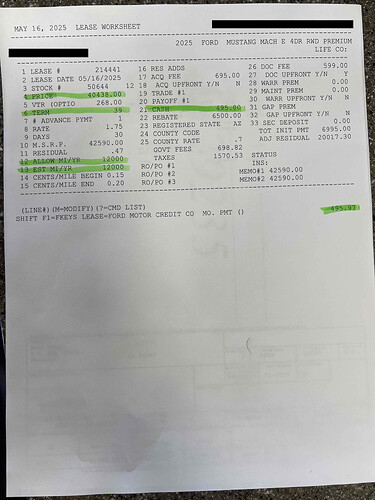

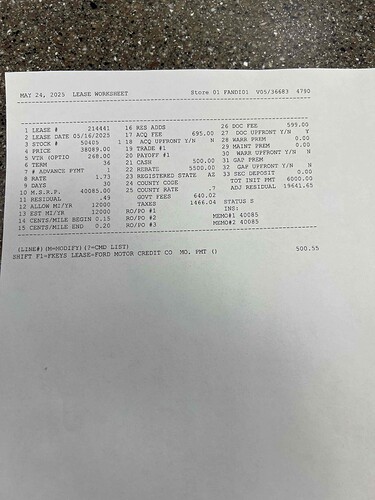

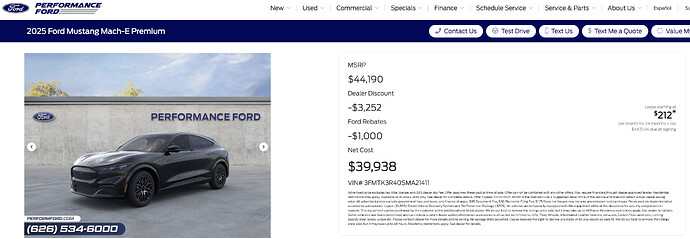

There is a lot of information missing such as adjustable cap cost, cap reduction, capitalized amounts, amount due at signing. Sales tax rate is non-negotiable and is established by your AZ tax jurisdiction. What I find troublesome is the residual factor is only 47% which is non-negotiable for a given lease term and annual mileage requirement. Also, the dealer discount off MSRP is a awful IMO … just 5%. I would check LH signed deals and the LH marketplace to see what others are paying in your regional market.

FWIW-

Don’t waste time trying to decipher a dealer’s worksheet. Otherwise, you’re allowing them to control the deal. They often omit a lot of relevant detail such as the money factor; not itemizing fees and occasionally will make mistakes. Rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.).

The only useful thing about dealer lease worksheets is the input data. All data must be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Check available tax credits/incentives via the dealer or fund provider who may issue tax credits or, at minimum, may assess a lower sales tax rate to energize sales for some models (e.g., Texas).

Do a deep dive and research a reasonable selling price in your market. Sometimes, dealers embed rebates in their discount. Keep them separate but recognize that transparency may become an issue. Secure a copy of the factory window sticker. Check for non-factory add-ons or dealer-installed options. If possible, eliminate those you don’t need or want. Get a list of customer rebates, incentives, and credits (e.g., electric chargers) including VIN-specific discounts, if any. The dealer has such a list. GM calls this list the Customer Incentive Acknowledgement form which includes mandatory rebate and incentive disclosures. Restrictions may apply to the extent that some rebates may not be required disclosures such as college grad, military, educators, AMEX, Costco, etc.

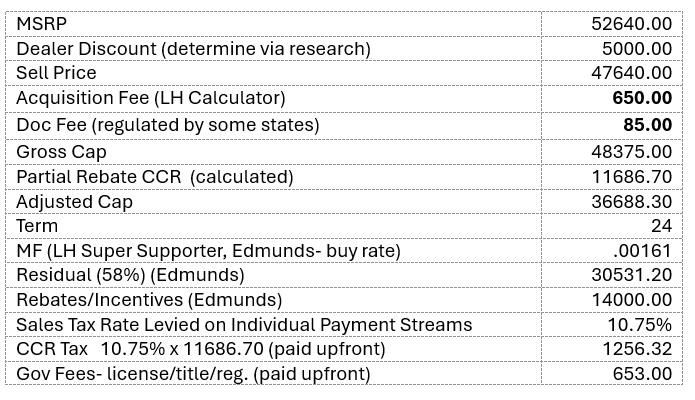

Organize all researched and vetted data, fictitious example tabled below, with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own deal, not replicate or reverse engineer the dealer’s deal.

