This may help

New_Vehicle_Opportunity_Hot_Sheet_July_August_2022.pdf (751.6 KB)

Are there any lenders that offer these type of loans that are not in NY? It seems the ones listed in the thread only allow membership from residents of specific states.

All three of the recommended CUs (AmeriCu, CapEd and Hanscomm) will accept public membership with the proper small donation to the proper charity. I have used all three and I live in NJ.

However, NY happens to be the honeyhole of CUs support balloon loans. I would look into SEFCU, they are NY only and usually have very competitive rates.

How do you access AFG balloon loan? Is it only through CU?

Decided to check out going through the balloon program. I went through BMW FS and was approved for the Select Option on a new M340i. The difference is pretty staggering compared to what one of the dealers was giving me for a two year old one.

I plan on trying to see if I can get approved through another CU and seeing, if possible, jumping up to an M3/M4 if it can stay under what the proposed wife budget is.

Question though, how does the equity work going forward? When you are paying the payments and putting the down payment, does that go right to the principle? So, in three years and I want to go trade it, what is expected to be down from the total you finance? That part I’m a bit tripped up on.

A number of credit unions partner with AFG to offer a retail balloon loan program.

In the first post I recommend three CUs; AmeriCu, CapEd and Hanscomm

Note that the BMW select program is not the same as a non-captive balloon loan. Although this program maybe superior to conventional captive financing options, generally the terms are not as favorably as non-captive options.

It works the same way it does with a conventional loan. Any down payment is a direct reduction of the loan balance. Each payment has a principal component, which reduces the loan balance. You can buy out the vehicle at any time for the balance due on the loan. If you want an exact answer to your loan balance at a certain time, choose to see the amortization schedule when using the final balloon payment calculator.

I’ve given this a pretty good look. For those looking for a program in CA, Americu https://www.americu.org/ has easy membership. Join the American Consumer Council https://www.americanconsumercouncil.org/index.asp for $8-15 (based out of San Diego, CA) and you become eligible.

Thanks for the response.

I am going to try and check out one of those you mentioned. I believe I had an issue with one of them on my credit report (apparently I had a fraud check a while back and it flagged in their system).

If they don’t price protect ordering a 23 $8000 off with $900 doc fee might be a better option for you.

Would this make sense for a used vehicle to keep payments low? I have a lease ending on a 2020 4Runner soon with a buyout of 31k. (USBank)

36m balloon loan through Americu is around $380 with a final balloon payment of $21k

36m conventional is around $940

Could you refi or sell a vehicle with a balloon loan at anytime? I’m not 100 percent on how they work other than your last payment is essentially the remaining of the full loan balance.

Went into BMW with the Select Option and approval work. They weren’t a fan. Tried to get me to do traditional loans. Then came out saying the Select Option wouldn’t work. Said something about a higher price car raised the residual 8% and it didn’t make sense. For a 64k car they wanted 8k down for 1400 a month (Select Option). They wouldn’t give me a rate or anything. It was SUPER screwy.

I talked to BMW FS and they just said, “seek a second opinion.”

Not sure what to make of that entire thing, to be honest.

I did get a call from Hanscomm and sent in my info. Waiting to hear back.

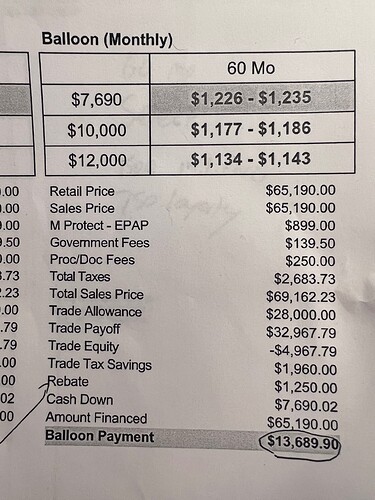

I included the sales sheet. It doesn’t make any sense. I wasn’t told rates, either.

Well you are rolling in 5k of negative equity so I would look at it as a 70k car , not a 64k

Having negative equity at present and pursuing a balloon loan simultaneously aren’t good signs btw…

I just got a balloon loan from BMWFS for around 104k and my monthly is $1406, balloon payment of around 29k @2.9%. Only paid around $1100 when taking delivery. Either your interest is crazy high or they are doing shady stuff in the back, or both. My dealer was transparent and showed me all the info on the screen for different finance options.

Oh wow! Yeah, I asked about my rate and they didn’t tell me what it was. I must have asked a few times. They continued to push traditional loans. I know they get a good kick back from those, but the moment I said I was just there for the Select program they moved on. It was super strange.

I called BMWFS to see what my rate was and they wouldn’t tell me. They said it was the job of the dealer. So, I am at a loss for words.

Waiting on Hanscomm to get back to me.

2022 Wrangler 4xe look strong on Americu. I could buyout the lease I just signed, no additional money down and it would lower the payment $112/month. It would also get me about $2200 cheaper than the residual at end of 36 months.

Not sure I want to bc I don’t know how long I’m keeping it, but for those that are it is worth checking out.

Do these still look good for the '22 Wrangler 4xe of you’re thinking you might keep it once the “lease” is up?

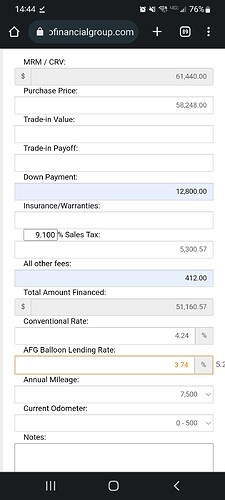

This setup looks good. The maximum MRM would be $62,400 so you must have left some options unchecked that we can’t see in the screen shot. I always check every extra option, I’ve never actually had to prove I’ve had them…

Going through the balloon loan process with AmeriCU right now. They asked for the window sticker, they didn’t do that with you?