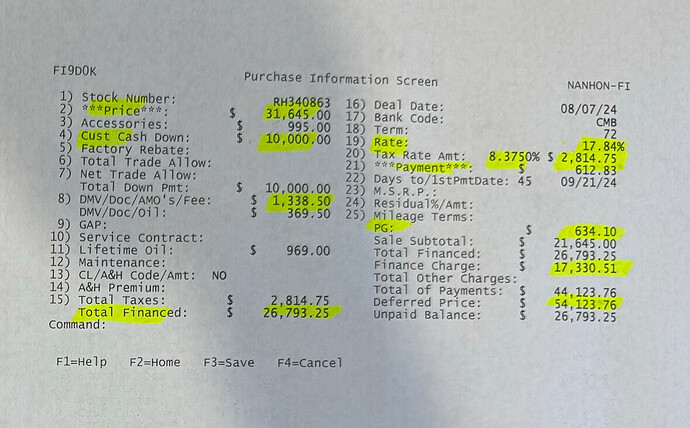

Hello, this is the first time I am trying to finance a car. I got this deal from dealership since I have only 4mos credit history. I know apr is high and down payment they asking for. Still all the numbers on this paper don’t make sense. My plan was go with the deal and pay it off faster in a year or two to save up on the interest. I just don’t know what the total amount would be if I paid off in a year. Also dmv fees and taxes doesn’t seem right along with the monthly payment. I used the finance payment calculator the payment should be around $490 for the same interest rate. Please help me understand

Run away from that deal as fast as you can as there are so many problems that I lost count.

Literally - run away.

I know. nothing made sense on that deal. My plan was finance a car and put good amount of down payment and pay it off faster to save up but it seems like I am losing in that deal

This is patently insane to even consider.

You should be shopping for a used car under $15k and work on building up your credit if that really is anywhere near the type of rate you’re getting.

It is this car:

https://www.lithia.com/new/Honda/2024-Honda-Civic-197fe813ac181d2c986d187f9d3da123.htm

Here is what makes no sense, to start with:

- You are paying sticker price with zero discount

- You are paying $995 likely for junk add ons

- The DMV, doc and “oil” fees seem high

- “lifetime oil” is a huge waste of money (if you drove it 100k miles at 5k intervals for an oil change you are still getting ripped off)

- Interest rate is insanely high even for a 4 month credit history

You can do way better on here with a broker and find a much better interest rate even with limited credit.

one of my friend’s cousin is a broker. I tried with him first but couldn’t even get approved for the car. yes, I was questioning everything you said in the dealership but they were giving me non sense answers. should I try with different dealership or consider different options. they ran my credit couple of times already

I was thinking about that too but I really don’t have that much time to look for a car and transportation is a problem too since I don’t have a car. That’s why I was looking to get either lease or finance

Shop a good rate first with a local bank or credit union that might be able to pre-approve you. Multiple credit checks are not great but in a short span they really only count as one:

Then go find the car with the great deal when you have the decent finance rate in hand. $10k down on a $30k car will go a long way in making a lender feel comfortable with your short credit history.

Thanks for the advice

I hear ya, but a $33k car that should be $28k with an 18% rate isn’t a great solution. Invest the effort now before you cause financial pain for your future self years and years from now.

As others have already shared, this proposal is simply B.A.D.! That rate is usurious and the add-on BS fees are just that. DO NOT ever talk to this dealer again.

If your credit history is thin, see if you can get a co-signer to complete this transaction with you. And, pay off the note as quickly as you can.

Also do insurance quotes first for the vehicle. Few years back my insurance for a civic was more than my payment. I could have gotten accord for cheaper overall since insurance was less.

Not all brokers are created equal.

Any decent broker would have pointed you towards prequalifying with your own financing through a credit union, etc, to help make this happen.

This for sure!

The Civic is a great car but under these circumstances, this is the route I’d go, something like this:

2023 Sentra, 29k miles, $17k:

https://atcm.co/VDPTXTSHRE/2ac4ac3d

2024 Forte, 10k miles, $18k:

https://atcm.co/VDPTXTSHRE/2afa7b46

2023 Elantra, 8k miles, $18k:

https://atcm.co/VDPTXTSHRE/2b01de0d

2023 Jetta Sport, 13k miles, $19k:

https://atcm.co/VDPTXTSHRE/2ab41510

Throw the $10k at that then find the best rate from a CU, etc to finance the rest.