Deal check on a 2026 M5 with all options.

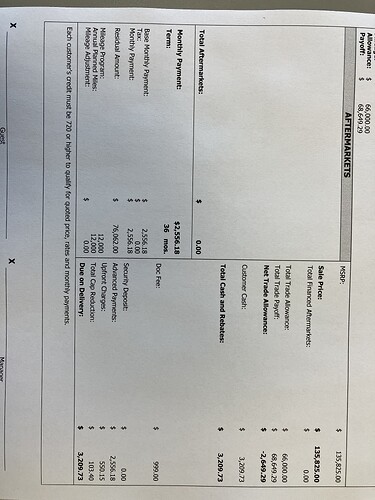

138,824 msrp (includes $2k negative equity in trade)

36 months

12000 miles per year

3208.73 due

2656.43 per month

Residual: 76062.00

MF : .00280

Got it down to base Mf .00240 and monthly down to $2556.

Sounds like a lot for an M5 and this is the second dealer I’ve tried to work with that won’t budge much at all on msrp.

What is the negative from if u dont mind me asking ?

Also why 2026 and not a 2025 standing unit a dealer ?

The end of my lease for X5M. I have a few payments left, I’m over mileage, and who knows about tariffs. The 2026 is sitting on the lot, not ordered.

May be try your luck on a sitting 2025 for a better price. That payment is insanely high even with the m5 being a new model.

I will give you an example. Check out swapalease for 2023 i7 and 2023 bmw XM payment from high to low. You will notice many signed leases when these cars came out and then review shared threads here to see how much people paid who patiently waited.

If you can manage the over mileage which should be 0.28 cents per mile of u preypay om ur curent lease and wait it out a little, the patience should pay off.

Take the trade out of the deal and sell it outside. It’s $2k negative, pay it cash and get a higher offer.

Also why lease this car vs finance?

1 Like

The $2k is probably total of his remaining pahments on the existing lease. Chances of equity being on an X5M only -$2k is very low but yes he can just pay off that $2k in extra payments.

1 Like

Leasing because it’s a company car, not personal vehicle but will be my daily.

I have 3-4 payments left at over $2k each so I thought only rolling 2k into it wasn’t too bad.

I can certainly hunt for a ‘25. I found the build I’d want if I ordered it myself and emotion kicks in. But 2500 feels nutty.

That makes a lot of sense. Not negative equity just payments

1 Like

So technically it’s not a rolling in payment, it’s them buying it and saying you’re $2k neg. Check Carmax carvana (even though they can’t buy it) and see how it looks vs payoff.

Otherwise, even MSRP and buy rate isn’t the worst lol

1 Like

I was quoted MSRP for a 26 M5 with a sticker of 126k. This was north Florida. I also tried a south FL dealer, they didn’t budge either.

1 Like

We can discount these pretty well. Reach out!

1 Like

I just shared a listing above for FL and its a $126k msrp as well. Getting a discount on an M5 is hard in the FL market specially south florida or Orlando area.

On the specific unit I’m currently to working on with the dealer?

Just bc it’s a biz car doesn’t mean it makes sense to have an astronomical payment on this car. 2750/mo for an m5 even with the associated tax write offs is not a great deal IMO. Lots of people approach tax stuff this way, spending a dollar to save 40 cents.

And yes you should be able to get a decent discount. Would not pay sticker for this car

2 Likes

It’s 2500 at the moment and I’m not approaching it for tax reasons in any way. Leasing cars makes more sense for my business and I’m a car guy.

You get what he is saying. They payment is too high for what this car is worth.

This ! Whether its for personal or business doesnt really matter, its still your money at the end of the day. Nobody here will try to convince you to not buy the car you like, its just that the payment is pretty high.

What is the total $ amount of monthly payments remaining on your current car ?

What is the buyout and offers to buy (if u havent tried yet, try now) for your X5 at the moment?

I have a feeling that your negative is higher than the $2k the dealer is telling you. They may be trying to blend it in to the selling price of the M5.

1 Like

Why does leasing make more sense for your biz if not for tax reasons?

Just because you currently have an expensive car which may or may not be its own poor deal, doesn’t mean you need to make another mistake. Sure you can probably afford it if it’s similar to current payment but again that doesn’t mean it’s an advisable decision.

So what is the expectation of discount for a new model M car? Is it reasonable to expect a dealer to discount t 10% so that it could fall into the good deal category? I’ve tried 3 dealers so far and they don’t budge on msrp. I stood firm with one, and the car was gone in 2 days. I understand the value of a good deal, but I’m also trying to get into a car in fairly strong demand and limited inventory. Beyond telling me this deal or the other 3 that I received at msrp are bad, what makes it good? It’s simply the discount off msrp as far as I can see it as I am already at base mf. What else am I missing here?

Also, all 3 dealers said the same about my current car. This one is giving me the best deal and I’m going to keep attempting to make it a push and no negative equity. I’ve already checked the market price and all options are coming out the same.

Here is the proposal. I won’t be accepting it but am trying to set the expectation of what would make this deal good.