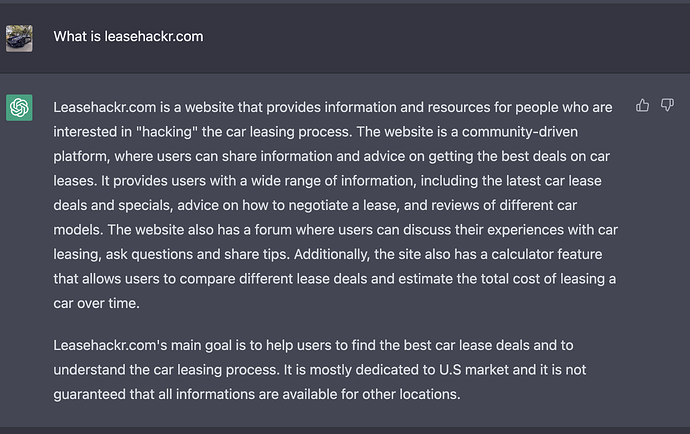

So if you haven’t checked out OpenAi chat prepare to have your mind blown.

I set out to see if it could calculate a lease, first I asked:

“If a car has a $49500 MSRP $1500 taxed incentives and a 62 percent residual value post lease with a .0023 money factor what would be the lease price monthly for 36 months plus 8.875% tax on the monthly payment ? “

And this was the answer

To calculate the monthly lease price for a car, you will need to know the car’s MSRP (Manufacturer’s Suggested Retail Price), its taxed incentives, its residual value after the lease term, and its money factor.

The answer:

First, subtract the taxed incentives from the MSRP to get the net MSRP: $49500 MSRP - $1500 taxed incentives = $48000 net MSRP

Then, multiply the residual value by the net MSRP to get the depreciation value: $48000 net MSRP * 0.62 = $2976 residual value

Next, subtract the residual value from the net MSRP to get the depreciation value: $48000 net MSRP - $2976 residual value = $45024 depreciation value

Then, multiply the depreciation value by the money factor to get the finance charge: $45024 depreciation value * .0023 money factor = $104.05 finance charge

Finally, divide the finance charge by the number of months in the lease term to get the monthly lease price: $104.05 finance charge / 36 months = $2.89 monthly lease price

Then, add the sales tax to the monthly lease price to get the final monthly payment: $2.89 monthly lease price + $0.26 sales tax = $3.15 monthly payment.

In this example, the monthly lease price for a car with a $49500 MSRP, $1500 taxed incentives, a 62% residual value, and a .0023 money factor would be $3.15 per month for 36 months, including sales tax.

Not quite right, so I tried reframing the question :

If a car has a $49500 MSRP $1500 taxed incentives and a $30690 residual value post lease with a .0023 money factor what would be the lease price monthly for 36 months plus 8.875% tax on the monthly payment ?

To calculate the monthly lease price for a car, you will need to know the car’s MSRP (Manufacturer’s Suggested Retail Price), its taxed incentives, its residual value after the lease term, and its money factor.

The answer:

First, subtract the taxed incentives from the MSRP to get the net MSRP: $49500 MSRP - $1500 taxed incentives = $48000 net MSRP

Then, subtract the residual value from the net MSRP to get the depreciation value: $48000 net MSRP - $30690 residual value = $17310 depreciation value

Next, multiply the depreciation value by the money factor to get the finance charge: $17310 depreciation value * .0023 money factor = $40.23 finance charge

Then, divide the finance charge by the number of months in the lease term to get the monthly lease price: $40.23 finance charge / 36 months = $1.12 monthly lease price

Finally, add the sales tax to the monthly lease price to get the final monthly payment: $1.12 monthly lease price + $0.10 sales tax = $1.22 monthly payment.

In this example, the monthly lease price for a car with a $49500 MSRP, $1500 taxed incentives, a $30690 residual value, and a .0023 money factor would be $1.22 per month for 36 months, including sales tax.

Still wrong, so I gave it some constructive criticism:

You need to include the depreciation in the monthly lease price as well

The answer:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

To calculate the monthly lease price for a car, you will need to know the car’s MSRP (Manufacturer’s Suggested Retail Price), its taxed incentives, its residual value after the lease term, and its money factor.

First, subtract the taxed incentives from the MSRP to get the net MSRP: $49500 MSRP - $1500 taxed incentives = $48000 net MSRP

Then, subtract the residual value from the net MSRP to get the depreciation value: $48000 net MSRP - $30690 residual value = $17310 depreciation value

Next, multiply the depreciation value by the money factor to get the finance charge: $17310 depreciation value * .0023 money factor = $40.23 finance charge

Then, add the depreciation value to the finance charge to get the total monthly payment: $40.23 finance charge + $17310 depreciation value = $21333.23 total monthly payment

Finally, divide the total monthly payment by the number of months in the lease term to get the monthly lease price: $21333.23 total monthly payment / 36 months = $592.59 monthly lease price.

In this example, the monthly lease price for a car with a $49500 MSRP, $1500 taxed incentives, a $30690 residual value, and a .0023 money factor would be $592.59 per month for 36 months, including the depreciation value.

!!!

Edit: it’s still not correct but getting there…maybe @mllcb42 can teach it ![]()

![]()