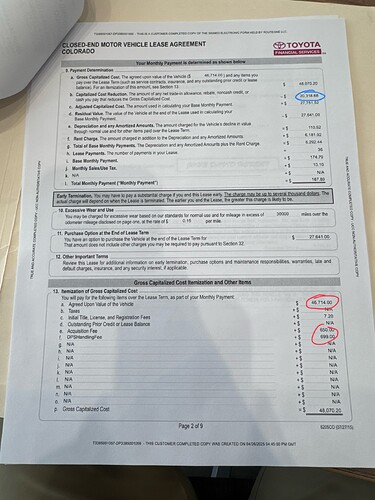

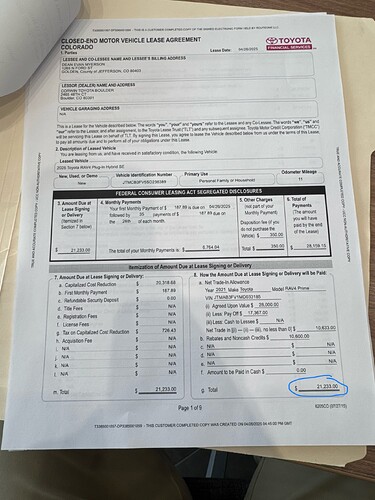

Your net trade value is not subject to sales tax. What is taxable are any rebates/cash used as a cap reduction (CCR).

Net Trade CCR = 10633.00

Rebate CCR = 9685.68

Total CCR = 20318.68

NOTE: Total rebate = 10600… of this amount, 9685.68 is used as a CCR. The balance of 914.32 is used to cover the upfront charges…

1st payment = 187.89

Rebate CCR Tax = 726.43 … = 7.50% x 9685.68

TOTAL = 914.32

Bottom line: DAS = 0 followed by 35 monthly payments of 187.89 each.

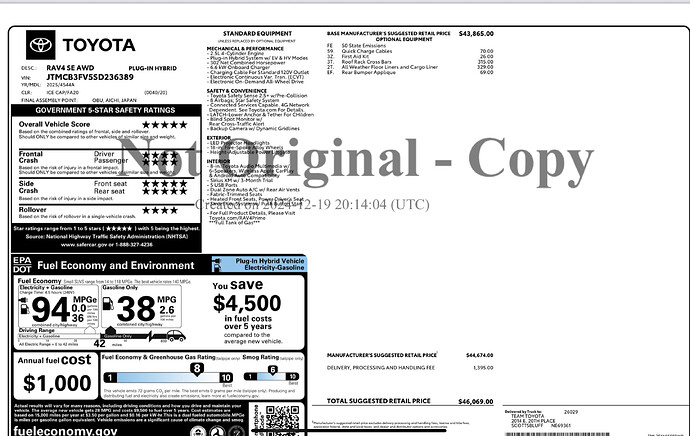

The agreed upon value of 46714.00 is the selling price and so, you’re paying 645 over the total retail price of 46069 and 2040 over MSRP. TFS acquisition fee is 650. The agreement shows DPSHF = 699. The acq fee is not part of the MSRP. The DPSHF likely includes the dealer doc fee. So, DPSHF is not part of the MSRP. You should get some clarity on the DPSHF disclosed in the agreement and the DPSHF disclosed on the sticker.

IMO, this is a terrible deal. However, I have no idea what the RAV4 SE is selling for in your local market.

??? Let me know.

EDIT: FYI- Your MF = .00310 (about 7.44% APR) which is likely marked-up. Also, if you’re going to do a buyout within 30 days or so, you’re better with a single-pay lease. Seems to me that this dealer is taking you to the cleaners. I suggest that you…

Don’t waste time trying to decipher a dealer’s worksheet or preliminary lease contracts or chasing after them. Otherwise, you’re allowing them to control the deal. You need to rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.). Do your own research and establish a reasonable selling price in your market. Check the sticker for non-factory add-ons or dealer-installed options. And, if possible, eliminate those you don’t need or want. Get a list of all customer and dealer rebates/incentives including VIN#-specific discounts/incentives, if any. And, yes, the dealer has such a list.

All collected data should be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Check available tax credits/incentives via the fund provider who may cover taxes or, at minimum, may assess a lower sales tax rate to energize sales for some models (e.g., Texas).

Organize all relevant data with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own target deal (proposal), not replicate the dealer’s deal. This leads me to suggest that you…

Craft a lease proposal (example below- the round peg, round hole won’t work) and email it to the sales manager (SM), not a floor salesperson as they’re often Mickey D order takers and lack knowledge. Be sure to contact the SM first to let them know you’re emailing them a one-page lease proposal b/c you want to close the deal ASAP. Be nice but firm. Unless they’re very stupid, once they see your proposal it will speak volumes. They’ll immediately know it’s time to put away their toys and board games and get down to business absent all the BS.

All numbers must be accurate otherwise, you’ll lose credibility. Negotiate via phone/email. Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. Moreover, it’s helpful to know the terms and conditions of the lease contract such as early termination liability criteria and purchase option criteria as well as lease amortization methodology and excess wear/tear criteria. If all is as agreed, tell the SM that you’ll come in to sign asap. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t transparent or is uncooperative or showing signs of incompetence, WALK AWAY AND MOVE ON!

Leasing is time-consuming and requires a good deal of study and attention to detail. If you don’t have the time to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. However, if you’re willing to commit your time and resources, be sure to always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.