You’re allowing the dealer to control the deal. Please excuse my long-winded dissertation but I think what follows is very important and can help you IMO.

Please don’t waste time trying to decipher a dealer’s worksheet or chasing after them. Otherwise, you’re allowing them to control the deal. They often omit a lot of relevant detail such as money factor, monthly base payment, monthly contractual payment, fees not itemized, etc. You need to rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.). Do your own research and establish a reasonable selling price in your market. Be sure to get a copy of the factory window sticker. Check for non-factory add-ons or dealer-installed options. And, if possible, eliminate those you don’t need or want. Get a list of all customer and dealer rebates/incentives including VIN#-specific discounts/incentives, if any. And, yes, the dealer has such a list.

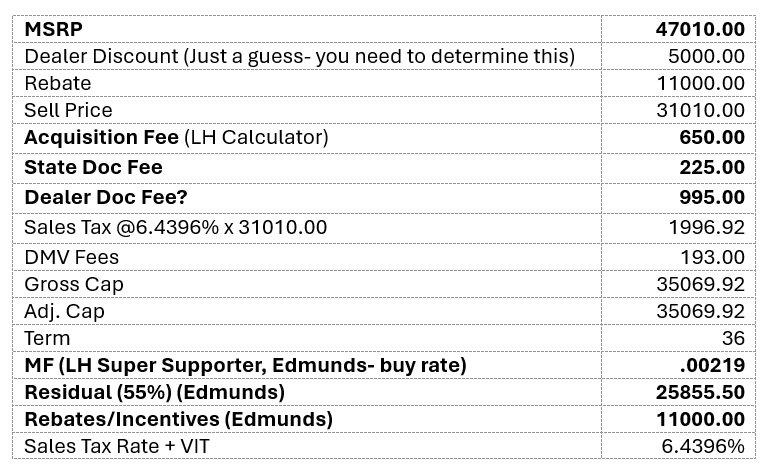

The only thing useful about dealer lease worksheets is the input data (bolded below). All data should be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Organize all relevant data in tabular format like those below with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own target deal (proposal), not replicate the dealer’s deal.

Next, perform monthly payment calculations like those shown below.

Contractual Pay = .00219 x (35069.92 + 25855.50) + (35069.92 - 25855.50)/36 = 389.38

All fees, including taxes, are capitalized. See my LH calc.

Bottom line: 389.38 drive-off fees followed by 35 monthly payments of 389.38 each.

Commentary

It’s very foolish and nonproductive to waste hours sitting in a dealership negotiating. This can be a huge distraction. You need time to think things through and formulate questions within the privacy of your own home. This leads me to suggest…

Craft a lease proposal (example below) and email it to the sales manager (SM), not a floor salesperson as they’re often order takers and lack knowledge.

All numbers should be accurate otherwise, you’ll lose credibility. Negotiate via phone/email. Once an agreement is reached, ask the dealer for a review copy of the lease agreement and all contract addenda BEFORE you go to the dealer and sign. If all is as agreed, tell the SM that you’ll come in to sign right away. You don’t want any surprises or dealer excuses like …. Oh, we made a mistake. That’s unacceptable and shouldn’t be tolerated.

If the dealer isn’t being transparent or is uncooperative, WALK AWAY AND MOVE ON!

Leasing is time-consuming a requires a good deal of study and attention to detail. If you don’t have the time to commit, perhaps your best alternative is a good broker. There are some outstanding brokers on this website. If you’re willing to commit your time and resources, always control the deal. That can only be achieved with education which breeds confidence and increases the likelihood of success.

??? Let me know.