What in the stupid millennial…

Doesn’t make much sense to me either @HersheySweet…This type of situation can’t last, and I absolutely loved the truck, but I couldn’t resist the ability to sell it for a profit, plus get the use of it for 13 months.

Exactly. This is not sustainable.

They’ve been paying these prices for two years now! Not sure they will be in it.

Late-model used car buyers are generally not smart shoppers. This has been true for ages.

Even more surprisingly, they sold it at that price in about a week!

I’m not sure what their sales costs are, but they grossed $2300 or so, plus I would guess a good percentage of their buyers may use them for financing as well.

It does seem like what they are paying has really jumped up in the past month though.

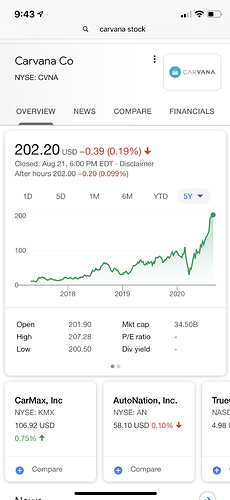

It’s also hard to argue with this, for the time being at least…

I don’t think most people realize how much the millennial generation loathes the dealership experience. There are a lot of people who want the Amazon experience with cars and Carvana is ready to cash in on that.

And the dealership network is entrenched in the legal systems of states - that’s not changing anytime soon.

Power to the online dealers.

I agree 100%. I am nearing the half-century mark and I am digging that approach on things as well✔️

I’ve only had one experience with Carvana, and it was overwhelmingly positive, massively overwhelmingly positive. The ease with which the transaction can complete with them, in my single experience anyway, was incredible.

Got to be the financing side of the house, the amount of volume they can claim which stimulates positivity in stock price. Many “online only” companies are just fronts for financial gurus banking on rising stock value.

Your brain is what I find most attractive about you

Even the vastness of this site does not allow the ability for me to articulate all the ways we are drawn to you.

Guys I thought this too. Until I looked closely at some of the tactics Carvana is pulling.

They are approving people that no other prime bank would.

I’ve seen on other forums, rates close to 20% on used car loans.

For example; if you’re someone that a normal bank would approve for a 30k car loan @ 4% APR for 60 mos…Carvana will approve your 30k loan at a decent APR…but they’ll let you get a 65k car if you wanted at a rate close to 20%…

TLDR: Carvana is crushing it with subprime lending; selling to many people that a normal dealership perhaps might not be able to approve.

Great insight! Thank you for sharing.

I wouldn’t limit it to late model used car buyers.

In October 2018 CarMax listed and sold (in under a week) my 10 year old Civic LX for 12.5k. That’s just such a marginal five year expected cost of ownership savings versus a much nicer, newer and safer Civic, Corolla or Accent. People’s willingness to spend comical amounts of money at these ease of use used car dealerships predated Covid and will continue afterwards.

It starts making a lot more sense once it hits you that this is basically a buy here / pay here shop on steroids.

Per their annual filings -

NOTE 7 — FINANCE RECEIVABLE SALE AGREEMENTS

The Company originates loans for its customers and sells them to partners and investors pursuant to finance receivable sale agreements. Historically, the

Company has sold loans through two types of arrangements: forward flow agreements, including a master purchase and sale agreement and master transfer

agreements, and fixed pool loan sales, including securitization transactions.

Gains on loan sales

As described further in Notes 2, 7, and 8 to the financial statements, the Company recognized gains on loan sales of approximately $137.3 million during the year ended December 31, 2019.

Looks like they sell their car loans and made a $130M doing so.

As I said, Wall Street circle jerk. Trading paper is profitable, especially when the tax payer is left to clean up the mess.

Where is the taxpayer involved here? The government does not buy or secure auto debt.

I’m actually entertaining to sell my 2016 CPO Tesla S 70…50k miles…2 years of basic Tesla warranty remaining/6 year battery warranty and freee supercharging for life, 2 new tires…new taillights (warranty), new computer (warranty)…full charge shows 226 miles…Vroom is offering 33500 - right in themiddle of KBB trade-in, but it would loose supercharging / warranty…msrp 79850…i wonder what’s fair private price could be?