I am glad you had a great experience with a friendly salesman. Hard stop there. They will try to be your best friend. This is a business transaction and they will get salty and rude once you approach this as such. They are not your best friend, they don’t have your best interest at heart, and you most likely will never see them again.

With that being said, first things first, what are your needs for a car? Are you payment shopping, or want/need shopping? Sometimes a Hyundai can cost more to lease than a Mercedes. Low msrp does not equal low lease payments a majority of the time.

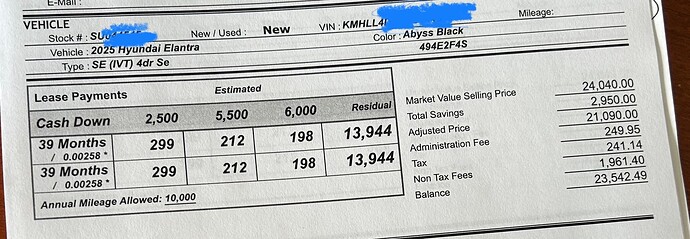

Now let’s look at this offer that you have here. First thing of note, the money factor (essentially the interest rate for this loan) is about 6%. Other captive banks (Toyota Financial, GM financial etc) may have rates of less than 1% depending on the vehicle. The money factor is the amount of interest you will pay over the course of the lease. The lower the mf, the better, most of the time.

In this particular offer, what is the actual sticker/msrp of the vehicle vs the market value selling price? A $8k discount could seem very strong, however, it could be $8k off of a vehicle that is priced $6k above msrp due to addons or other fees.

Do you qualify for any additional rebates or incentives? Hyundai has education/college discount and I believe first responder discount. You want all incentives separated out from the dealer discount as those are not dealer discounts, they are incentives from the manufacturer.

Lastly and quickly, you have to look at “effective cost”. A lot of people look at the monthly and think they got a good deal. I could get a Ferrari for $300 a month, but that would be with putting $50,000 down payment. Effective cost is basically, how much are you actually spending per month on this vehicle? For this car, you would take the $2500 down, which isn’t a good idea on a lease anyway, and divide that by 39 which roughly $65 per month. Take that $65 per month and add it to your “monthly” and you get a payment of $365 a month for 39 months, which is your effective payment. Take the 365 per month, multiply it by 39, and you have essentially paid about $14k to lease a car for 39 months on a $24k car.

Either way, imo, you can do way better on a different vehicle for $365 a month. If you are dead set on this car, I would check out incentives, money factor rates for different terms, and find the true price of the vehicle sticker and any other hidden fees or add ons.