I’m wondering if anyone sees finance companies sitting on a huge future liability of being upside down on EVs? Based upon the residual values in the signed thread, could automakers be upside down on thousands of EVs? I’m trying to learn more on how automakers will be able to navigate this in the future.

I think your instincts are correct. They will almost all certainly be upside down to some extent. But since most of these are public companies, I’m sure their accountants have already considered this depreciation write down as part of their future financial reports.

My BMW iX is supposed to have a $53K RV after three years, but I see them on AutoTrader for $45K. So for argument says let’s say all iX are underwater by an average of $10K. I’m sure BMW will just liquidate them all at auction for $43K, and then take a $10K write off for each one. There’s not much else they can really do.

The logical part of my brain says BMW should offer lessors an option to buy their car at a reduced price (but higher than wholesale auction price), but this is “not becoming of a luxury brand”, I’m told!

BMW and Mercedes have been playing this game for so long, (it’s not just EVs, but all luxury leased vehicles have this problem), so I think it’s all baked in to their numbers already. They need to continue this “High RV” strategy in order to keep the esteem of their luxury brands.

BMW is still a super profitable company, so least for them, this system seem to be working.

Residual value insurance (RVI) is one way the lessor can protect against significant asset depreciation. It also shifts the accounting of any residual value loss to the insurance company, where it can be written off against other group insurance gains. The lessor can also manipulate the asset basis and leverage short or long-term depreciation accounting to strategically use loss to their tax advantage.

from PWC-

The residual value insurance market has seen significant growth, particularly in the electric vehicle sector. The global EV residual value insurance market size reached USD 2.4 billion in 2024 and is projected to expand at a robust CAGR of 18.7% from 2025 to 2033, reaching a value of USD 12.6 billion by 2033.

I never knew there was an insurance policy for residual values. Thank you for teaching me something new today.

BMW, Mercedes, Audi and even VW (to an extent) are probably less likely to be impacted because of the sheer volume of vehicles they lease for a massive profit. The bigger issue will be Hyundai, Toyota, Nissan, Honda, Stellantis, GM, Ford and especially VinFast. I don’t see how VinFast will survive since they aren’t too popular in China and Vietnam likely won’t be able to bail them out.

The short answer is non-captive lessors. Last I checked, Vinfast does not underwrite its lease offerings, they instead have an agreement with US Bank. Using non-captive banks limits the liability of the vehicle manufacturer and are particularly essentially to the “startups”. For a long time, even Tesla used non-captive banks for it’s leases (but does now offer some captive options).

Those who remember the 2008 to 2010 “automotive industry crisis” may recall that Chrysler Captial had to restructure, more than once, to avoid bankruptcy and during that time stopped offering leases. The dual existence of Stellantis Financial and Chrysler Capital is an enduring byproduct of those times.

There is an insurance market for nearly everything, and there is always an option to self-insure something insurable through a carrier, and in either case there is always access to reinsurance. A former employer ![]()

![]() used to self-insure some crazy things through LoL (paging Mantacore

used to self-insure some crazy things through LoL (paging Mantacore ![]() ) and cover all those bets with reinsurance.

) and cover all those bets with reinsurance.

Cerberus Captial didn’t leave just one burning bag ![]() on Uncle Sam’s doorstep, they left two.

on Uncle Sam’s doorstep, they left two.

VinFast is also controlled by the Samsung equivalent of Vietnam, so they have a multibillion dollar balance sheet and can absorb these “learnings”.

All the other companies have healthy ICE businesses, so they can absorb the losses easily.

It does seem insane to see a VW Buzz lease for $99/month though, doesn’t it?! ![]()

Wait..where’s the $99 ID Buzz lease? I wanted one and I’m willing to risk angering the wife to have one ![]()

It was more like $250-300/mo with the DAS ![]()

They self insure, or they repackage the liabilities’ elsewhere and I will pay it out via a bailout.

It’s their problem, not mine (directly), and they can go bite me.

I’m surprised no one hacked it down to an effective $150/month.

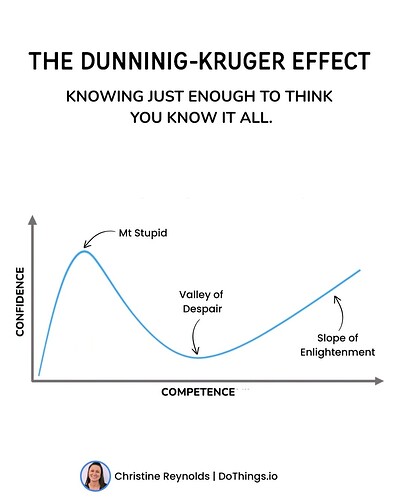

Better than certain stealership that told me there’s a $17k depreciation on a Mach E with the net price of $27k and a residual of $24.5k. This guy had to call “his boss” because he didn’t know how to calculate a single pay lease..they couldn’t sell a car because the guy lacked experience then ran around and told me he had 10 years of finance experience..10 years of doing it wrong is still 10 years of experience I guess. Guess where he was on this graph ![]()

This, and this:

Losses exist as current losses and carryovers, and they exist in no small measure to be applied as vehicles for tax “protection” against those pesky profits.

Lmao we are such a house of cards, the fact that this exists just as a way for insurance companies to lose money for tax purposes is insane.

The problem is that this is a insurance that will be underwater 99.9% of the time.

Imagine 99% of the cars in the street were totaled… no insurance company would survive.

Yes they would, reinsurers handle that and they have reinsurers as well.

When that all went bad it is the US Government with the mortgage crisis all over again.

We will see it in the next 6-18 months I think. But yeah hard to find an EV which is not underwater by high 4-digit number. My only other thought in this, banks may try to offload it to oversees markets where EVs are more popular