July programs will run through Monday afaik

That’s good to know! I know they want to hit monthly numbers, but good to know it’s not necessarily do or die today.

Is this a more reasonable offer to send to a dealer? Am I messing up any language or missing any point? I appreciate everyone’s help. I feel much more educated about what’s going on now!

My offer:

MSRP: $60,490

Selling Price: $56,256

Term: 24 mo/12k miles

Residual: 57%

MF: .00232

Lease Cash: $17,750

Acquisition Fee: $650

Doc fee: $251

Title/Tire: $31.25

Upfront Taxes: $1,306

Due at signing: $2,599 (Up front taxes/fees + 1st month payment)

Monthly: $361

You don’t ask- you make a well-researched offer proposal where you dictate and present the terms. If they don’t want to play ball- move on. Time is $ and you can’t buy that back.

Or hire a broker.

Never ASK a dealer for anything. You’re letting them control if you do. You never ask them, you tell them via a comprehensive, flawless, one-page lease proposal. Below is only an example and may not apply to your particular situation…

Again, read the pdf I posted above where most of your questions will be answered.

You need to check LH marketplace as well as LH signed deals. Also, look at the local geographic region. For example, the Great Lakes region would encompass Ohio, Indiana, Illinois, Michigan, and Wisconsin. You may want to see if you can narrow this down so that it captures only bordering states. So, if you reside in Ohio, your local region might include OH, PA, KY, and IN. If that fails to produce meaningful data, I would default to US Census data regions (i.e., Northeast, Southeast, Midwest, and West).and try to segment those regions into sub-regions that might best mimic your car manufacturer marketing regions.

Once again, I appreciate everyone’s input! I wound up picking up a car today that basically aligns with this deal. I feel much better about this one and it’s 10.2 leasehackr score.

Only difference is due to them trying to meet my offer, I accidentally rolled $55 of the upfront fees into my lease, which makes the payment $418.99 instead of $416.

Gotcha thanks, unfortunately it does not look like there are too many ioniq9 signed deals.

And what is a “hackable” car? How do I find them?

Not every car makes sense to lease. Browse the Marketplace and Shared Tips / Signed Deals to get a sense of what is leasing well. Keep in mind for some brands the programs roll tomorrow, and others on Monday.

Combo of

Significant dealer discount

High RV

Low MF

Substantial manufacturer rebates and incentives

One good indicator of which ones these are is the frequency in which they’re discussed here (Marketplace, Signed Deals, and even to some extent the Trophy Garage thread).

You can see current offers in the Marketplace

A few more characteristics of a hackable car…

- Lease-Friendly Manufacturer Marketing Regions : States like California often have better programs due to competition and volume.

- Strong Lease Support Presence : Some brands (e.g. BMW, Volvo, Lexus) consistently offer favorable lease terms. You see a lot of these on LH.

- One-Pay Lease Options : Prepaying your lease usually reduces MF and total cost. This is the cheapest option particularly if you intend to buy the car shortly after signing your lease contract while taking advantage of huge rebates not available if you’re purchasing.

- Unicorn Deals : Rare combinations of all the above including those mentioned by @jeisensc, @trism, and @max_g.

Final update: Link to Signed post

Thanks @delta737h and @max_g!

Congratulations on your deal. Looks like you are saving over $200 a month compared to your original deal. A little education goes a long way. Imagine how many people probably signed something similar to that first deal and walked away happy!

If I want to keep my options open and may buy the car, is high RV good or bad?

Is single pay lease usually available? and does usually result in lower MF?

I know there are no gurarantees but I want to know what is normal so that I can call BS if someone told me a different story.

Like if I pick any pre negotiated deal on leasehackr and ask for single pay, should I expect it to be available and will lower the listed MF?

Ditto for any lease deal I negotiate with the dealer. At the end of my negotiation, can I throw in, “oh and make it single pay and I am expecting MF to drop” … and squeeze the dealership for that final bit of margin?

Assuming everything is single pay..

