Went into the GMC dealer where we leased the car, Lease is up and want to keep it,

I see the amount to finance is $500 over what payoff is, and they say its the disposition fee. Which I thought was only charged if turning it in. GM finical was closed so could not confirm. GM web site does say it can be waived. They also wanted me to pay the tags even though those are not due for 6 months, Plus a $85 doc fee which I can live with. Anyone buy out a lease and run into this. Should I just go to another dealer?

Why are you talking to a dealer about buying out your lease in CA? You should be able to just go to your gm financial and do it there.

I called GM they told me I had to go to the dealer, Believe I don’t want to go to the dealer.

Yes CA

Weird. I wonder if this is a gm only thing.

they put you through hell like if you just walked in off the street, Can not talk to finance you have to talk to a salesperson. Then they start the let me ask my manager I will be right back, After 5 times of that he comes out to tell me, He is on my side its GM that requires all this… At that point I left.

Maybe don’t give your money to a company like that.

I would not deal with a dealer who put me through that crap just to buy out a lease. Call any other dealer in the area and ask about buying out your lease. Should be easy to find out if you actually have to pay the disposition fee - which sounds ridiculous as it is.

Per the GM website, “ If you lease or buy a new GM vehicle, or if you purchase your leased vehicle, the disposition fee may be waived. If you choose one of those options, please contact the Lease-End Experience team if you are unsure that the fee has been waived. If you have questions about this fee, you can contact us in the GM Financial Mobile app or by logging in to MyAccount. You can also call us at 1-866-631-0132.”

thanks, That’s what I plan to do tomorrow, I did call a few dealers every one said I had to talk to a salesperson. One went as far to tell me it had to be inspected before I could buy it.

I went to local chase where we have several accounts and they won’t even do a car loan now,

You need to find your lease contract and read every word on it. There will be a section explaining exactly what you must pay to buy out the lease.

Disposition fees are what you pay when you turn a vehicle in at the end of term. GMF might charge you a purchase option fee which is usually around the same price as the dispo fee. If they do, it must be included in your lease contract.

FL is the only state I have heard of where lenders are required to send leasees to a physical dealers in order to buy out the vehicle at the end of the lease.

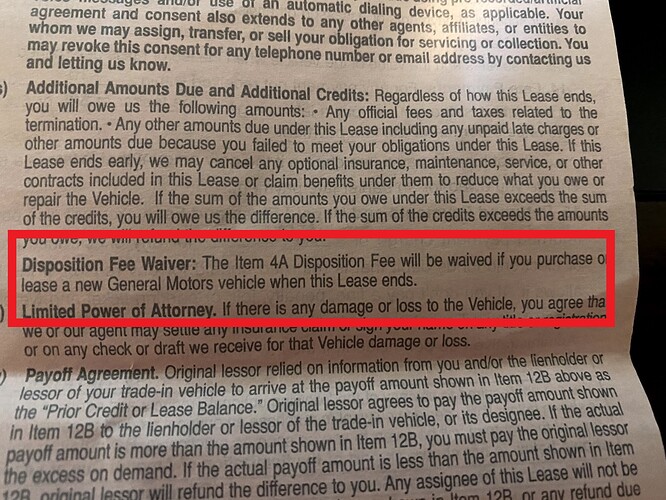

The wording in the first section it says its waived if you buy BUT it says to refer to section T,

which seems to leave it up to the dealer. When I called last month (GM Financial) asking about the pay out. It was as stated on the lease they did not tack on $500

Exactly. Call GMF again and reiterate the exact wording on the contract. They should now provide you the purchase price (RV) plus applicable sales tax. Check with your local credit unions for the most favorable rates to finance this.

I know in FL for Hyundai they make u buy it from dealer and the dealer gets to charge you another dealer fee

This is a Florida thing. FL law requires anyone selling the vehicle to have a dealer license and a physical location in the state, so you end up having to go through a dealer. FL is the only place that does that that I know of.

Sounds like a lease purchase option fee. Is there anything stipulated in that section? Edit: found this from 18’. Thought on the fee may be for title transfer, currently registered to lease co, would need to be put in your name, would also explain why you need new tags.

I’ve had good experiences with LightStream. All online, very competitive rates, no fees, next day funding, and they don’t always require the car has collateral. That last benefit makes it easier to sell the vehicle since the title doesn’t have a lien.

I would start over and call GM Financial again. Start over from scratch and forget that the first call ever happened. The contract is clear as day that the fee is waived if you buy out the car or buy/lease another GM.

I’m guessing you got a rep that didn’t have a clue, makes no sense that they would try to send you to the dealer AND say the dispo fee was still due, double whammy of bad/illogical answers given the situation.

HUCA (hang up call again) is the name of the game when dealing with any large corporate customer service department, many of these agents are completely clueless, not unique to GM.

Just show it to Your dealer and let see how they will react.

from what I’ve heard so far, only Hyundai does that in FL. But I could be wrong.

You do need a solid credit score to get a good rate. I used them many times and always locked in the lowest rate, but last month tried getting a loan for my wife (780 credit score) and they offered 5.99% on a 15k auto loan…

Nope it’s FL state law unfortunately.