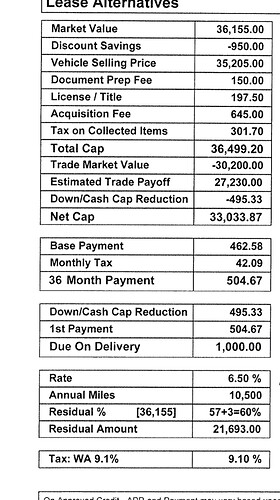

Hi! I am working on a lease for 2022 for maverick lariat lux awd. I live in Eastern WA 99216 and I know the tier 0 is 5.5 for 36 months. Does this breakdown look correct? Even at 5.5 it seems high. I have 3000k trade value and putting 1k down.

$600+/mo for a maverick lease sounds horrible. With a .00270 MF, it seems like this would probably be a better purchase candidate, especially with all the challenges in selling a ford lease should the rv do better than 60%.

Buying it seems like a wiser option as mentioned. Leasing is especially useful when the residual value set by the bank is much higher than the real world value, rates are lower, and more incentives.

This has none of these.

For tier information go to the Edmunds leasing forum and post to ask.

I did and that is where got 5.5 tier 0 for 36 months, dealer is trying to bump for backend perk , but overall those numbers look right?

Are you asking if they look like a good deal, a wise leasing option, or if the output is appropriate for the inputs?

Appropriate for the inputs. Thanks

When you filled out the lh calculator, did the output match?

No. Calc said 468. Little low since I’ll pay tax on down payment. I did 4800k drive off calculator with .0027 factor. 6.5. 4k drive off is 492

Can you post your calculator?

I did it for 4k drive off which is what I told them which includes 3k trade in. I’m sure I’m doing it wrong🤔

You’ve got the rv set to 61% rather than 60%

If you correct that and match the $3970 DAS amount from the offer, it’s spot on

Got it! Thanks a bunch. Leasing numbers are a pain sometimes

@Pepper1080 - Any reason you are not considering buying it?

At 5.5 APR the payment is about 480 total which is not terrible for my budget. I prefer lease to get a new model every 3 years and based on my down payment if I want a new one in 3 years I might be underwater on it in 3 years if I buy, even at 3.99 apr

Are you tied to the maverick? The Tacoma leases much better and seems like the Frontier does as well

With $4000 DAS, this is about $600/mo effectively.

Being underwater is neither here nor there. What would be your cost of ownership over 3 years?

There is no way to guess what the real-world RV will be on this. Since the captive is obviously doing no favors on this, you might look into other banks to see what they are offering on it.

I ran estimates through for buying and also compared lease to buying. In the end it looks like it’s about the same residual/market value amount after 3 years…but the lease effective payment shows buying is better…

How did you possibly figure out the real world residual on a vehicle that has never existed before?