That’s for purchases, not leases.

Seems like it, I thought everything was included in there so in that case all I could find was a faq about eligibility rules.

Yes the hidden deep in the IRS doublespeak is

- 30W Purchases By a Consumer direct (a consumer lease is NOT a consumer purchase) - Must follow a whole slew of rules to get $7500

- 45W Purchases by a Business (including a consumer lease) - You (the business or bank) get $7500 on all EVs and PHEVs. (I think there is a battery size requirement but I forget who doesn’t cover that)

So a lease can get $7500, and almost 95% give it back to the consumer.

Yeah, and the 5% that do not give it back to the customer on a lease is that short list we’re attempting to cobble together.

Multiply the msrp by the ratefindr rv and then add $7500 to the calculated rv. Thats the actual rv.

Oh ok so if you were to get a Blazer EV right now, the dealer will show a RV that is higher than the MSRP x Ratefinder RV. But, it seems like the customer is benefitting from the $7,500 either way so it’s probably mostly moot. Like AutoCompanion shows the $7,500 as lease cash, which is probably more simple for folks to grok.

I’m trying to figure out if the approach of subventing the resid is better or worse than the more common method where the $7,500 is treated as a taxable rebate (customer cash).

On the one hand, the MF is now multiplied against this higher resid. So you’re paying rent factor on the $7,500. On the other hand, burying the $7,500 in the resid makes the $7,500 sales-tax exempt in most areas. This is where it comes in handy that @delta737h uses LH hahah.

The biggest issue is if tou are trying to do a lease to buy to capture the ev credit

Are there any implications to that for the leasee in terms of TCO?

Increases total rent charge because youre maintaining a higher adjusted lease cost.

In most states, it decreases your upfront/capitalized tax liability because it isnt a taxable incentive.

If it increases or decreases your tco will depend on your state’s tax laws and the mf on the lease.

EV Credit/Rebate Treatment

Is it more advantageous to use the EV credit as a CCR or to residualize it?

then use the EV credit as a CCR; otherwise, residualize it. The above assumes the CCR tax is capitalized and that the monthly payment streams are taxed. The difference between capitalizing and not capitalizing the CCR tax is negligible. So, either pay the tax at lease inception or capitalize it. Either way, it will have a negligible impact on your decision.

NOTE: The expression above, if true, tells us by how much the residualized contractual payment exceeds the CCR contractual payment. In the example below, it is 33.65.

EDIT: Another way to use the EV credit is to pay lease inception fees with the balance used as a CCR.

Lol again, I wasn’t sure what to expect from you, but this is more maths than I was envisioning. We gotta figure out how to get the LH software to embed a working spreadsheet hahah

I’m curious if there’s an inflection point where if the MF gets low enough or the tax rate gets low enough… that you’d be worse off with CCR Rebate vs Residual Rebate.

After picking up my brains from the floor since they EXPLODED

Your 3rd column is wrong as Residualized doesn’t work that way, they Alter the RV and the MF at the same time so your ‘simple’ plan of adding $7500 to the RV doesn’t work.

Absolutely! Check out the spreadsheet below. The payments are nearly equal with an MF = .00108. Try using MF = .00001 and it’s much better to residualize the EV credit. So, for this scenario, MF = .00108 is the breakeven. Anything below it favors residualizing the EV credit. Anything greater, favors using it as a CCR assuming the other variables (e.g., sales tax rate) remain the same.

| Baseline | CCR | Residualize | |

|---|---|---|---|

| Rebate = 0 | Rebate | Rebate | |

| MSRP | 120,000.00 | 120,000.00 | 120,000.00 |

| Sell Price | 110,000.00 | 110,000.00 | 110,000.00 |

| Gross Capitalized Cost | 111,200.00 | 111,200.00 | 111,200.00 |

| CCR | 0.00 | 7,500.00 | 0.00 |

| Adjusted Capitalized Cost | 111,200.00 | 103,700.00 | 111,200.00 |

| Term | 36 | 36 | 36 |

| Money Factor | 0.00108 | 0.00108 | 0.00108 |

| Residual Factor | 58% | 58% | 58% |

| Residual Value | 69,600.00 | 69,600.00 | 69,600.00 |

| Residual Adjustment | 0.00 | 0.00 | 7,500.00 |

| Adjusted Residual | 69,600.00 | 69,600.00 | 77,100.00 |

| Tax Rate | 7.50% | 7.50% | 7.50% |

| Base Payment | 1,350.82 | 1,134.39 | 1,150.59 |

| Monthly Payment Sales Tax | 101.31 | 85.08 | 86.29 |

| Contractual Payment (exclu. capped tax) | 1,452.13 | 1,219.47 | 1,236.88 |

| Monthly CCR Tax | 0.00 | 17.45 | 0.00 |

| Contractual Payment (inclu, capped Tax) | 1,452.13 | 1,236.92 | 1,236.88 |

Hmmmmmmm… Why would they alter the MF too? Doesn’t make sense to me. As @mllcb42 stated…

Seems to make the most sense and that’s exactly what I did.

Wow, thanks @delta737h and @mllcb42 .

I guess GM Financial has found a way to get people the lower monthly lease payment, and also remove their incentive to rapidly buy out the lease. I wonder if the other EV financing companies will follow suit.

I also wonder if their way of using the $7,500 to subvent the residual will make it harder to sell or securitize the lease. Since now the residual is grossly inflated. Most Blazer EV customers will get the $7,500 rebate as a tax deduction, so the real value in the secondary market will be much less than the subvented residual on the lease.

Not sure why GM cares that people rapidly buy out their leases.

Anyway my simple solution is “don’t buy a terrible GM product”.

I think the captives self-insure their residuals. However, the banks usually purchase residual insurance through residual insurance carriers. I doubt the banks, or their residual insurers would allow a residualized EV credit.

Good question. I don’t know how their accounting works.

Rather than eating the $7500 as cap cost reductions immediately to customers. GM can raise MF some(Blazer LT model money MF is .00251) and collect the $7500 business tax credits for their financials.

The 2LT lease advertised on Chevy website at $469/month w/ enhanced residual. Normally would be $431/month, had the $7500 been a cap cost reduction.

Seems like this has been sufficiently answered, so to summarize…

Yes, it only applies to purchase, though many manufacturers pass it through on a lease. You can refer to this link for additional information, but be sure to confirm w/dealer before purchase.

If you intend to purchase and find that you do not qualify for the $7,500 credit due to the income limit, simply try being poorer.

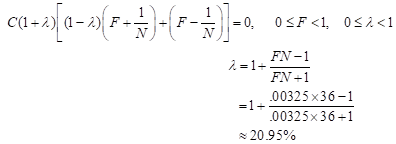

To find the break-even money factor, set the inequality = 0 and solve for F as follows…

To find the break-even sales tax rate, set the inequality = 0 and solve for

![]() as follows…

as follows…