New to leasing. My company has a special TrueCar incentive that I can put towards a purchase or lease. Looking at a 330i M Sport. I am still trying to chisel the actual MF out of the sales guy but given my credit rating and the latest intel for my area let’s assume .00093.

What’s confusing is this. The email they sent me would be approximately this deal, which is almost 11% off MSRP:

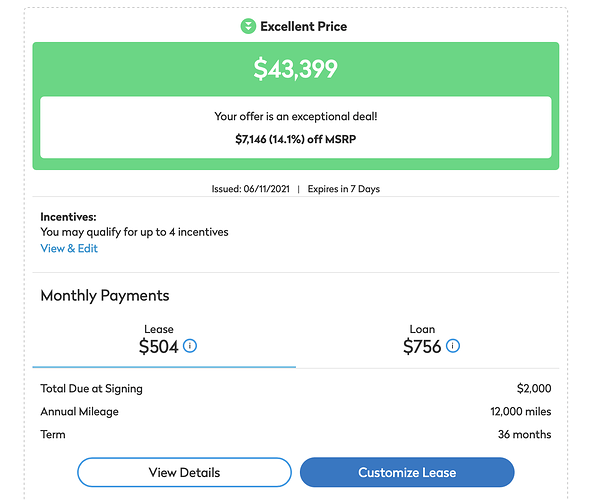

But when I click through the email to look at the offer on the company perk site, it shows a lower purchase price, over 14% off MSRP:

I know I didn’t totally bullseye the deal in the calculator but it’s close enough for my purposes. Also I spoke with the salesman and he said the expiry date isn’t actually an issue. A guy at work who chatted with me about this seems to think the worse deal is the actual cost. But isn’t the 43k price closer to what I’d actually be paying? Is there something about this deal that’s illusory?

I only took interest in this just recently because my current car went UP in value by about $2k. But if I can do more than $3k better in a year I’ll just wait.

My guess is that deal includes the 4 listed incentives that you may or may not qualify for.

Good point. But when I click on it on the deals page, none of them are checked. I went in and checked the top two and sure enough it dumped the price down to ~41, so I think those four incentives aren’t factored in.

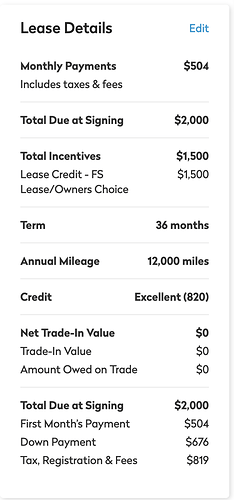

I’m pretty sure the 1500 is the corporate perk, essentially. So that would be through TrueCar. But, then again, in a year’s time, I might be able to layer that on top of an even larger negotiated reduced price, so maybe this is attractive but it could be better after the chip shortage.

We may have occasionally seen 15% on a new unit but that wasn’t the standard. If you are looking to carve out as good of a deal as possible, have you thought about using msd’s.

If the chip shortage / inventory issues work themselves out, your current car will go down in value. No one has a crystal ball as to when these things will occur.

The last thing I would do is assume b/c you have great credit that a dealer will automatically give you the base mf. Many dealers have it as part of the business model to mark up the mf on people with excellent credit. Many times you would be better served by taking a higher mf coupled with an even higher discount.

1 Like

You’re absolutely right about the MF. I emailed the sales guy to get that number specifically. My credit is about 820 so I can insist.

I am open to MSDs but to be honest, a few bucks here and there isn’t my primary concern. What I’m interested in is how good a deal this is compared to a non-insane market. My hope is that the inflation on my used car compares well to a lease deal that is itself not inflated. But if this is a bad deal by pre-shortage standards then I’m inclined to wait. My car is in good shape and this replacement would be because I am a car guy and am done wearing the commuter car hair shirt

Good credit won’t entitle you to base MF, it simply means you’re technically eligible to receive it. However the dealer may be fixed on a marked up MF, you simply need a stronger discount to make up for it. MF markups are essentially just like getting a smaller discount, two different ways to profit.

