I am in the market for a KIA EV9 GT-Line. For perspective, I live in MD. I would like the community’s input on this deal I thought I negotiated well before I sign. Am I getting a good deal, or should I negotiate further? What’s a good benchmark I need to be at? For some reasons I am beginning to feel like I could have got a better deal.

Your advise would be greatly appreciated.

Just in: Dealership called after i gave them approval to run my credit. They said the deal is now $760/month. I’m losing my mind here because that’s just crazy.

What should I do? I’ve contacted other dealerships around the DMV but these guys seem to be better off.

24month term usually works out better on EV9. $5250 discount is solid for a GT (no broker, no shipping) – but they claw some if it back with fees, try to get these itemized. I don’t see any tax accounted for in this deal sheet. This has potential to be good, but FYI the Land leases better.

I agree about the Land leasing better. My wife has something for tech in cars and she wants this to be top of the line. That’s the more reason why I’m tied to the GT-Line

What does the GTLine have that the Land doesn’t?

The GT-Line has a relaxation package that includes massaging front seats and reclining second row seats. Head-up display, automated parking system, and self-leveling rear suspension. The list goes on.

Here are the base trim differences between Land and GT-line

The 2nd row relaxation package is an option available on either Land or Gt-line. While the Gt-line lists “increased towing” only the Land is available with the tow package.

And your wife actually need these features?

Well, she said she does. Moving from the Model X to this, she wants all the bells and whistle to come with it.

Fair enough. To each their own. To me paying let’s say $150/month (assuming) more might not be worth the massaging front seats. ![]()

Run don’t walk! FYI-

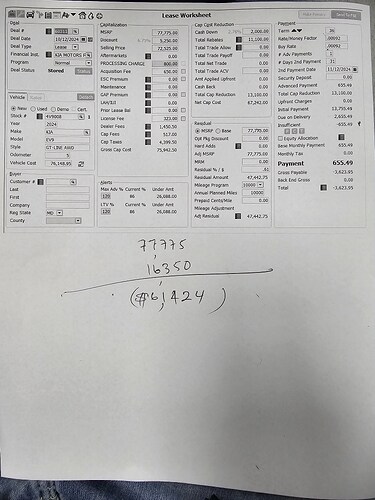

Referencing the dealer deal sheet…

Sales tax = 6.00% (72525 + 800) = 4399.50

The discount off MSRP looks okay but the fees are a matter of concern. The dealer is charging you and 800 processing fee plus a 1450.50 dealer fee… that’s horse shit! The processing fee may be the dealer doc fee which is sky high… but a dealer fee of 1450.50? And now they want to raise your payment to 760? That’s unconscionable IMO. I’d bailout if I were you.

Another concern… Why would you put 2000 down to be used as cap reduction when you already have an 11100 rebate? You could lose most or all of it in the event the vehicle is stolen or totaled. Remember, a car is an expense and a depreciating asset, not an investment. Use the 2000 to invest in other durable goods or other more meaningful and productive investments, particularly if you can earn the equivalent of an after-tax rate of return exceeding 2.208% (2400 x .00092 ≈ 2.208%) which shouldn’t be too tough to do. I would use a portion of the 11100 as a cap reduction and the balance to pay your lease inception fees (1st payment).

I really like your suggestion as thats where my thought had been as well. The dealer had been pleading with me to come back. I told them “no money down and we got a deal.”

You can do that BUT… you should know that 2000 of the 2655.49 is an out-of-pocket cap reduction which only serves to lower your payment. Eliminating it will increase your payment from 655.49 to 712.88. Frankly, I would opt for the higher payment and use the 2000 for other more productive things. This means that your amount due at signing would be 712.88 unless you choose to cap the 1st payment leaving you with zero due at signing. However, capping the first payment means your monthly payment will increase. The capped 1st payment must match each of the remaining 35 monthly payments… requires a bit of ninth grade algebra to calculate.

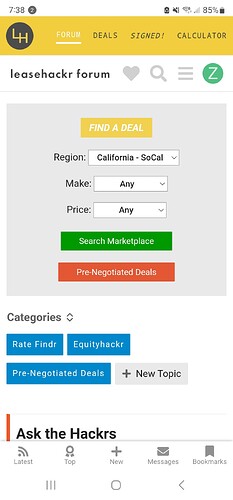

I suggest creating a lease proposal (example below) and email it to the sales manager (SM), not a floor salesperson as they’re often order takers and lack knowledge.

All numbers should be accurate otherwise, you’ll lose credibility. Negotiate via phone/email. Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. Moreover, it’s helpful to know the terms and conditions of the lease contract such as early termination liability criteria and purchase option criteria as well as lease amortization methodology and excess wear/tear criteria. If all is as agreed, tell the SM that you’ll come in to sign right away. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t transparent or is uncooperative or showing signs of incompetence, WALK AWAY AND MOVE ON!

Leasing is time-consuming and requires a good deal of study and attention to detail. If you don’t have the time to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. However, if you’re willing to commit your time and resources, always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.

??? Let me know.

The payment will be lower at 24months. That should be step one.

Do you know of any good broker in MD or the DMV area?

In reading this thread, I’ve noticed that “wife” is the new “family member” as it relates to model and option choice.

As for brokers, I have no idea. I would note that broker deals are listed and a good tactic is to use their listing and the signed deals to craft your deal.

No. Sorry. I would default to @MrSmith79159 suggestion.

You need to understand what the $1450 in dealer fees is for. Why did the payment go up after running your credit? Higher MF or something else?