Rebates are usually treated in one of two ways: (1) Allocate a portion of the rebates to cover lease inception fees with any remaining balance used as a CCR, or (2) Use the entire rebate as a CCR.

Next, perform monthly payment calculations shown below.

Base Pay = .00161 x (36688.30 + 30531.20) + (36688.30 - 30531.20)/24 = 364.77

Contractual Pay = 1.1075 x 370.88 = 403.98

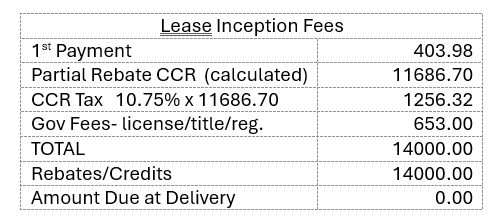

Now, table all lease inception fees and how they are to be paid. Depending upon how the CCR is calculated (there are several different formulas) will determine the amount due at delivery (signing). Suggest that the CCR be calculated so that DAS = 0 or DAS = 1st payment plus gov. fees. I calculated the CCR so that DAS = 0. As a side note, I would not capitalize non-taxable fees such as taxes and gov. fees. In those states that tax the payments, you’ll pay tax on capped non-taxable fees. As such, it’s suggested that non-taxable fees be paid at lease inception whenever possible.

Observe that the 14000 rebate exactly covers the CCR as well as all lease inception fees including 1st payment.

Bottom line: Zero drive-off followed by 23 monthly payments of 403.98 each.

Commentary

No need to pay large out of pocket cash upfront especially with large rebates. If cash is used as a cap reduction, you could lose most or all of it in the event the vehicle is stolen or totaled. Remember, a car is a depreciating asset and an expense, not an investment. Use the cash to invest in goods and services or other more meaningful and productive investments, particularly if you can earn the equivalent of an after-tax rate of return exceeding 24 x MF or, 24 x .00161 = 3.864%.

It’s very foolish and nonproductive to waste hours sitting in a dealership negotiating. You’ll get dizzy watching some salesperson running back and forth. This can be a huge distraction. You need time to think and formulate questions within the privacy of your own home. This leads me to suggest…

Craft a lease proposal (example below- the round peg, round hole won’t work) and email it to the sales manager (SM), not a floor salesperson as they’re often Mickey D order takers and lack knowledge. Be sure to contact the SM first to let them know you’re emailing them a one-page lease proposal b/c you want to close the deal today or, at the very latest, tomorrow. Send the proposal as soon as you hang up. It must be comprehensive, authoritative, professional-looking, and flawless otherwise, you’ll lose credibility.

Negotiate via phone/email. Be nice but firm. Explain to them that it is your practice not to deal with multiple dealers simultaneously as it is poor business practice and that you refuse to play games like “can you match or beat this”. Above all, say what you mean and mean what you say. Remember that local dealers know each other. Speak in a commanding and business-like voice that exudes confidence. Unless they’re very stupid, once they see your fabulous proposal it will speak volumes. They’ll immediately know it’s time to put away their toys and board games as it’s time to get down to business absent all the BS.

Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. Moreover, it’s helpful to know the terms and conditions of the lease contract such as early termination liability criteria and purchase option criteria as well as excess wear/tear criteria. If all terms are as agreed, tell the SM that you’ll come in to sign asap. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t transparent or is uncooperative or showing signs of incompetence, WALK AWAY AND MOVE ON!

Leasing is time-consuming and requires a good deal of study and attention to detail. If you don’t have the time or interest to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. However, if you’re willing to commit your time and resources, be sure to always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.

??? Let me know.