does cc score not take a hit with closing of cards?

It does but it will depend on your credit profile

If a person has 4 credit cards - closing 1 will be a significant hit on the credit score

If that person has 10 credit cards - closing 1 will not affect that much.

I’ve noticed also if it does dip it is very short-lived and trends back up within a month or so.

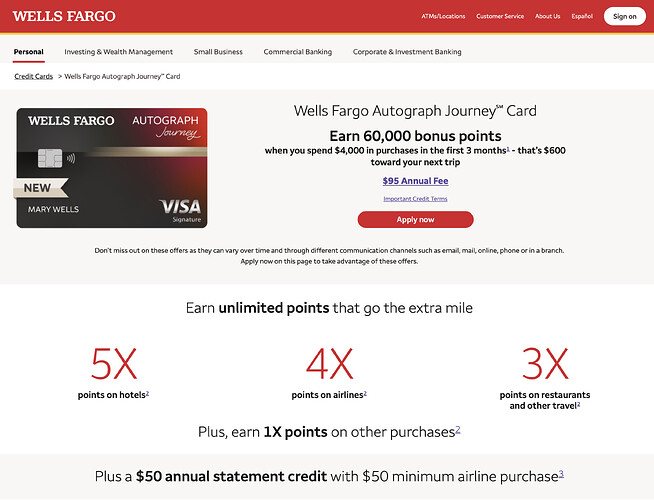

It’s been a while since I’ve associated “Wells Fargo” with “sign-up bonus,” but here we are.

AF is > 50% covered by the airline credit.

Giving this one a go as well…just received the card last week. Worth it for a year anyways!

Citi Strata Premier… new (or at least newish) product.

Most of the third-party SUB references reflect a 70,000-point offer, but I’m seeing a 75,000 offer on Citi’s own site.

I think we’ll each grab one of these.

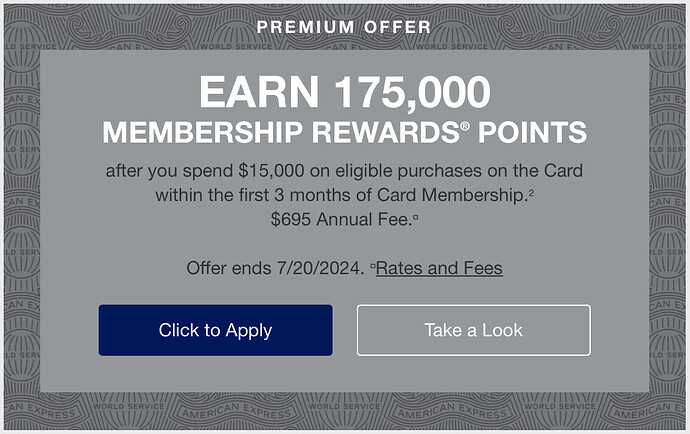

175k MR points sign-up bonus for Amex Platinum is available if you get lucky (targeted offer, visiting the site via VPN in an incognito window, or snag a referral). $8,000 spend in 6 months. Also 250k for the business card ($15k spend in 3 months). That’s a lot of travel value in either case–just don’t forget to enroll in all of the benefits relevant to your interests.

Think not eligible if you got the Premier Sub already right?

Hate Citi for that, was so excited to hold 2 cards with similar benefits

The new Attune was attractive to me as well, even with a measly SUB. I just applied for one last week. 4% on some things I use occasionally with no annual fee felt like a no-brainer

What a weird collection of categories, EV charging, thrift store shopping, gym, and concerts.

Did you make that up? ![]()

Haha you would think. I actually just saw the 4x and was intrigued and those are legit the categories that bonus. Thinking this is how corporate envisions millennials spend their money lol

4% back on used bowling shoes – and I only have to make minimum payments!!!

4% back on Nike adidas DSG + other brand retailers, in addition to my lifetime and fitness class memberships is worth around 150 bucks annually to me, or $75 over my double cash card. Definitely small beans but for no annual fee it it’s no sweat off my back to “carry” it in my Apple wallet and decrease my credit utilization (they gave me a surprisingly large credit limit)

I have 16 cards with at least one outstanding posted charge right now, so I definitely understand the draw toward maximizing returns on niche spending.

Ink Preferred now has 120k sign up bonus

I have the personal Platinum, and keep getting this Business Platinum offer by email.

Problem is I have a terrible time finding a useful way to use the MRs to get even 1 cent per point, so I might be able to get $900 or $1k in value for the bonus. Subtract the AF and there’s maybe $300 left.

Meanwhile I could put the same $15k in purchases on my existing 2.625% cash back card and get back nearly $400 without bothering with another new card. And that’s the worst-case scenario on a general spending card.

I don’t even put airfare for 5x on my personal Platinum anymore.

Super curious to know how you are getting 1cpp or less…