Makes sense.

Let me ask the question within the question: Whatever the case is with the MF or the discount, what in the broad strokes would constitute a good deal? The measurements I read about were the 10% and 1% rules. Get at least 10% off MSRP (done) and have the monthly payment be about 1% of MSRP. This seems to tick both those boxes well. Is there something else that makes this, in the main, a bad deal? Or is it that I could do even better in a year’s time?

Forget the 1% rule, its not grounded in any real math. The best way to evaluate the quality of the deal would be the pre-incentive % discount normalized for buy rate. The answer to what a good pre-incentive % discount is, is relative to the market. In normal times on a new 330i you’d often see 10-12% as the number for a “good” deal, with some exceptional deals as high as 14%. With the inventory shortage its become harder to say, however 10% would still, imo, be a good deal, with 11 or 12% as a great deal.

If you’re trying to just not just the quality of the deal, but also the value (is this car worth this much, rather than is this price as good as it gets for this car right now), you need to account for the fact that lease programs have generally weakened. So 10% pre right now may still yield a payment higher than 10% pre last year.

1 Like

My apologies… I googled pre-incentive % discount normalized for buy rate … the only times I’ve seen it are other posts by you. I hate to ask you to go to more trouble but could you expand on that term a bit?

Pre-incentive % discount is just your straight dealer discount relative to MSRP. Make sure you always separate incentives and lease cash from dealer discount.

(MSRP - selling price excluding incentives) / MSRP * 100% = pre-incentive % discount. You’ll see a field for it in the LH calculator listed just under the selling price. It makes it easy to compare deals between cars with different sticker prices. The normalized for buy rate component means that if there’s a MF markup you check how much discount that undoes. 13% pre with a 0.00020 MF markup may, for example, be actually 12% accounting for that MF markup. This allows you to evaluate the deal accurately.

2 Likes

Okay, that’s great. Thank you. I rejiggered the calculator values and now it looks like this (with the email price as the seller price excluding incentives and the incentives below. )

It looks like there’s a down payment. I’m having trouble exactly lining up with their numbers but it’s fairly close. If I cared about every single nickel I’d stay in my Accord another 5 years. Their quoted 10.8% actually showing as 10.76%. Removing the down payment hikes the monthly up to 536/mo. So this seems… fine, but probably not a blockbuster. Still, I haven’t attempted to reduce the cap cost yet… this is just their initial offer. So it’s entirely possible I can counter and get more off the car. What do you think would be a fair target deal?

Hmm… I kind of fudged the fees at the bottom so that it matches their breakdown on the site, then adjusted the MF and got to their monthly number. So my guess is the MF is sliiiiightly up. .00098 instead of .00093.

Couple things on the calc.

-

$1500 should be in taxed incentives. Also general lease cash on the 330i is $1500 right now, everyone gets that. Corporate fleet on the 300i is $500 right now (I’m not sure if this is the perk you’re referring to).

-

Gov fees are still the default.

this site will allow you to get more accurate fees: Registration Fees - California DMV

Bmw dealers almost always mark up in multiples of .0001. Usually .0002 or .0004. It’s unlikely they’ve marked it up by .00005.

1 Like

Sure, this is a fudge job to be certain.

OK, so I wonder if the employee discount is messing with me. If everyone gets 1500, then where is the Passport/TrueCar incentive being factored in? I think this added element is screwing up my ability to calculate this deal using the normal systems. I’m going to call Passport tomorrow and find out what I need to know about evaluating deals and how their perk gets applied. Better to talk to them than the dealership of course.

Its possible this special incentive is just a pre-negotiated dealer discount, rather than a standalone incentive like lease cash ($1500), loyalty/corporate fleet ($500), penfed ($500), OL ($500-$1000), etc.

1 Like

This is most likely the case. That was how my older employer that got a true car discount was.

1 Like

Just dug the information out and you’re right. It’s a replacement for negotiation. So, assuming this deal is locked in stone (unless maybe I adjust the mileage down to 10k) does this feel like a pass to you?