Right now I am taking the bottom line on any lease deal as 2 things

- Total Cost per year

- summing up total RV + Total Cost - in case I end up buying

Is this the right way to think about it?

High RV is great for leasing, because it’s a major determinate of the depreciation portion of your lease cost.

RV is also the amount for which you’d pay for the car if you want to buy it out at the end, so it’s bad for that.

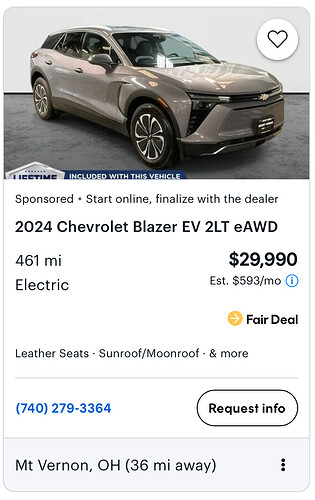

We have a 2024 Blazer EV. RV was something crazy like 83%.

Ours will have about 6-7k miles at turn in, next July.

Here’s the first listing that came up on Cargurus just now. We still have one year to go, and ours already has 3,500+ miles on it.

There are some exceptions, but generally it doesn’t make financial sense to lease a car for the full term and then buy it out at the end.

The most common lease/buy scenario that does make sense is leasing to capture some large rebate that isn’t offered on a purchase, and then immediately buy out the car.

Yes and yes. This may be stating the obvious, but the reason for the discounted cost of money (MF) is to incentivize customers to accept the single pay option in lieu of traditional monthly payments. What is less obvious is that the discounted MF attempts to capture the time value of money (TVM). In other words, the application of a discounted MF can be viewed as a conscious effort to estimate the present value of the base monthly payments instead of using an appropriately discounted interest rate.

Yes. However, it may depend. Most, if not all, of the finance captives (GMF, FMC, LFS, etc.) do have SP programs. However, whether the dealer is willing to do them is another story. I’ve been told that some dealers shy away from them because they don’t know how to structure them. I find this hard to believe as their finance service reps would provide either in-house or off-site training to at least F&I personnel. This would be true of any new financing programs that captives/banks offer. On the other hand, I’m not sure whether banks like Ally or USB offer single pay. My guess is that Ally does. I don’t believe that CU’s offer SP’s. Maybe someone else will chime in that can provide more definitive detail.

I believe that good faith negotiation involves transparency. I would be upfront and tell them that this is a SP lease via a comprehensive flawless professional-looking one-page lease proposal. Success always favors those that are knowledgeable and well-prepared. To that end, you might find this helpful…

Building a Motor Vehicle Lease- Data Collection and Calculations.pdf (403.6 KB)

Determining a metric that accurately measures total cost per year can be challenging for SP’s. Simply dividing total upfront costs, including the SP amount, by the term of the lease is a rather naive approach as it fails to capture the time-value of money (TVM). It’s best, IMO, to assess total costs at lease inception and at lease end (whether you buyout, turn-in, or trade the car).

You may also find this helpful…

Single Payment Adjusted Lease Balance Calcuations, Optimality, and Purchase Option.pdf (948.6 KB)

??? Let me know.

dang super helpful. I will have to dig into it to understand everything properly but i think i get the gist of it.

One more thing, we all know the companies get 7500 back from the feds for an ev lease, but not all lease deals include this. Is it a reasonable expectation to directly ask for some of that tax credit if it is not explicitly listed in any lease deal? And what are the chances of them agreeing?

wait? what? you can do am immediate buy out?

can i still finance the buy out and capture a good finance deal with the dealer too?

example, capture the 7.5 federal tax credits, buy it out then finance the buyout with manufacturer financing with 0% APR? I think Hyundai is offering 72 months at 0% now.

Clarification : The reason I am thinking about buying a lease is because I really want to buy the car but it is unclear if this generation of EVs will stand the test of time so I want an out if there is a big jump in EV quality in the next 3 years or something like that.

If this was the objective, how would you suggest i balance RV vs lease cost?