Currently have 2019 Rav4 XLE Premium with 20k miles(3/36k lease) maturing in 3 weeks. Dealer offering $7,334 in equity. New lease vehicle is 2022 Rav4 XLE Premium with msrp of $37,473. They’re willing to sell at sticker. 39 month lease cause they’re saying rates are better. Original offer is 300/month with 3k down. I got them down to $305/month with 1.5k down. I still feel like this is high considering I have over 7k in equity being applied. Thoughts?

Are they cutting you a check for the equity? Or is it $1.5K DAS + $7K equity (so actually $8.5K DAS)?

Is there a reason why you don’t want to buy out the car?

I believe the equity is being rolled into the new lease so yes $8,834 including the $1,500 out of my pocket. I’m definitely leaning towards buying out but thought I’d test the waters since I knew I had a lot of equity in current lease. Toyota Financial is sending paperwork to extend lease for 6 months at my current payment. They just have to add the NY tax for the additional 6 months.

They are charging you an effective $570/mo. In some ways, you are essentially paying the same total amount for using a car for 39 mos as you would to buy your current car outright.

It doesn’t seem you drive very much. If your current car has been trouble free, I personally would just buy out your car…

Just buy your current car. RAV4s hold their value so well that you will see a decent amount of your loan payments recovered whenever you do sell.

Financing your car at 5 years with $1500 down will be about $415/mo. After 39 months you’ll owe $8400 and your car should be worth about $18-$20k. Or keep it the full 5 years and it’ll still be worth $15-$18k.

If you roll that equity into a lease now, you might not have much if any equity in 3 years so you’d be $10-$12k behind in that scenario.

I agree buying was the way the go. Just figured with all the equity and getting car at msrp that the deal would have been better. Do you see any harm in extending for 6 months then buying? I figured money factor rates were probably lower when I leased back in 2019 than used car rates now. And I’ll still be building equity so buyout will be around 20k after 6 month extension.

Have you checked offers anywhere else? Just sold my fiancé 2019 xle with 20k miles for $30,400 and ended up with a little under 11k in profit. As posted on here a bunch of times, keep the trade and new car separate

Shoot me a text and I can check if I can do better. Not sure I have a premium in stock though.

Jim

215-359-6836

i would not. used car values are absolutely plummeting. guy’s getting a replacement for basically the same price he had before in a super inflationary environment. dump the thing, get a new one. lease equity is effectively “house money” and should be treated as such.

Why are they plummeting? Dealer lots are still empty. And they still want ridiculous up charges.

Lots might be sparse but money, buyers, and economic factors point negatively.

Supply matters less if demand is less.

I would agree, if his current car were very troublesome, if he put a lot of miles on the car, if he had a car that is historically unreliable, or if he even just didn’t like the car and wanted something else for fun.

Using the equity to replace his slightly used car w/ the exact same model (does the 2022 RAV4 have any updates over the 2019?) does not seem worth it to me. But YMMV.

Because gdp has printed negative for 2 straight quarters, interest rates are high, and the used market is flooded with cars

You can use the “R” word. We all know the definition. ![]()

I’ll add defaults are also up

“We believe subprime loses will hold at 5%.”

narrator voice - they did not.

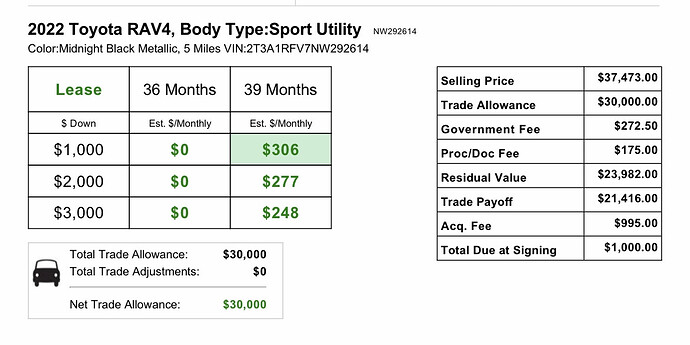

Latest offer and probably best they’re gonna do. So looks like they up trade equity to 8,600. Add in the 1k and it’s essentially 9,600 due at signing. A $306 payment seems crazy for all that equity. The difference between purchase price and buyout of new car would be roughly $5300 after equity subtracted and fees. How is $5,300 over 39 months 305/month. Is the money factor that high. What am I missing?

Wait, are you trading in your car for a car for your MIL? If so, what will you drive?

Or are you thinking of 2 deals (what you will do for yourself and what you will do for MIL)? I’m a bit confused.

No it’s always been “her car” just in my name and me paying lol. I have my own 2 cars.